- Telangana government’s delay in settling dues, liquor industry in dire straits

- Cash-strapped Congress government mulling increase in liquor prices

- Third tax hike in the last five years

With the exception of States which have prohibition, all other States, if they need to shore up their revenues, first target alcobev sector. State government after state government have increased excise duties, license fees etc without batting an eyelid and in most cases without taking the industry into confidence. The alcobev sector is the milch cow.

The latest news is that the cash-strapped Congress-led Telangana government is looking at the liquor industry to come to its rescue. Telangana’s alcobev sector, which is a major revenue earner for the state, is now faced with two major issues – government’s inability to clear outstanding dues of over Rs. 4,700 crore and its impending decision to increase taxes on liquor – both of which adversely impacting the sector.

To give a perspective, the Telangana government is depending on Overdrafts, Ways and Means Advances and Special Drawing Facility (SDF) from the Reserve Bank of India to meet its expenditure. The Congress government which came to power in December 2023 in Telangana has so far raised Rs. 12,358.48 crores through these routes.

In many states, excise is a major revenue generator and in Telangana revenue from liquor sale doubled from Rs. 12,703 crores in 2015-16 to Rs. 31,225 crores in 2021-22. For 2022-23, the state government had projected a revenue of around Rs. 37,500 crores from liquor. In 2023, the Telangana Excise Department managed to collect Rs. 2,639 crores without selling a single bottle of liquor, the money coming from nearly 1.32 lakh applications charging Rs. 2 lakh non-refundable application fee for the allotment of 2,620 liquor shops.

Fiscal deficit up

Despite the increase in revenues, the government has not been able to reduce the fiscal deficit as the Congress government has announced quite a few freebies that is costing the exchequer. To shore up revenues, the Congress government is planning to increase tax on liquor which in turn will push up the prices. The proposal made recently is expected to come into effect soon. The previous Bharat Rashtra Samiti (BRS) government in its term had hiked the liquor prices twice and now the Revanth Reddy government is contemplating, in five years that would be the third tax hike.

An industry veteran told Ambrosia “Nobody likes a tax increase. As liquor is a discretionary product, people slip down the value chain or they resort to alternate sources of supply, so both of which have implications to both the state government and the suppliers. In that respect, it is not the best of moves. This kind of thing is happening in other states, given that they have made electoral promises and have to fund that and alcobev is the soft target.”

The veteran who has held top posts in various companies said “As of now, we don’t know what levels the tax is going to be increased. Somewhere, there is a mention of license fee going up, we don’t know whether it is tax on consumer or manufacturers/suppliers or both we don’t know yet.”

The CEO of the International Spirits & Wines Association of India (ISWAI), Nita Kapoor in an interview with ET Hospitality has called for urgent attention to the critical issue of high state excise duties that account nearly 70- 80 percent of consumer MRP, inflationary pressures adding significant pressures on the industry. As inflation rates rise in the country, the alco-bev sector faces significant challenges due to escalating costs of production, transportation, raw materials, and exorbitant import duties. This combination poses a dire threat to the industry’s sustainability.

Ms. Kapoor said, “The liquor industry has consistently and significantly contributed by generating 25-40 percent of revenues for state governments and nearly 2 percent of nominal GDP. However, the current tax and tariff structure, characterised by high excise duties, limited supplier price flexibility, and exorbitant import duties of 150 percent (50 percent BCD + 100 percent AIDC), is pushing the industry toward a crisis. Regulators must recognise the necessity of inflation-linked adjustments in supplier prices as the Alcobev industry is a cornerstone of economic activity.”

Beer suppliers due Rs. 1,200 cr

On the one hand hike in liquor prices and on the other the government not releasing outstanding dues, both are hitting the industry hard. Beer suppliers, it is estimated, are to get nearly Rs. 1,200 crores, pending since October 2023. The alcobev sector has urged the government to resolve the issue as some of them were finding it difficult to go ahead with production.

The Director General of the Brewers Association of India, Vinod Giri said, “In absence of immediate resolution of this problem, I fear some companies may be forced to opt out of the state.” Of the Rs. 1,200 crores due to beer suppliers by Telangana State Beverage Corporation (TSBCL), around Rs. 900 crore is beyond tender credit terms of 45 days, he said, adding some of it is even 120 days overdue. “Payments are being released but amounts are too small and don’t even cover new outstandings, leave aside past ones.”

The alcobev companies in a statement said, “Delayed payments is creating a stressful cash flow situation for the manufacturing companies, hindering their ability to invest in operations, buy raw materials, pay employees and continue supplies to the consumers. Despite repeated attempts by industry leaders to meet key ministers in the state, the issue remains unresolved. This lack of communication and action is causing frustration and uncertainty amongst manufacturing companies in the state.”

It said that this might force companies to curtail supplies to Telangana. Unless the government does something soon, some companies may be forced to cut costs, including job retrenchment. This situation, the alcobev sector said would further dent industry confidence and dampen investor sentiment in Telangana.

As regards the delay on the part of the government on outstanding dues, the industry veteran mentioned that “All suppliers put together beer, spirits and wine, as of May 31st the outstanding was over Rs. 4,700 crore. That itself is an additional cost the supplier is bearing and if consumers resort to alternate sources, it is not good for the suppliers. The suppliers have held on for quite some time, the question is for how long can they hold on.”

Telangana major liquor consumption state

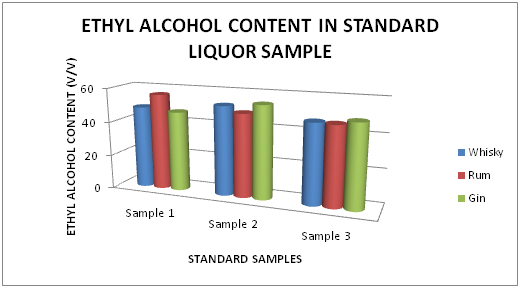

Liquor consumption in Telangana is high as the state guzzles over 6 crore cases of beer or 15% of 40 crore cases sold across the country per annum. As regards Indian Made Foreign Liquor (IMFL), Telangana’s consumption is about 3.4 cases or 9% of 39 crore cases sold.

The non-payment of dues and the constant hike in liquor prices had left some in the trade to sell liquor above the maximum retail price (MRP) to make up for the losses. Besides, some licensed vendors were reported to have opened bars in the guise of permit rooms. The Bar Owners Association complained to the Excise Department against the wine shops which were allowing consumers to drink on the premises. The Association argued that they were already burdened by the excise rules of the government and adding to the woes were the so called ‘permit rooms’. In the process, the government was also losing revenue. The bar owners, on the other hand, complained that bars with retail outlets on the premises was affecting their business.

Despite woes, AP traders planning to move to Telangana

Whatever the issues, the consumer in Telangana continues to patronise the alcobev sector and this has enthused some liquor manufacturers to move or add liquor businesses from Andhra Pradesh to Telangana. According to reports, some of the liquor dealers in Andhra Pradesh were selling unknown brands at exorbitant prices through the state-run AP Beverages Corporation Limited (APBCL). Brands such as President’s Medal, Capital, Timer, Boom Boom, Classic Blue, Old Admiral, Royal Green and Sentinel were out in the market, particularly rural, in large numbers.

There have been allegations that out of 100 liquor companies, the APBCL procured 75% of its liquor from only 15-16 manufacturers like SPY Agro, Adan Distilleries, PMK Distilleries, etc., which are controlled by the erstwhile ruling party leaders of YSRCP. It now remains to be seen how the Telegu Desam Party which has come to power in Andhra Pradesh will take a call. However, the Telangana market being a lucrative one, the AP businesses are looking at Telangana.

Meanwhile, in Telangana there are charges and counter charges from the ruling dispensation and the BRS. In an open letter to the Telangana Chief Minister, A.Revanth Reddy, the BRS leader M.Krishank urged the Chief Minister not to introduce adulterated liquor in Telangana. Krishank said that on May 21, minister Jupally Krishna Rao stated that no proposals had been made to allow new liquor companies to operate in Telangana State. He warned that if anyone reported such news, a defamation suit of Rs 100 crore would be filed against them. However, on May 27, the BRS party exposed minister Jupally Krishna Rao’s falsehood, revealing that the government had indeed granted permissions to a company named Som Distilleries, pointed out Krishank. The Minister acknowledged stating that the decision was taken by the Beverages Corporation. It is now reported that the government has decided to cancel the permission given to Som Distilleries to sell its liquor in Telangana.

The liquor industry not just in Telangana is looking for stability in policy making but also to ensure that the government takes care of the liquor industry which is a revenue-spinner.