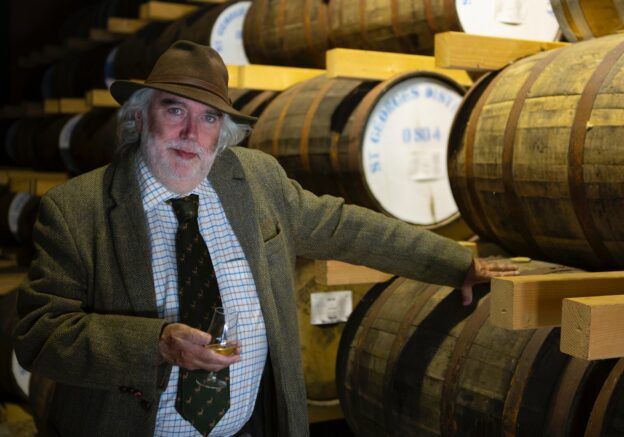

Jim Murray stands as a prominent figure and key player in the global whiskey scene, having held the title of the world’s first full-time whisky writer for over three decades. The 2024 release of his widely successful “The Whiskey Bible” marks the 20th anniversary of the publication. Maintaining a staunch commitment to independence, Jim fearlessly critiques those deserving of scrutiny and advocates for whiskies that were once overlooked or unfamiliar.

In the present day, the likes of Ardbeg, Pure Irish Pot Still, and Canadian and Japanese whiskies such as Yoichi and Yamazaki have gained widespread popularity, thanks in no small part to Jim’s daring efforts to bring them into the public eye. Despite facing criticism and occasional attempts at character assassination, Jim’s bold choices have significantly shaped the current whisky segment.

In a conversation with Ambrosia, Jim shared insights into his passion for the spirit, details about his personal life, encounters with setbacks and comebacks, and perspectives on emerging whisky trends and Indian distilleries.

What led to your transition from journalism to becoming the world’s first full-time whisky writer, and are there any interesting stories or experiences from your journey you’d like to share?

I began my career in journalism covering sports and general news, gradually diving into more intense subjects like murders and special investigations while working for national newspapers. Amidst these experiences, my first encounter with a distillery occurred in 1975 during a hitchhiking expedition across Scotland. Boarding a boat bound for Skye, I visited the Talisker distillery, and it literally changed my life.

The vibrant sensory details of the distillery – the colours, smells, sounds, and the meticulous process – left a lasting impression on me. As a journalist, I used to get to travel a lot. Tasting whisky straight from the barrel with its 60% alcohol content was a revelation, and it sparked a personal interest. From the age of 17, during my spare time, I started making personal notes on whiskies, differentiating their unique qualities. By 1989, I began writing and selling articles about whisky globally, all while maintaining my role as an investigative journalist.

In media publications, I noticed a gap in whisky coverage. Wine writers were handling whisky topics with incorrect terminology and descriptions. Convinced I knew more about whisky, I considered transitioning into whisky writing. This decision faced resistance, especially as it meant giving up a stable income. Despite the initial resistance from my wife, in 1992, I took the leap, becoming the world’s first full-time whisky writer.

Back then, there were no whisky festivals or visitor centers, maintaining a sense of mystique around the industry. Breaking into the scene was tough. For years, I earned little, even became a single parent. Despite financial challenges, I persevered, creating fresh content for the emerging market. The books I wrote brought in money, but research costs were high due to the lack of prior literature on the subject. Believing in the cause, I endured the financial strain, comparing it to the pain barrier in athletics. It’s been a journey with continuous challenges, drawing parallels to my days as a long-distance runner facing a tough race.

A pivotal moment occurred during a meeting with Jim Milne, a J&B revered blender, who has been blending since the 1950s. In a seminar he conducted, whiskies labelled X, Y, and Z were presented without disclosing the distillery names. Upon nosing one of the whiskies, I asserted, “This doesn’t belong in your blend; it’s Fettercairn.” To this, he acknowledged, “Indeed, that is Fettercairn, and it’s included here only because of an oversight.” By identifying a misplaced sample, I earned the blender’s respect and was urged by him to share my opinions on whisky. This encounter led to a realisation – my extensive self-guided apprenticeship in studying whiskies positioned me uniquely.

Unexpectedly discovering my heightened olfactory senses (got to know I had a unique skill set, ranking in the top 2% for sensitive noses), this breakthrough moment changed my perception, realising I could sense and appreciate whiskies in a distinctive way. I ventured into consulting as a blender, complementing my role as a writer. This unforeseen skill set, acknowledged by one of Scotland’s most respected blenders, allowed me to contribute to the whisky industry in ways I had never imagined.

What is your typical approach to whisky tasting? Are there specific methods or techniques you adhere to during the process?

My approach to whisky is akin to that of a blender. I first identify any flaws in the whisky before acknowledging its merits. This involves deducting points for aspects like added caramel, an imbalance of oak flavours that overpower the malt, and any weaknesses that detract from the overall quality of the whisky. I can discern whether a whisky has been meticulously crafted or hastily put together.

When it comes to public awareness, blind tastings are crucial to eliminate biases. People often have preconceived ideas about certain whiskies, which can influence their perception. Therefore, I conduct blind tastings to remove any biases and judge the whisky solely on its merits. When compiling my Whiskey Bible, I don’t taste blind as I need to consider the distillery’s style and whether the blender has captured its essence. I assess the whisky’s complexity and intended profile before making judgments.

My tasting method, dubbed the “Murray Method”, involves avoiding strong perfumes, water intake, and spicy foods to keep my senses sharp. Strong perfumes can interfere with the senses, affecting the ability to discern aromas accurately. Additionally, I avoid consuming spicy foods while working, ensuring my taste buds remain undisturbed and receptive. However, recognising the cultural practices, I understand that asking Indians not to eat spices isn’t practical, given their culinary preferences. In 1997, I authored “Jim Murray’s Complete Book of Whiskey: The Definitive Guide to the Whiskeys of the World”, which gained significant popularity, selling over a quarter million copies. While discrepancies in numbers and subsequent editions may have altered the count, the book’s success is evident.

I’ve come across articles critiquing the book “Whiskey Bible”, accusing it of being sexist. However, generally, I’ve noticed that descriptions of food in a sensual manner are common in many publications. How do you respond to this perspective?

You need to grasp the immense impact of this book. It sparked the rise of Indian whisky and catapulted Japanese whisky to new heights. I awarded World Whisky of the Year to a Japanese whisky, leading to a whopping 3 billion dollars in revenue for them. Despite this success, I personally didn’t gain financially because I don’t accept kickbacks. I maintain complete independence. However, there’s a phenomenon known as industrial espionage, where some individuals might see the power of this book as a threat.

This book is pivotal because, like food and drink share common ground: sight, smell, taste, and touch. These senses, when combined, create a sensual experience. If people in the industry argue that whisky isn’t sexy, they probably shouldn’t be part of it. As a writer, honesty is of utmost importance. The motto of the Whiskey Bible is “the truth, always above all”. Criticism requires integrity and candour.

Some distilleries hold a grudge against me because I refuse to engage in their marketing tactics or succumb to their influence. Despite my disdain for those attempting to control me, I remain impartial in assessing the quality of their whisky. I won’t conform to the prevailing trends, particularly the notion of labelling everything as an anti-feminist crime. Personally, my marriage met its demise when I embraced the role of a whisky writer, a sacrifice I made for my career. The constant globetrotting has hindered the possibility of forming lasting relationships. I’ve never remarried, but it’s not due to a lack of romantic inclinations. Unfortunately, my genuine love for others has been weaponised by jealous individuals aiming to undermine the influence of the Whiskey Bible. Frankly, I feel sorry for these people, in their pursuit to tarnish my reputation, reveal a certain poverty in their character.

During a recent visit to Kentucky, a woman expressed admiration for my writings on whisky, considering it one of the most beautiful things ever shared with her. The hypersensitive woke culture on certain social media platforms seizes any opportunity to unleash their destructive tendencies, fuelled by baseless hatred. Many of these individuals are familiar with my identity and knowledge of whisky, yet they target me simply because I’m a convenient male figure to attack. This trend reflects the fragility of Western society.

Watching a stunning sunset often sparks a longing for someone to share the experience. Similarly, I take pleasure in sharing my love and passion for whisky with the world. I want to introduce people to the finer things in life.

When comparing Indian whisky to traditional whisky-producing nations, do you observe any notable differences?

The primary distinction lies in the heat when comparing it to traditional whisky-making countries. The maturation process in cooler climates allows for an important element: time. This time factor plays a vital role as tannins and other components from the environment have the opportunity to integrate and blend seamlessly. In contrast, hotter countries face a more accelerated maturation process, making it challenging to achieve the desired balance. Balancing whisky in warmer climates requires more effort and skill. While some argue that water quality influences whisky, the key is ensuring water is free from contaminants like pesticides and iron deposits, which can discolour the whisky. Interestingly, despite the romanticised notions surrounding water sources, many Scotch whiskies use tap water.

Unlike the present era filled with marketing gimmicks, the industry in the late ’80s and ’70s was less saturated with such tactics. Kentuckians, for instance, boast about having the best whiskey due to their water source originating underground, having been there for centuries, dissolving limestone and aiding fermentation. This stands in contrast to other Scottish distilleries, although not Glenmorangie and Highland Park, two renowned Scottish distilleries, which also derive their water from limestone, similar to the Kentuckians. I advocate for focussing on the contents of the glass rather than getting swayed by marketing claims on labels.

What trends do you perceive in the whisky industry, in your view?

Looking back at the whisky industry’s history, it’s been characterised by cycles of growth and decline. In the 1980s, whisky consumption dwindled as it was perceived as a drink of the older generation, with younger drinkers favouring lighter spirits. A common joke was that one could spot a whisky drinker by looking at the obituary column, as they were diminishing in number. This decline in blended whisky consumption led to an excess of single malt whisky sitting idle in distillery warehouses. It was during this time that efforts to promote single malt whisky, spearheaded by individuals like Michael Jackson, began to gain traction, revitalising interest in the category.

Similar to the boom in distillery construction in the 1890s, the recent surge in new distillery openings has created a crowded market. However, the current global situation introduces uncertainty, making it challenging for new distilleries to establish themselves and sell their products. Despite these challenges, smaller distilleries are poised to thrive, although they will face significant pressure. Nevertheless, it’s crucial for them to remain authentic and transparent in their approach to whisky production.

A concerning trend observed among some Irish distilleries is the practice of finishing whisky in various casks, obscuring the true character of the spirit. This approach detracts from the whisky’s identity, akin to wearing excessive layers of clothing that mask one’s true self. Moving forward, distilleries should prioritise honesty and authenticity to attract discerning consumers. The road ahead may be arduous, but it presents an opportunity for distilleries to redefine themselves and engage with consumers on a more genuine level.

How can Indian distilleries enhance their quality and global standing?

When considering the steps Indian distilleries can take, it’s important to acknowledge the unique dynamics in the Indian market. Unlike Scotland, India has a massive population of over a billion people, with a growing middle class. Over the past 30 years, I’ve witnessed significant changes in India, particularly in terms of economic growth and an expanding consumer base. The challenges faced by Scotch whisky in India may not be as pronounced, given the increasing number of people who can afford high-quality whisky. Notable distilleries, like Amrut and Paul John, have set a commendable standard, maintaining their commitment to excellence. In my early involvement with Paul John, I assisted in training their blender and witnessed their staunch dedication to quality. Several other Indian companies are also making strides in improving their whisky, demonstrating a continuous pursuit of excellence. While there is always room for improvement, the progress made in all these years is remarkable.

Comparing the whisky from three decades ago to the present would reveal a staggering leap in quality. This positive trajectory showcases the dedication and attention to detail exhibited by Indian distilleries. The success of Indian whisky on the global stage can be attributed to the determination of distilleries to make a lasting impression. Unlike some companies that may compromise on quality when relying solely on their brand name, Indian distilleries have prioritised maintaining high standards. The meticulous attention to detail is a driving force behind the success of Indian whisky. Even distilleries that were once considered mediocre have elevated their standards, while new entrants to the market are setting the bar even higher.