Avishek Bambii Das, CEO of Ospree Duty Free by MTRPL outlines the growth of Ospree, the marketing initiatives and expansion plans.

What was the rationale behind the creation of Ospree?

MTRPL operates across seven international airports in India, with future plans for global expansion. Our vision behind the creation of Ospree was to bring all existing duty-free stores under a single, unified brand identity.

The brand ‘Ospree’ represents a contemporary, customer-centric approach to redefining the shopping experience at duty-free outlets.

Ospree serves as MTRPL’s strategy to consolidate its duty-free operations across locations in Mumbai, Thiruvananthapuram, Amritsar, Lucknow, Jaipur, Ahmedabad, and Mangaluru under one cohesive brand. By doing so, we aim to create a seamless and consistent experience for travellers, whether they are flying from Mumbai or Jaipur.

The brand identity of Ospree is tailored to meet the evolving expectations of modern, discerning travellers. Our goal is to make Ospree the ultimate destination for global travellers seeking a premium and elegantly curated shopping experience. Ospree seeks to transform the duty-free shopping landscape, offering a mix of luxury and convenience. With its carefully curated range of premium products and its focus on customer satisfaction, Ospree strives to create a luxurious and approachable atmosphere, redefining duty-free shopping in India.

What is the retail strategy adopted to grow liquor duty-free sales at your duty-free shops?

Ospree Duty Free has developed a multi-pronged strategy to significantly increase liquor sales. This approach is built on four main pillars: premium assortments, immersive retail experiences, competitive pricing, and simplified pre-order system. Additionally, we have largely expanded our single malt category and now house over 250 brands under one roof. Other introductions include various Japanese whiskey brands, Teremana tequila, Ardbeg, Idaya Rum, House of Suntory, D’YAVOL and more.

Exclusive Product Curation:

Ospree collaborates with major global brands such as Diageo and Moët Hennessy to offer a wide selection of premium and rare liquors, including exclusive duty-free releases. These premium assortments are particularly attractive to international travellers who are often on the lookout for unique spirits that aren’t available in regular retail outlets. By curating a high-end selection, we drive both impulse buys as well as planned purchases by knowledgeable customers.

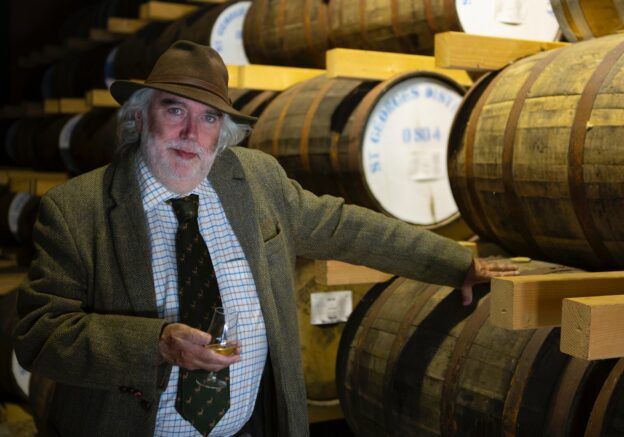

Immersive Shopping Experience:

Enhancing the customer experience is one of Ospree’s top priorities. We have designed our stores to offer an immersive shopping experience with interactive displays, expert-led product recommendations, and tastings.

These experiential elements elevate the shopping journey, transforming it from a transactional experience to a memorable one. Additionally, our personalised “White Glove Service” caters to high-spending customers, offering them tailored advice and ensuring a seamless, premium shopping experience.

Competitive Pricing and Promotions:

Ospree’s tax-free pricing offers significant value across its liquor portfolio, making it an attractive proposition for travellers. Furthermore, our ongoing promotions – such as “Buy More, Save More” and the “Shop and Win” contest, where travellers can win luxury prizes – have been highly effective in boosting customer engagement and driving larger purchases.

Digital Pre-Order Simplified:

Adani One’s pre-order service offers our customers an even more convenient and rewarding duty-free shopping experience. The platform makes it easier than ever for travellers to browse our wide variety of products, secure the best deals, enjoy ease of product selection, receive additional pre-order discounts, and skip the queues. This innovative partnership is a major step toward transforming duty-free shopping into a seamless and stress-free experience for all travellers.

By combining these strategies, Ospree has successfully established itself as a leader in duty-free liquor sales, strengthening both customer loyalty and sales growth.

Is there any pricing strategy in place? How cheap is it to buy in Indian duty-free than in the local market?

Yes, Ospree has a robust pricing strategy that emphasises the authenticity and originality of the products it offers. All products sold at Ospree Duty Free either come directly from the country of origin or are obtained through official brand channels, ensuring their authenticity.

Our pricing is highly competitive, with products available at an average of 20-30% lower than those found in downtown retail stores. This is a significant draw for international travellers who are looking to purchase premium products at better prices. By offering a combination of tax-free pricing and exclusive duty-free deals, Ospree provides an unmatched shopping experience.

How has Ospree Duty Free grown in the Indian Travel Retail Market?

Ospree Duty Free has experienced tremendous growth in the Indian travel retail market, driven by several key factors. First, we have launched over 100 initiatives aimed at accelerating growth by revisiting what we call the 7 Ps of Duty-Free Excellence: Product, Price, Premiumisation, Penetration, Presentation, Promotion, and People. Additionally, we have expanded into six seaports, including Mundra and Krishnapatnam (recently launched), with Kattupalli and Hazira set to open by the end of June, followed by Dhamra and Gangavaram by the end of July 2024. These new locations will cover a total retail space of 6,500 sq ft and serve over 600 vessels monthly. They will offer a wide selection of international duty-free goods, including imported liquor, confectionery, perfumes, travel accessories, and destination-specific products.

Second, our strategic expansion into major international airports has enabled us to capture a larger share of the travelling public. By focussing on creating a premium shopping experience, particularly with our diverse range of luxury products, we have successfully appealed to customers seeking a more sophisticated and refined retail experience.

Our attention to detail in product curation and customer service has translated into increased foot traffic and higher sales. By continually refining our offerings and focussing on customer satisfaction, we have been able to differentiate ourselves from competitors in the Indian duty-free market.

How are luxury spirits performing in the Indian duty-free market?

Luxury spirits have consistently outperformed other categories in the Indian duty-free market. Ospree’s commitment to offering a broad selection of over 275 single malts, paired with competitive pricing, has made it a go-to destination for liquor enthusiasts.

The demand for luxury spirits has been driven by several factors, including the rise in disposable incomes and the increasing number of international travellers. The appeal of exclusive, high-end brands, available at competitive prices, has ensured that luxury spirits remain one of our fastest-growing categories.

Aside from whisky, which other liquor segments are doing well in the Indian market?

In addition to whisky, other liquor segments such as vodka, gin, and tequila are performing well at Ospree Duty Free, collectively contributing around 4-5% of our liquor sales.

In recent months, Ospree Duty Free has seen remarkable growth in its tequila category, reflecting our commitment to offering a diverse and high-quality selection of spirits. Tequila was introduced at Ospree Duty Free Mumbai 12 months ago and now accounts for 7% of the total alcohol sales at that location. Don Julio 1942 has become one of our top three SKUs. High-end brands like Clase Azul, Patrón El Cielo, and the soon-to-arrive Avión Reserva Cristalino are further establishing tequila as a lifestyle statement in India.

One of the standout additions has been Teremana Tequila, which we are excited to introduce for the first time in India. This premium, small-batch tequila is crafted with a strong emphasis on sustainability and quality, and its arrival at Ospree underscores our commitment to offering unique, global products to travellers. By expanding our tequila selection, we continue to cater to evolving customer preferences and enhance the shopping experience at our stores.

Additionally, we have observed significant growth in our wine category, particularly with French and Australian wines, which are growing at a rate of 7-8% month-on-month.

Champagnes, along with red and white wines such as Bordeaux, Moët & Chandon, and Dom Pérignon, are among the most popular items. Overall, the wine and champagne category has experienced over 50% growth, further diversifying our liquor offerings.

Flemingo has a strong presence in the Indian duty-free market. How has Ospree leveraged its expertise?

Ospree has effectively leveraged Flemingo’s extensive experience in the Indian duty-free market to optimise its own operations. By incorporating Flemingo’s best practices in retail and customer service, Ospree has enhanced the overall shopping experience while customising it to meet the specific needs of its customer base.

How have Flemingo and Ospree grown in recent years?

Cannot comment on Flemingo’s growth. But Ospree has experienced significant growth in the Indian travel retail market. The rebranding has played a pivotal role in this growth, allowing us to expand our duty-free operations and offer a more diverse range of luxury and premium products. By focussing on creating a seamless, upscale shopping experience, we have been able to attract a wider range of customers and increase our market share in a highly competitive industry.

How many airports does Adani Enterprises operate in India?

Adani Enterprises currently operates seven airports across India. These include major airports in Mumbai, Trivandrum, Ahmedabad, Lucknow, Mangalore, Jaipur, and Amritsar. Additionally, Adani operates three seaports: Mundra, Krishnapatnam, and Hazira, further showcasing its extensive presence in India’s infrastructure sector.

How large is the Indian luxury spirits market in duty-free?

The Indian luxury spirits market within duty-free continues to experience impressive growth. Brands like Indri and Jaisalmer have become star performers at Ospree, while Indian liquor brands such as Paul John, Old Monk, Rampur, Amrut, and Stranger & Sons are gaining global recognition. These brands contribute around 5% of our total liquor sales.

As more Indian travellers venture abroad and their disposable incomes increase, the demand for luxury spirits continues to rise, creating favourable market conditions for Ospree to expand its footprint in this segment.

Does Ospree offer special promotions to boost Indian premium spirits at major international airports in India?

Yes, Ospree has implemented several promotional initiatives to highlight Indian premium spirits. These promotions include exclusive discounts, high-visibility promotional areas within stores, and limited-edition releases. Some recent highlights include the launch of Idaaya Rum and exclusive releases from Ardbeg Circus, which have garnered attention from travellers.

These initiatives have not only increased awareness of Indian premium spirits, but have also encouraged travellers to explore the rich heritage and craftsmanship behind these products.

What are your expansion plans for the Indian market?

Ospree is actively pursuing expansion plans, which include increasing its portfolio of luxury brands and exploring opportunities to acquire non-Adani airports for duty-free operations. Our goal is to further establish Ospree as a premier destination for luxury shopping, both within India and globally.

What are your sales in terms of volumes and value?

Ospree primarily focusses on value over volume, as sales vary based on the demand for specific categories. Ospree Duty Free has achieved unprecedented growth (almost twice pax growth) in the last FY 23–24.

Ospree Duty Free FY 24 Business Highlights:

YOY Sales Growth: 44%, YOY Pax Growth: 23% and SPP Growth: 15%.Additionally, departure sales grew three times the PAX growth. We also have observed a 30% increase in the average sales per passenger. Our luxury sector has also expanded, growing from 7% last year to 20% this year.