Asia Pacific Travel Retail Association (APTRA), APTRA India Conference highlights India as the industry’s most compelling long-term growth opportunity. Growth in APAC region on the rise.

The India travel retail market is anticipated to reach $6.67 billion by 2032, growing at a CAGR of 19.80% during the forecast period 2025-2032.

The India travel retail market is witnessing substantial growth, fuelled by a rise in both international and domestic tourism. According to the World Economic Forum’s Travel and Tourism Development Index (TTDI) 2024, India ranks 39th out of 119 countries, highlighting the nation’s increasing prominence in the global tourism sector. As international tourist arrivals (ITAs) continue to recover from the impact of the COVID-19 pandemic, India is poised to capitalise on this upward trend, particularly in the travel retail sector, as global tourism steadily rebounds.

According to the Public Information Bureau, India recorded 9.24 million foreign tourist arrivals (FTAs) in 2023, reflecting a 43.5% increase compared to 6.44 million in 2022. This growth is driving a rise in demand for travel retail products, especially at airports and transit hubs. The duty-free retail segment, which plays a key role in this market, is also benefitting from the surge in tourism. Duty-free shopping at airports provides travellers with the opportunity to purchase a wide range of international products, such as luxury goods, cosmetics, perfumes, and electronics, often at lower prices due to tax exemptions.

Consumer preferences in India’s travel retail sector are undergoing a notable shift. With evolving lifestyles and increased exposure to global trends, travellers now seek unique and high-quality products. This inclination towards exclusive offerings is reshaping the assortment of goods available in duty-free shops, airport boutiques, and hotel stores. As consumers prioritise experiences and value authenticity, there’s a growing demand for products that reflect their individuality and cater to their discerning tastes. This shift underscores the importance for retailers to adapt their offerings to align with changing consumer desires, thereby enhancing their competitiveness in the market.

The surge in disposable incomes, constituting close to 60% of the GDP, propels the growth of India Travel Retail Market. As consumers become more affluent and well-travelled, there’s a notable shift towards discretionary spending, especially on leisure and business travel. Additionally, a study by Oxford Economics forecasts New Delhi and Mumbai to emerge as the world’s largest consumer cities for middle-income households by 2030, further affirming India’s rising economic stature and its promising outlook for retail growth.

However high operating duty-free retail spaces in airports entails substantial costs. Despite generating significant revenue, these spaces require extensive maintenance and operational expenses. To address these high operating costs, duty-free operators are increasingly exploring innovative strategies, such as online pre-purchase orders to optimise efficiency and profitability.

Geopolitical tensions can have a multifaceted impact on the India Travel Retail Market. Uncertainty and security concerns deter international travellers, impacting duty-free sales at airports and other travel retail outlets. Reduced tourist influx affects revenue streams and disrupts supply chains, leading to decreased consumer confidence and spending. Additionally, fluctuations in currency exchange rates and trade restrictions further exacerbate the situation, hindering market growth. To mitigate these challenges, stakeholders must closely monitor geopolitical developments, implement robust security measures, and diversify market strategies to adapt to changing dynamics and sustain resilience in the face of geopolitical uncertainties.

Geographically, the India Travel Retail Market is divided into North India, South India, East India, and West India regions.

Major players operating in India Travel Retail Market include Ospree, Dufry, Delhi Duty Free Services Pvt Ltd, Lotte Duty Free, The Shilla Duty Free, Flemingo Travel Retail, Travel Food Services (TFS) India, Cochin Duty Free, Hyderabad Duty Free, HMY, Beauty Luxe, Beauty Concepts and Relay India. To further enhance their market share, these companies employ various strategies, including mergers and acquisitions, partnerships, joint ventures, license agreements, and new product launches.

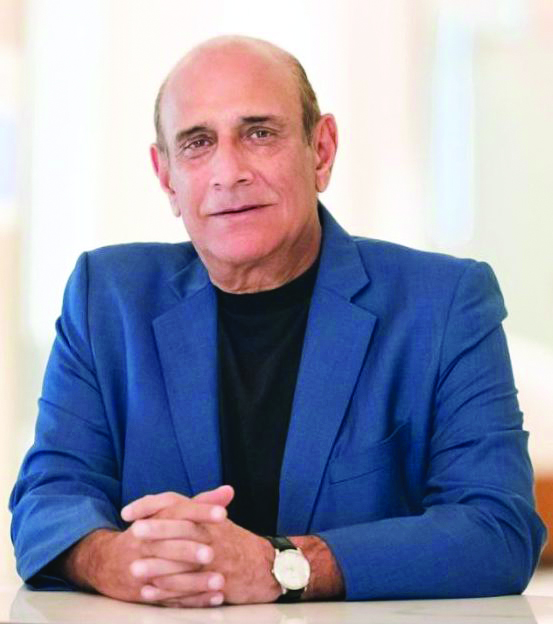

Sunil Tuli, President of the Asia Pacific Travel Retail Association (APTRA), opened the APTRA India Conference with a call to embrace India as the industry’s most compelling long-term growth opportunity.

Addressing delegates in Mumbai recently, Tuli acknowledged the challenging business environment, including global trade tensions and inflationary pressures across key categories such as beauty, spirits, and confectionery. “We now face a new disruptor in the form of tariff wars,” he noted, pointing to ongoing tensions sparked by the US administration’s trade strategies.

“India’s economy will soon reach $4trn, making it the world’s fifth largest, with projections to overtake Germany by 2027,” said Tuli.

Tuli highlighted the transformational growth of India’s aviation and retail infrastructure, including the upcoming Navi Mumbai International Airport, set to begin commercial operations in late July. The new hub will support Mumbai’s ambition to grow its economy from $140bn to $1.5trn by 2047.

With over 40,000 new passports issued daily and international travel spend by Indian consumers rising to $70bn in 2024, Tuli described a “new India” fuelled by its rapidly expanding middle class and Gen Z consumers. This digitally savvy, brand-aware demographic is increasingly prioritising travel and consumption, creating new expectations for retail experiences.

“Increased outbound traffic—growing at 5–6% year-on-year—means more travellers, more spending, and more opportunity for travel retail to shine,” he said.

Local retailers such as Ospree Duty Free and Delhi Duty Free for setting new standards in customer engagement, with activations ranging from Bollywood celebrity appearances to gold giveaways. “Retailers in India are delivering memorable shopping moments—this is the kind of magic we need to inspire shoppers,” he said.

He pointed out APTRA is committed to supporting growth across the region through advocacy, knowledge-sharing and stronger collaboration between retailers, brands, and airport operators.

“Together, we must rise to meet this moment,” Tuli concluded. “India is not just part of the future of travel retail—it is leading it.”

TFWA has released details of the upcoming Asia Pacific Exhibition & Conference, which will be held in its totality from May 11-15, with the conference taking place on May 12 at the Marina Bay Sands Expo & Convention Centre in Singapore.

Philippe Margueritte, TFWA President, said of the upcoming event: “Asia is the location of some of the world’s most dynamic economies. As passengers across the region continue to take to the skies and seas in ever greater numbers, it’s paramount that we turn these travellers into shoppers. This conference will give attendees plenty of fresh ideas on how to do just that.”

Tickets for the APTRA Singapore Networking Lunch – now in its third consecutive year, are available and selling fast for the upcoming event on Sunday 11 May 2025, ahead of the 2025 TFWA Asia Pacific Exhibition.

The lunch is open to everyone in travel retail and this year it will be held in the Padang Restaurant at the Singapore Cricket Club, between 12.00-3.30pm. Located in the Marina Bay Street Circuit, the venue is 10 minutes by taxi from the MBS Expo Centre, Singapore. Tickets are available at US$120 per head to include a buffet lunch and drinks, including Champagne Piaff from Loch Lomond Group, that is supporting the event, along with Lindt.

APTRA President, Sunil Tuli said, “One of APTRA’s core strategies is to provide opportunities for networking and connection amongst members and the wider industry. We’re very grateful for the support of our partners Champagne Piaff & the Loch Lomond Group and Lindt, as their contribution helps us to deliver a premium event at a reasonable price.”

In keeping with APTRA’s status as a non-profit organisation, the tickets are priced to cover costs without profit.

For many, the news from Asia Pacific is cause for concern. China’s ailing economy has damaged consumer confidence, leading to a projected 20% drop in luxury consumption according to a recent Bain & Company report. Meanwhile, South Korea’s duty free market faced a -22% year-on-year fall in H1 average spend, based on figures from the Korea Duty Free Association. Contrast those negative pointers with a 55% rise in concession income at Airports of Thailand for the year ending in September, more than double the growth of passenger traffic through the country’s terminals. And DidaTravel noted surging Chinese outbound travel during Golden Week, with trip bookings within Asia Pacific up 77% over last year and almost tripling for the Americas.

APAC continues to be the largest travel retail market by region – accounting for approximately 40% of global market share by revenue.

China is expected to remain the largest travel retail market through to 2030 and will continue to be a priority market for many brands.

India is also expected to grow in importance over the medium to long term as more Indians join the ranks of the country’s growing middle class.

Southeast Asian markets also present significant growth opportunities, with brands looking to capitalise on growth in new markets including Thailand and Vietnam.