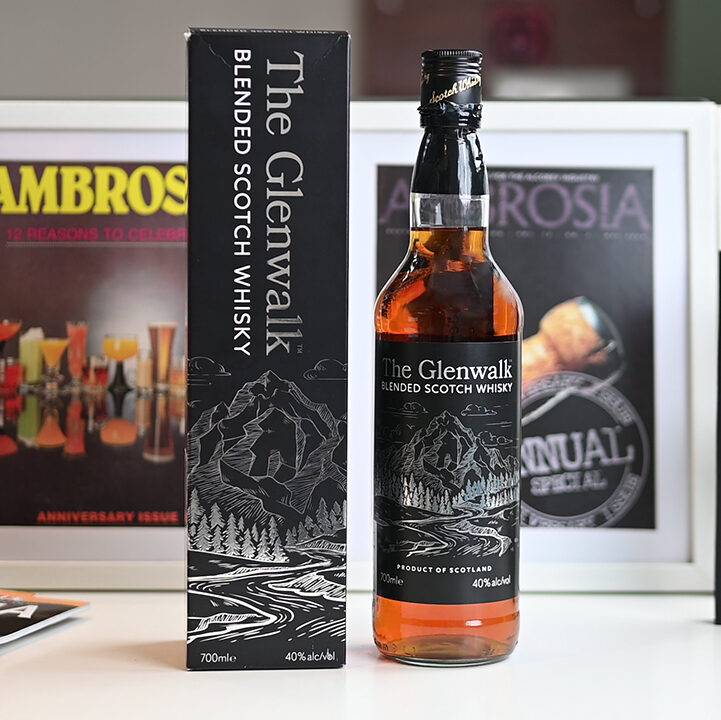

It isn’t everyday that a famous English cricketer decides to launch their own Scotch whisky – well may be not globally atleast. In India this has become a recent trend where celebrities have started jumping onto the alcobev bandwagon. Take for instance Sanjay Dutt, whose Glenwalk Whisky is doing pretty well in the market. Even SRK and his son Aryan have launched their premium Vodka in the market..

Now what makes Dram Bell special is that it comes from Kevin Pietersen – the former England Cricket Captain, who is a marquee investor in the company. I did sit down with him for a chat and you can read that conversation here.

The Dram Bell scotch whisky comes in 2 variants – the Premium and the Reserve. The Reserve comes with a 5-year age statement. But today I am reviewing the premium, priced at INR 1,750 per bottle for a 700 ml with a ABV of 40% and currently it is only available in Maharashtra with plans to launch in other states soon. Now this is positioned slightly higher than the other products in this. Why? We’ll talk about that later.

This whisky is brought to you by Ardent Alcobev Pvt. Ltd., which is a JV between Rajasthan Liquor Ltd (RLL) and Industry veterans, Debashish Shyam and Jatin Fredericks. Now you must be wondering how does KP come into the dram here? As mentioned earlier he is an investor in Ardent and naturally he is going to use his star power to promote the brand.

The whisky gets its name from a unique tradition during the Victorian time when distilleries rang a bell for the workers to come and enjoy a dram of whisky – on the house – a tradition that apparently these makers continue to the day.

What’s interesting is that Angus Dundee Distillers is the one who distils, blends and bottles Dram Bell in the Highlands Region in Scotland. Now they are a renowned name who are the makers of famous single malts like Tomintoul, etc and have been around for a longtime.

The scotch is made under the supervision of Ian Forteath, Dram Bell’s Master Blender with the blend using a combination of aged malt and grain Scotch whiskies, matured in first and second-fill American bourbon oak casks and the makers say that this results in a refined and complex flavour profile. Now what does first and second fill cask mean? It means that a cask that has previously been used to age sherry, port, bourbon, or other aged wines or spirits, and is now being used to age another whisky for the first time. And this process tends to add a distinctive flavour.

Packaging

The mono carton packaging is very Scottish in terms of the red/maroon colours with all the information – the key one being that it is exclusively made in Scotland.

It comes with a neck tie that has info from KP and the bottle is very familiar, since it is bottled by Angus Dundee it is slightly familiar to Tomintoul single malt. I like the ingredients where is states on the bottle – scotch whisky, water and natural colour, which means it has purely got its colour from the barrels and maturation process – making it authentic.

Nosing and Tasting

At first whiff you can get the aromas of sweetness, hint of chocolatey, toffee/caramel sort of finish. Its is surely fruity and also a hint of fennel may be? In terms of taste – it is sure sweet with hints of apple, spice and caramel finish. On the throat the finish is short but smooth and there is no burn, which hints that it has even matured well.

Conclusion

So how is Kevin Peterson Dram Bell scotch whisky? Well for a price of Rs. 1750 it is competing with some very good names in the category. Like Teachers Highland Cream, Grants, 100 Pipers Deluxe etc. And with the prospect of it being more affordable in other states (when it launches), this makes it a pretty good proposition.