There is an air of optimism as the threat of Covid is on the wane. A report on the growth of the alcobev and duty free market.

The global alcoholic beverages market was estimated to be at USD 1.58 trillion in 2020 and is projected to grow at a compound annual growth rate (CAGR) of around 3.5% between 2020 and 2023. India is one of the fastest growing alcoholic beverages markets globally, with an estimated market size of USD 52.5 billion in 2020 and the market is expected to grow at a CAGR of 6.8% between 2020 and 2023.

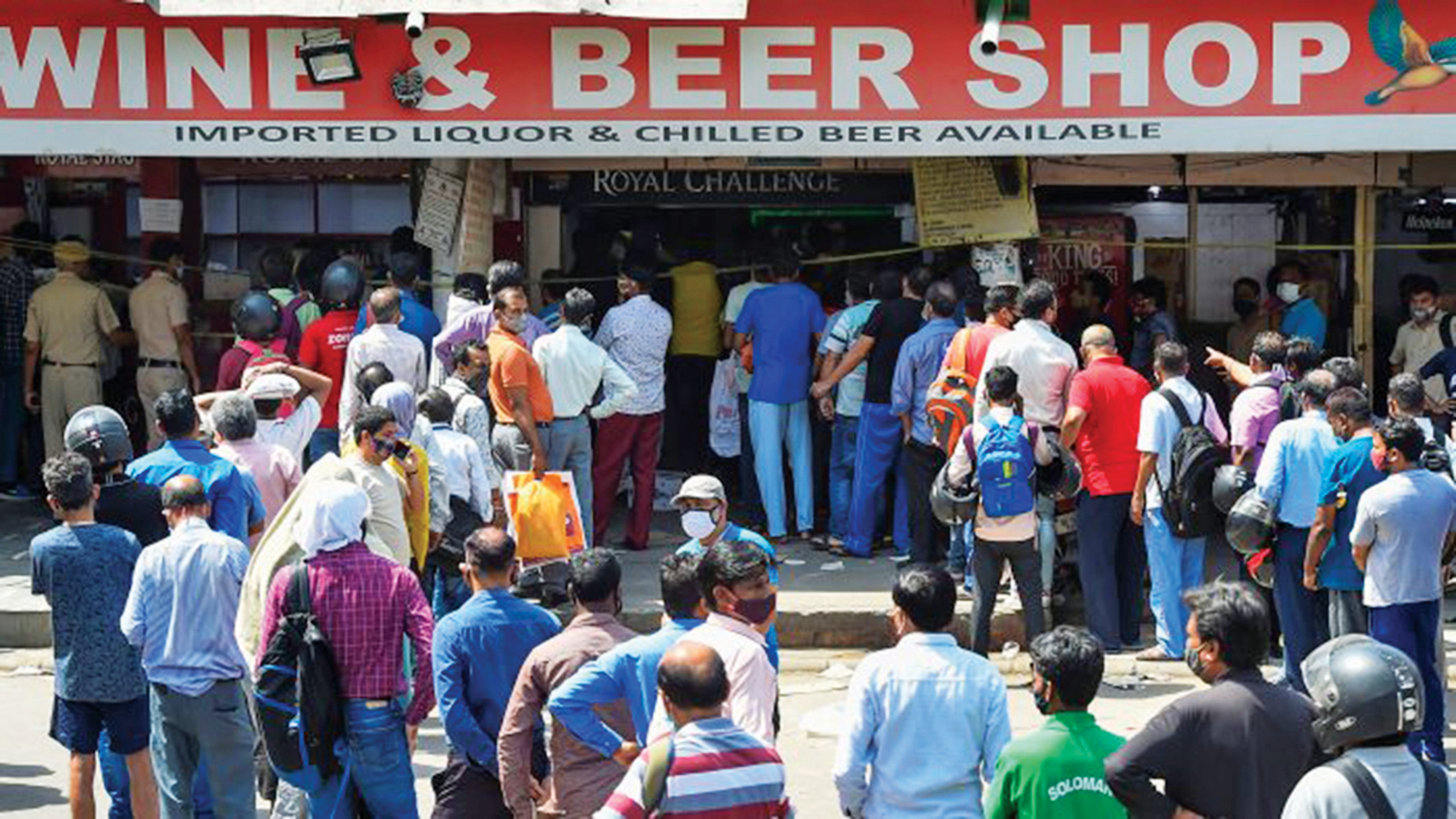

The alcoholic beverages industry contributes to around 1.5 million jobs in India and generated around USD 48.8 billion in sales revenue in 2019. The sector is open to foreign investments and many states offer subsidies for local manufacturing (for example, Maharashtra and Karnataka for wines). From the demand side, factors such as rapid urbanisation, changing consumer preferences and a sizeable and growing middle-class population with increased purchasing power have contributed towards growth in demand for alcoholic beverages.

According to industry estimates, the number of people consuming alcohol increased from approximately 219 million in 2005 to 293 million in 2018; it is projected to increase to 386 million by 2030. The share of the upper middle income group in alcohol consumption has increased steadily from 7% to 21% and is expected to increase to 44% by 2030.

The Global Duty-Free Retailing Market is projected to reach USD 127.83 billion by 2027 from USD 87.37 billion in 2021, at a CAGR 6.54% during the forecast period.

The Americas Duty-Free Retailing Market size was estimated at USD 21 billion in 2021, is expected to reach USD 22 billion in 2022, and is projected to grow at a CAGR of 7.37% to reach USD 32 billion by 2027.

The Asia-Pacific Duty-Free Retailing Market size was estimated at USD 36 billion in 2021, is expected to reach USD 38 billion in 2022, and is projected to grow at a CAGR of 6.75% to reach USD 53 billion by 2027.

The Europe, Middle East and Africa Duty-Free Retailing Market size was estimated at USD 31 billion in 2021, is expected to reach USD 31 billion in 2022, and is projected to grow at a CAGR of 5.71% to reach USD 43 billion by 2027.

The global duty-free and travel retail market is estimated to generate revenues of around $112 billion by 2023, growing at a CAGR of approximately 8% during 2018-2023.

The duty-free retail market in the Asia-Pacific, the largest market for duty-free retail products, is expected to cross pre-pandemic levels in 2023 as normalcy returns to the market and customer demand picks up, according to a report from GlobalData.

The rising number of middle-class population and rapid urbanisation is propelling the growth of the global duty-free and travel retail market. The increase in disposable income, improvement of standard living, and affordability and convenience of air travel are boosting the number of middle-class population travelling and purchasing products from these stores in the global market. The leading vendors are developing consumer-focussed businesses especially for this end-user segment to boost their travel retail industry size over the next few years.

In emerging countries such as India and China, middle-class consumers are the largest contributors to the economic development and have the spending capacity to promote the growth of the duty-free industry in the global market. With the surge in middle-class median income, their expenditure trend, travelling mode, and demand for premium brands will also rise, thereby, fuelling the travel retail sales. The rapid development and urbanisation will augment the development of infrastructure and offer access to better amenities in the global market. The building of new airports and ports will boost the revenues in the global duty-free and travel retail market.

The significant growth in the tourism industry is one of the key factors driving the market growth. In line with this, the increased time spent by passengers at airports due to security concerns and early check-in times is favouring the market growth. Additionally, the increasing preference for luxury and premium products, such as cosmetics, fragrances, and alcohol, is acting as another growth-inducing factor. Besides this, the rising air travel and proliferation of new international airports due to the rapidly expanding aviation industry is providing a considerable boost to market growth. Moreover, the introduction of touch screens and interactive retail kiosks, which offers seamless ordering and payment solutions, is providing an impetus to the market growth. Apart from this, the widespread adoption of new marketing strategies by brands, such as launching exclusive and limited products and partnerships with prominent distribution chains to gain a competitive edge, is propelling the market growth. Furthermore, the implementation of various government initiatives promoting international tourism is positively influencing the market growth. Other factors, including rising expenditure capacities of the consumers, emerging trends of digitalization in retailing processes, the rising consumer inclination for premium wines and spirits, and the introduction of pre-ordering applications, are anticipated to drive the market growth.

The global duty-free and travel retail market by product is segmented into fragrance and cosmetics, liquor, fashion and accessories, tobacco goods, electronics, watches, and confectionery.

However, some countries impose duty on goods brought into the country, though they had been bought duty-free in another country, or when the value or quantity of such goods exceed an allowed limit. Duty-free shops are often found in the international zone of international airports, sea ports, and train stations but goods can also be bought duty-free on board airplanes and passenger ships.

The competitive landscape of the industry has also been examined along with the profiles of the key players being Aer Rianta International, China Duty Free Group Co. Ltd., Dubai Duty Free, Dufry, Duty Free Americas Inc., Gebr. Heinemann SE & Co. KG, James Richardson Group, King Power International, Lagardère Travel Retail, Lotte Duty Free, Sinsegae Duty Free and The Shilla Duty Free.

Erik Juul‑Mortensen, President of the Tax Free World Association (TFWA), was also positive, an outlook largely based on the latest available travel data. Noting that, with the exception of China, every major market in the Asia‑Pacific region has partially or completely reopened to vaccinated travellers, he added, “Many markets have seen a strong recovery in March and April, and with pent‑up demand or ‘revenge travel’, two markets have just exceeded their 2019 duty‑free revenues for the same period, namely Australia and Singapore.

“This has happened despite the total number of travellers remaining relatively low. Duty‑free members have been reporting higher basket value, driven in part by pent‑up demand and less store congestion, and, therefore, more attentive service by store personnel. The pandemic has forced the industry to consider and adapt to a still‑changing environment. Our priority in duty free and travel retail is to keep pace with, even to anticipate, those new expectations. They will continue to evolve, and so must we.”

On duty‑free spending trends, Sunil Tuli, President of the Asia-Pacific Travel Retail Association and Group CEO of King Power Group, agreed, saying, “Around the region, we have reports of increased spending per passenger. Every day there are more people travelling – for instance, here in Singapore, Changi Airport passenger traffic more than doubled in April from March, approaching 40% of pre‑pandemic levels, just one month from when borders were fully re‑opened to vaccinated travellers. However, across the board, significant pain points exist in terms of stock shortages, security delays in product screening, partial retail space re‑openings, low staff levels, a reduction in routes, recession fears, and the Russia‑Ukraine crisis driving inflation.”

The likelihood of impending recovery in the duty‑free industry was championed by Pedro Castro, Chief Operations Officer Asia‑Pacific of travel retailer Dufry, who said, “Markets such as the US, the Caribbean, Central America and Europe have already seen a return to about 60% of 2019 levels, with only Asia‑Pacific still lagging behind at about 10%. Domestic travellers in some markets around the world are already slightly higher than 2019 levels, and business travellers are close to 2019 levels. The Asia‑Pacific region is ready to support a rapid return to normalcy.”

Ashish Chopra, CEO of Delhi Duty Free Services, provided a deep dive into the Indian market, an analysis likely reflective of the air‑travel and duty‑free industries across Asia‑Pacific markets – if not now, then in the near future, saying, “In the past two months, we have seen sales reach 90% of pre‑pandemic levels on the back of 70% of passenger traffic. There is definitely pent‑up demand, and we expect Delhi to reach 2020 levels by this year.” For now, the passengers were business and high‑middle‑income travellers, and therefore were willing to spend more, with mass‑market travellers expected later in the year.

According to a new report published by Allied Market Research, titled, “Airport Duty-free Liquor Market by Type: Opportunity Analysis and Industry Forecast, 2021-2027”, the airport duty-free liquor market size was valued at $8.9 billion in 2019, and is projected to reach $10.4 billion in 2027, registering a CAGR of 22.22% from 2021 to 2027. The airport duty-free liquor at airport shops have become a favourite destination for travellers who like to shop before starting their journey. This is due to the elimination of local import tax or the duties implemented by the government bodies.

The key players operating in the global airport duty-free liquor industry are Brown-Forman, Diageo, Erdington, Bacardi, Heineken, Glen Moray, Accolade Wines, Constellation Brands, Inc., Remy Cointreau, Pernod, and Ricard.

The airport duty-free shops have become a favourite destination for travellers who like to shop before starting their journey. This is due to the elimination of local import tax or the duties implemented by the government bodies. This results in lesser pricing of liquor or any other products such as cosmetics, perfumes, souvenir, and others, which are available at duty-free shops.

Due to Covid-19 crisis, there is a decrease in international travel, which has affected airport duty-free sales in large proportion. As the lockdown continues in major parts of the world, airport duty-free retailers have unsold stock, while some retailers are finding imaginative ways to keep trading. As the travel retail sector market is temporarily on hold, airport duty-free liquor has experienced crucial sales channel cutoff. Airport duty-free liquor sales declined to large proportion due to the closure of international flight operations.

By type, the whiskey segment accounted for the second maximum share in 2019, owing to increase in demand for whiskey across the globe.

For the past few years cognac has gained universal recognition as one of the finest spirit, which is distilled from grapes. Cognac is also getting popular in the airport duty-free liquor market due to the recent surge in demand for premium liquor.

By region, Europe accounted for the highest revenue in 2019 owing to the tourists from the Middle East, China, the U.S., and Russia contributing a significant part in the market. Also, love for travel is experiencing an upward airport duty-free liquor market trends among Germans, which significantly contributes toward the growth of the market.