In the recent past, the stock market has crashed massively with the BSE Sensex going below 77,000 and the NSE Nifty50 also saw a sharp decline. Most broader market indices have been in the red. At the time of writing on February 13, the Sensex and Nifty were trading higher bringing relief for investors, following a six-day decline. The rise has been attributed to the meeting of the Indian Prime Minister Narendra Modi with the US President Donald Trump and the appreciation of the rupee against the dollar.

How have the liquor stocks been performing in this backdrop. It is reported that a few liquor stocks are outperforming consumer staples, even though there is slowdown in consumption. Brokerage firms are betting on some liquor stocks, the notable ones being Radico Khaitan and United Spirits. Some brokerage firms have estimated an upside potential of up to 19%, while some others have given six stocks a growth potential of 7% to 54%, something to cheer.

This is despite the demand environment remaining muted in Q4 FY24 due to inflation. In the previous quarter, liquor companies have had higher sales, thanks to the festive season, Cricket World Cup and wedding season.

United Spirits, a good bet

Though United Spirits, with famous brands such as Johnnie Walker, Black & White, Black Dog, Signature, Royal Challenge, McDowell’s No.1, Smirnoff and many more, had subdued sales in Q4 FY24, it is now focussed on premiumisation, in line with global trend of upgrading to better brands.

For the fourth quarter of FY24, the company recorded consolidated net sales of ₹2,666.00 crore, down from ₹2,989.30 crore in the December quarter and ₹2,864.70 crore in the September quarter. For the nine months ending December of the current financial year, the company notched up net sales of ₹18,995.50 crore, compared to ₹7,879.90 crore in FY22, ₹6,946.60 crore in FY21, and ₹5,664.80 crore in FY20. PAT for the nine months of the current year stood at ₹927.60 crore, compared to ₹847.70 crore in FY22.

United Spirits stock is trading at ₹1394.50 (down 3%) with the 52week low being ₹1075 and the high being ₹1700. If an individual had invested ₹1 lakh on February 12, 2020, it would now be worth ₹2.02 lakhs.

Radico Khaitan Riding High on Premiumisation

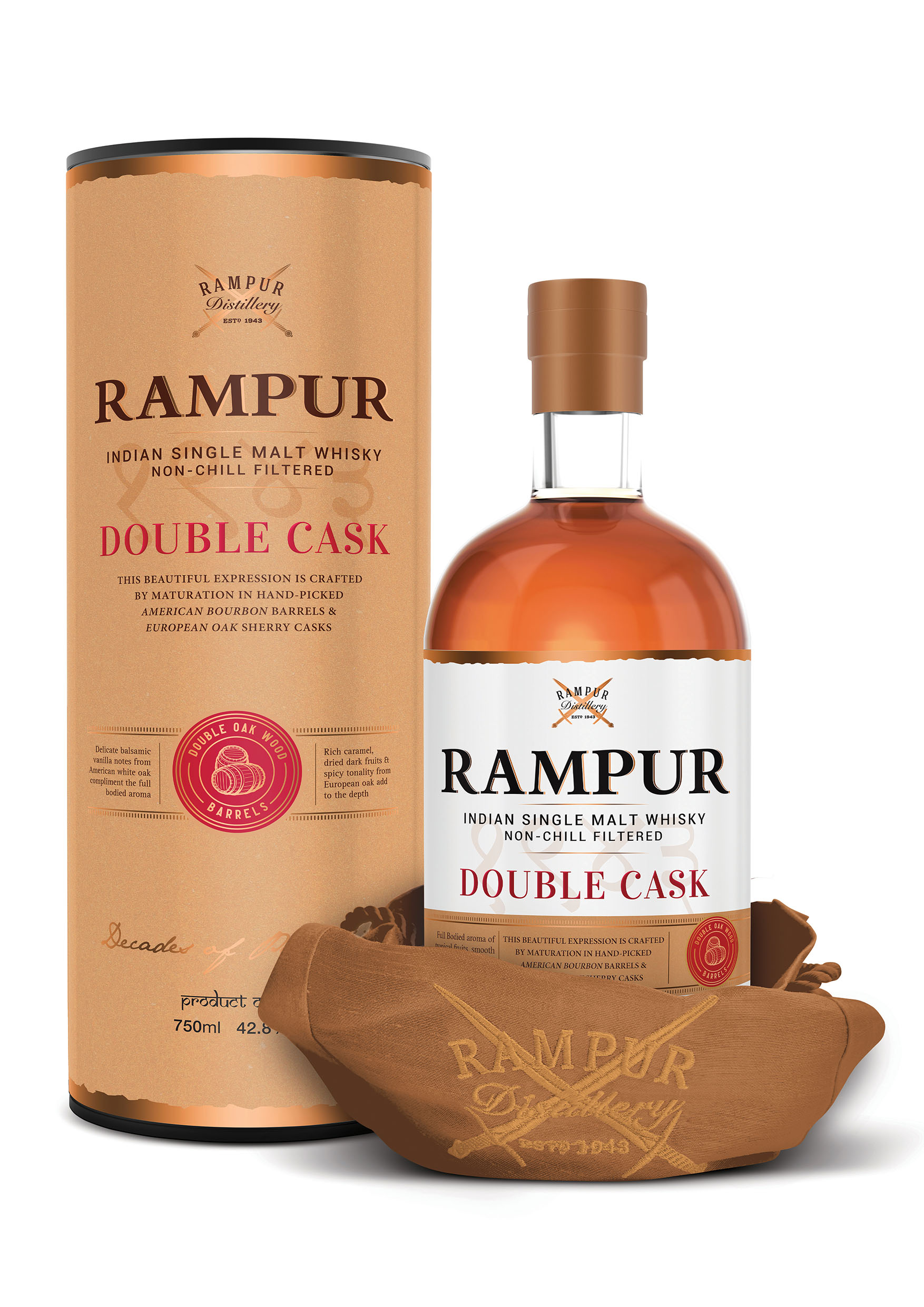

The next company to watch is Radico Khaitan, manufacturers of Rampur Indian Single Malt Whisky, Magic Moments, Dazzle Vodka, 8PM whisky and more. The company, one of the largest manufacturers of Indian Made Foreign Liquor (IMFL), which has 30 plus bottling units, over 75,000 retail outlets, reported an increase of 27.05% in its consolidated net profit to ₹95.48 crore in the third quarter ended December 2024. The company had posted a consolidated net profit of ₹75.15 crore in the October-December quarter a year ago, according to a BSE filing from Radico Khaitan.

Its revenue from operations went up 8% to ₹4,440.90 crore during the quarter under review. The figure was ₹4,111.23 crore in the corresponding quarter of the previous fiscal. In the December quarter, Radico Khaitan’s total IMFL volume was at 8.36 million cases, up 15.3% year-on-year. The Chairman & Managing Director Lalit Khaitan said, “Despite challenges in overall consumption growth, the spirits industry in India has experienced strong momentum, particularly driven by premium brands. In this context, we have delivered an impressive operational performance in Q3 FY25.”

Radico Khaitan is driving a premiumisation strategy which has benefitted the company’s financials. The premium products category is growing at over 20%. Rampur India single-malt whisky is gaining popularity by the day, all of which are driving EBITDA margins to 17-18% and improving the cash flow. The company expects these positives to result in a sharp fall in its debt levels by FY26.

If an individual had invested ₹100 in Radico Khaitan in 2021, it would now be fetching ₹242.81. The stock is trading on February 13, 2025 at ₹2,119 (down by ₹118 for the day).

United Breweries 17% gain in a year

United Breweries, subsidiary of Heineken N.V and makers of Heineken, Kingfisher Premium, Zingaro, Kalyani Black Label, London Pilsner etc., had gained 3.9% in trade following Heineken N.V reported its 2024 full-year results. The market capitalisation of the company stood at ₹54,561.32 crore. The 52-week high of the stock was at ₹2,299.4 per share and the 52-week low of the stock was at ₹1,645.8 per share.

UB is a market leader and its brand Kingfisher grew in volume in mid-single-digit, while Kingfisher Ultra and Heineken Silver volumes grew in the mid-thirties, gaining segment market share. UB shares have gained 17% against Sensex’s rise of 7.3% in the past one year.

Sula Vineyards Robust Growth

India’s largest wine producer, Sula Vineyards, has reported robust growth in its premium wine portfolio and wine tourism segment for the third quarter (Q3) and nine months (9M) of FY25, despite a challenging market environment. The company, known for its expansive range of wines and innovative wine tourism initiatives, announced its financial results, showcasing resilience and strategic adaptability.

In its latest performance update, Sula posted its highest-ever 9M net revenue of ₹489.2 crore, marking a 1.7% year-on-year (YoY) growth. This growth was largely driven by the company’s premium and elite wine brands, which saw a 5.6% YoY increase in Q3. The share of these higher-end labels in the company’s portfolio reached an all-time high of 80.5% in Q3, up from 77% last year, reflecting Sula’s strategic focus on catering to India’s evolving taste for luxury and quality.

Wine tourism, a key differentiator for Sula, also shone brightly, recording a remarkable 11.6% YoY growth in Q3 revenue. This was attributed to a vibrant festive and wedding season, coupled with higher guest spending, improved occupancy rates (81% compared to 76% in the previous year), and an increase in Average Room Rates (ARR).

However, the company faced significant headwinds in Q3, impacting profitability. The reduction in WIPS credits resulted in a direct EBITDA impact of ₹4.7 crore for the quarter, contributing to a 26.3% decline in EBITDA to ₹53.9 crore. Profit After Tax (PAT) also fell by 34.7% YoY to ₹28.1 crore, reflecting the pressures on margins.

Sula Vineyards share price is ₹317.55 as of February 13, having a 52 Week high of ₹639.95 while 52 week low is ₹308.10. Some brokerage firms are suggesting investors to hold on.

Tilaknagar Industries confident

Tilaknagar Industries Ltd., primarily engaged in the manufacture and sale of IMFL and extra-neutral alcohol, has brands such as Courrier Napoleon Brandy-Green, Mansion House Whiskey, Lumumba, Apple Fizz, Madira Rum, Brandy Smash, Warm Punch, etc.

Tilaknagar Industries for nine months FY25 had a net revenue from operations at ₹1,028 crore v/s ₹1,035 crore the previous period. The EBITDA improved by 28.6% to ₹176 crore v/s ₹137 crore; adjusted for the subsidy income. Volumes grew 2.1% to 84.9 million cases, while the net service revenue stood at ₹1,227 per case.

However, the company’s share price had hit 20% lower circuit at the time of writing, following the Bombay High Court’s dismissal of its petition in a trademark dispute involving the Mansion House brand. The company is going on an appeal on the Court order. The share price on February 13 was ₹261, the 52 week high been ₹457 and the low been ₹182.05, with a lot of promise. The alcobev market in India has been growing gradually over the years, thanks to the rising disposable income, urbanisation and retail innovations, all of which are making liquor stocks a good bet, despite the industry been highly regulated and prohibition in place in some states. The alcobev sector is dynamic, attracting investors as demand for alcobev products sees no decline. India’s alcohol industry is projected to reach sales of US$ 112,338.9 million by 2034, indeed a bet worth taking.