The global duty free retail market size was valued at USD 35.87 billion in 2021. The market is projected to grow to 72.23 billion by 2029, exhibiting a CAGR of 9.17% during the forecast period. The global Covid -19 pandemic saw the Duty Free Retail experiencing lower-than-anticipated demand across all regions compared to pre-pandemic market exhibited a decline of 42.38% in 2020 as compared to 2019.

This market generates significant revenue for airports, airlines, tourism, and other travel-related industries worldwide. Total income from duty free and travel retailing. Duty free goods’ sales typically happen within international zones, and these goods can also be sold on ships or onboard aircraft with shoppers/travelers in transit.

The duty free retailing market is majorly driven by increasing growth of travel and tourism industry coupled with rising penetration of low cost airlines. Increasing sales alcohol and confectionery is a major factor driving the growth of the global market.

Travel retail revenues make a functionally important influence to the overall financing of airports, the maritime companies as well as their infrastructure. All in all, these physiognomies of duty free retailing pose distinctive offerings for the travelers by meeting their needs, generating revenues and in turn supporting the maritime and aviation transport infrastructure and their services. Duty free retailing has emerged in parallel with the expansion of sea and air travel.

Although, the use of perfumes and cosmetics has a long history, increasing demand for premium fragrances and cosmetic products has raised the growth of the global duty free retailing industry. Rising investments by the governments of several economies to set up duty free retailing centres to cater to international tourists is another key factor driving the global market. Perfumes and cosmetics as well as tobacco goods are expected to register the fastest growth over the forecast period owing to increased demand for international tobacco and cosmetic products. Travellers prefer tasting tobacco and other products of different countries and prefer purchasing them from duty free retailing shops. This is expected to drive the overall market growth.

According to the research, in 2021-22 lower prices vs the domestic market and value for money are consistently quoted across all segments, whether age groups, genders or travel purposes. Good value for money is a particularly significant purchase driver for seniors at 49% and millennials, 34%.

Convenience is also an important purchase driver for both seniors, 36%, Gen Z shoppers and leisure travellers (both at 23%). Another common purchase driver in travel retail in 2021-22 is loyalty to the brand, especially for seniors (30%) and females (26%).

Travel retail revenues make a functionally important influence to the overall financing of airports, the maritime companies as well as their infrastructure. All in all, these physiognomies of duty free retailing pose distinctive offerings for the travellers by meeting their needs, generating revenues and in turn supporting the maritime and aviation transport infrastructure and their services. Duty free retailing has emerged in parallel with the expansion of sea and air travel.

Although, the use of perfumes and cosmetics has a long history, increasing demand for premium fragrances and cosmetic products has raised the growth of the global duty free retailing industry. Rising investments by the governments of several economies to set up duty free retailing centres to cater to international tourists is another key factor driving the global market. Perfumes and cosmetics as well as tobacco goods are expected to register the fastest growth over the forecast period owing to increased demand for international tobacco and cosmetic products. Travellers prefer tasting tobacco and other products of different countries and prefer purchasing them from duty free retailing shops. This is expected to drive the overall market growth.

The research also analyses the importance of sales staff in influencing shopper behaviour. Sales associates have a significant impact on the decision to purchase and this varies quite considerably by customer segment as well as by region. The research reveals that the impact of the interaction has increased considerably in the wake of the pandemic as travellers set to the skies again.

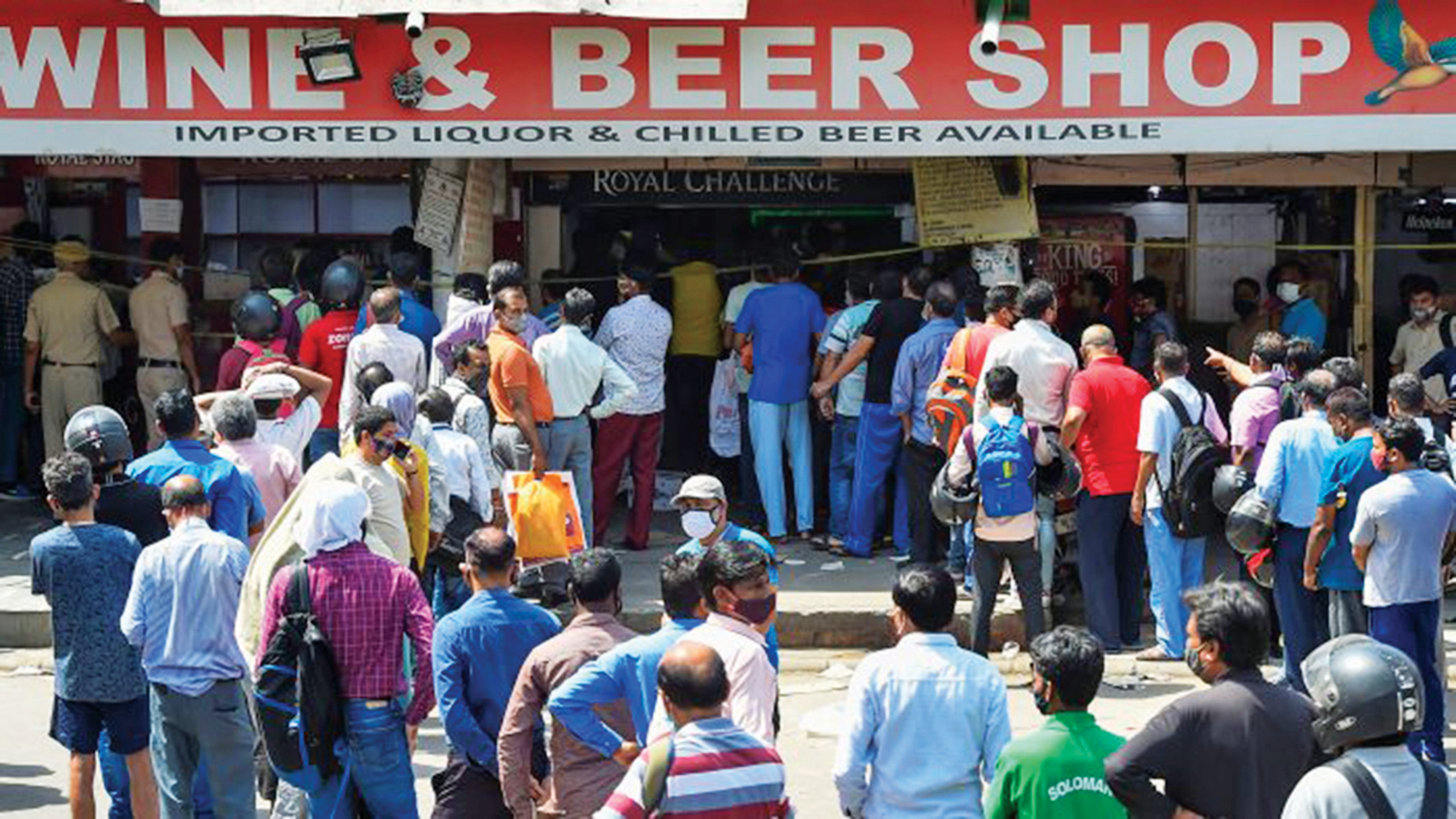

Recent years have witnessed considerable demand for duty free alcohol across countries, notably in Asia. The diversifying consumer buying habits, rapidly increasing international tourist arrivals, and rising spending among the rising demand for premium liquor is creating heightened consumer interest in duty free alcohol worldwide at a macro. The alcohol category has also witnessed significant developments, most notably product launches, in recent years. At a macro level, the growing demand for retail will boost duty free alcohol sales and other product types during the forecast period. Furthermore, the alcohol category is likely to encourage market key players to offer luxury and premium products.

The proliferation and introduction of new international airports across countries are creating lucrative business opportunities, in February 2021, the Airport Authority of India (AAI), an Indian governmental body that operates 125 airports saw revenues of USD 135.07 million (`987 crore) for the first phase of an international airport named ‘Dholera’ in Gujarat. According to Civil Aviation Ministry’s ‘Indian Aviation’s Vision 2040 claims that by 2040, India will have 190-200 operational international airports, while the top 31 Indian cities will have two operating airports. The fleet of 622 airliners to more than double to 2,359 aircraft by March 2040.

Numerous airlines across countries are expanding their international networks and establishing new airports as post the Covid-19 crisis.

Duty free markets are sensitive to exchange rates among countries. Although they operate in several countries with currencies including Euros, Dollars, and Pound, which have specific exchange rates, they are subject to global market changes exchange rate of a particular day. The currency exchange fluctuations in the global market may positively or negatively including retail chains that offer luxury goods, depending on the fluctuating exchange rate.

Based on type, the global market is segmented into perfumes, cosmetics, alcohol, cigarettes, and others. Internationally reputed distribution channels offer luxury perfumes worldwide. Affluent global travellers typically visit duty free retail chains that offer perfumes of internationally reputed Gucci, Giorgio Armani, Al Haramain Dazzle Intense, Belle, Signature Rose, Signature Silver, and Khulasat Al Oud. Perfume types, including Perfume or De Perfume, Eau De Perfume (EDP), Eau De Toilette (EDT), and Eau De Cologne.

Based on sales channel, airports, onboard aircraft, seaports, train stations, and others constitute the market segment worldwide. The mushrooming number of domestic and international airports across countries is favouring products. Various developments within the ‘airports’ category highlight the increasing number of duty free stores across airports in 2022, Flemingo, a Dubai-based global travel retail operator, and Adani Group, an Indian integrated business establish a duty free shop at the Thiruvananthapuram International Airport by mid-May 2022. This strategic move intensifying competition in the Indian market.

As the duty free & travel retail industry had hoped, 2022 has so far brought real signs of hope that the recovery in international travel is under way. The pent-up demand for travel, so often alluded to during the darkest days of the pandemic, is evident in all markets. But that demand is putting severe pressure on airport and airline capacity. And the reopening of some countries, notably in Asia, is only taking place at a gradual, even glacial, pace.

The duty free and travel retail market was hit hard in 2020 due to the sudden fall in tourism amid the Covid-19 pandemic. The tourism sector has already felt the negative impact of the pandemic on its performance much earlier. Globally, travel restrictions and measures started as early as January 2020. Domestic and international tourists limited their travel due to fear of contracting Covid-19, which reduced the number of domestic and international customers for this retail channel.

Duty-free and travel retail comprises a category in a growing list of ancillary offerings by airlines. For some low-cost and ultra-low-cost carriers, the growth in the scope and magnitude of ancillary revenues has become key to their operations, allowing them to offer lower ticket prices and stimulate the overall demand for air travel as a result. Furthermore, when compared to airport duty-free and travel retail, the duty free and travel retail sales generated by airlines are substantially smaller, both in magnitude and relative to the financial performance of the respective recipient.