Yearly Archives: 2022

30 Best Bars India announces new category – Best Sustainable Bar

A jury of over 50 industry professionals and bar enthusiasts from across the country are currently at work to create the long list of Top 100 Bars for 2022. Starting early November, a larger pool of more than 200 jurors will vote to rank the country’s 30 Best Bars, and also pick winners in 10 jury-nominated categories including Best Hotel Bar, Best Restaurant Bar, Best Independent Bar, Best Cocktail Menu, Best Bar Team, Best Bartender, etc.

The 2022 Jury Chairs for the 30 Best Bars ranking across various cities include names like Sanjay Ghosh (YouTuber and Director, Cocktails India), Rohan Carvalho (Founder and Partner, Bar Square India), Harinath Shanker (Director, Bar Masons), Puru (Drinks Enthusiast), Shatbhi Basu (Author, Managing Director & Owner, STIR Academy), Shreya Soni (Founder and CEO, DSSC), Minoti Makim (CEO, Carpe Diem), Karthik Setty (Founder of Hyderabad Thirst Club), Kimberley Pereira (Marketing Director at Kade Communications), Nolan Mascarenhas (Photojournalist, UpperCrust), Vaniitha Jain (Founder, The Perfect Pour) and Karina Aggarwal (VP, India Craft Spirits Co).

Incredible resurgence of bars

Speaking on the occasion, Vikram Achanta, Co-Founder of 30 Best Bars India, said, “India’s bar industry has been remarkably resilient over the past two years, and we are now witnessing an incredible resurgence – as new ventures are transforming the bar scene every day. We are incredibly excited to open applications for our third edition, with a new award category introduced to applaud sustainability innovations. We look forward to working with leading alcobev industry members to unveil our 2022 rankings.”

This year the Best Bar Design Award, which commends bars that set new standards of excellence in design, interiors, and bar ergonomics will be voted on by experts of the bar design industry. Bar owners who feel they may have been missed out from being included in the 30 Best Bars India long list can self-nominate themselves on https://www.30bestbarsindia.in/enroll-your-bar/, with required information and photographs.

“When we started, we wanted to honour the country’s best bars and bartending talent. Today, 30 Best Bars India is on every bar’s radar, and they are constantly upping their game to be featured on our Top 100 and Top 30 lists. With our masterclasses, workshops, and cocktail carnivals, we are rapidly shaping India’s cocktail culture, and aim to be the go-to list for consumers to find the best watering holes in their cities,” added Radhakrishnan Nair, Co-Founder of 30 Best Bars India.

Prior to the finale, 30 Best Bars India will also host immersive Masterclasses for the bartending community, cocktail workshops by renowned mixologists, and first-of-its-kind cocktail carnivals with specially curated cocktail menus from the world’s best brands across India.

Co-founded in 2019 by Vikram Achanta and Radhakrishnan Nair of Bar 30 India LLP, 30 Best Bars India aims to raise awareness about the rising standards of Indian bars and beverages nationally, and on international platforms. 30 Best Bars India ranking of the country’s best bars in the previous two editions in 2019 and 2021 have included well known bars that have gone on to be part of international bar ranking lists over the last three years. To see the full list of bars and their rankings in 2019 and 2021 please visit: https://www.30bestbarsindia.in/.

Raising the bar, indeed

Indian bars are stoked that some of them are making it in international rankings, something to cheer about. Some of the Indian cities have a vibrant cocktail culture, but never did they vie for international recognition. There are a couple of reasons for this trend, the first being those founding these heady bars are young, spirited, innovative and above all daring to dream. They are certainly raising the bar. Then there is the customer who is sipping his or her drink with finesse, with a lot of understanding and responsibly. The well-heeled traveller is one of the profiles of the customer, but then the internet of things, so to say, has given birth to a new breed of connoisseurs.

And when Delhi’s chic bar – Sidecar makes its entry into the World’s Best Bars with a ranking of 26, it certainly warms the cockles of one’s heart. Goa’s go to bar Tesouro which opened during the pandemic has just sneaked into the top 100 with a ranking of 99 in 2021.

In Asia’s Best Bars, Tesouro has taken the fourth place. The capital has three ranks in Sidecar – 14th; Hoot – 26th; Home – 30; and Bengaluru’s Copitas is at 44. And the industry believes that the number is going to swell.

Tesouro makes a splash

Tesouro, meaning treasure in Portuguese is a treasure trove in the coastal state of Goa which prides itself of the local brew – Feni. Tesouro in South Goa is a cool bar with Goan-Portuguese design elements and a very impressive bar and bar tending aficionados. The cocktail menu is a showcase of the bar team’s creativity with drinks such as Midnight Brekkie (gin, bianco vermouth, peanut butter, watermelon, strawberry) topping the ranks as the most popular drink. Tesouro certainly has made a splash as a new entrant in the international bar scene.

Sidecar – Racing away to glory

Delhi’s Sidecar has been winning accolades, thanks to the bar legend Yangdup Lama and business partner Minakshi Singh. The duo has positioned Sidecar as a ‘friendly neighbourhood bar’ in a happening place of Greater Kailash. The signature cocktails are something to toast too and Rohan Matmary has dished out amazing iterations of their namesake – the Sidecar.

Hoots – One might as well say ‘I care two Hoots!!’

Ranked 26, Hoots which is tucked away in Vasant Vihar in New Delhi is kind of pivot in the capital’s cocktail scene, kind of a pioneer having introduced a world-class cocktail programme, attracting the globe trotter and haute monde and who know what a fine cocktail is.

Home – Is where the spirit is

Ranked 30th, Home was previously a member’s club and only recently it opened its doors to the public at large who seem to be heading home, just by the whiff of it. The bar reminds one of a Parisian jazz clubs, but some of the offerings have a local flavour to it, making it a perfect fusion. Like a typical home, one can nurse one’s drink with a book in hand or just enjoy the music which wafts through without being loud.

Copitas gives a different flavour to Pub City

It is said to be Bengaluru’s watering holes, besides the many places such as Toit, Byg Brewsky etc. which have elevated the IT city to another level. Copitas is located on the 21st floor of the Four Seasons hotel and come rain or shine, the well-stocked bar leaves one tingling for more. Looking down at the city from that level has got more to do with the bartenders’ artistry than the city lights.

The cocktail culture is fast evolving in not just the Indian metros, but other cities and towns too. Yes, albeit a bit late on the international scene, but sure enough the bars are making waves.

India and Australia seek boost in wine trade and access

India and Australia have maintained a cordial relationship for many years, with bilateral trade between the two nations valued at $27.5 billion in 2021. The Economic Cooperation and Trade Agreement (ECTA) signed earlier this year has seen both nations looking to boost bilateral trade to as much as $45 billion by 2027. As Australia’s 9th largest trading partner, with a share of 43% of all wines imported from the Pacific region, stakeholders in the wine sector are now looking for avenues to introduce more premium Australian wines into the country.

The recent lunch hosted by Austrade and Wine Australia at the Australian High Commission in India was the latest in a series of efforts to showcase the best of premium Australian wines to Indians. The lunch came as part of the Australian-Indian Business Mission 2022, featuring insightful interactions between crucial stakeholders, including Sarah Roberts, Regional Manager Asia Pacific, Wine Australia; John Southwell, Trade and Investment Commissioner for Agribusiness, Food and Beverage, Austrade, as well as wineries and other crucial stakeholders.

At the event, premium brands such as the Three Lions Cabernet Merlot, D’arenberg Stump Shiraz, Brown 1889 Chardonnay, and Shaw Smith Sauv Blanc were served. The aim was to showcase how these wines can become a household staple in homes because of their unique and rich tastes.

Australia’s strategic advantage as an isolated continent surrounded by the ocean lies in the fact that it has a diverse wine ecosystem, with more than 100 grape varieties and legacy vines aged 200 years and beyond because it was able to escape the devastation caused by phylloxera. One of the main highlights of the event was the video presentation by Sarah Roberts wherein she shared details of demographics and the profile of Indian wine drinkers.

According to Tejaswi Rathore, Director, Communications, Austrade-South Asia, if there is one thing you can’t take away from Australian wine, it is variety and diversity. “Australian wineries work with so much freedom and innovation, resulting in a multiplicity of tastes and profiles. What this means is that each wine serves specific purposes. While the reds, especially the shiraz will go very well with Indian food, the consumer has a freedom to choose what works for him from one particular dish to another. This is why Australian wines are highly rated across the globe,” she says.

However, as much as Australia’s wine scene is diverse, it is not restrictive. There’s a conscious effort to continue to learn and adapt new ideas, knowledge, and technology from all over the world, fusing the experiences, and flavours from microclimates to create a truly rounded wine ecosystem. To adequately satisfy the tastes and cravings of Indian wine consumers and understand the best way to position their brands, a research team was put together to understudy the profile and demographics of Indian wine drinkers, and the result has been helpful in curating choice wines for the identified groups.

“What we need right now is for the ECTA agreement to come into force, so that Indians can gain access to these array of choice wines. Although our main focus is the tier one cities, we hope that every Indian that wishes can have a bottle of our finest wines whenever they please. We’re taking our awareness strategy across the supply chain to enhance visibility. There’s also the advantage of having great value for money without compromising the premium quality that the wine offers,” commented John Southwell, Trade and Investment Commissioner for Agribusiness, Food and Beverage, Austrade.

As the Indian population continues to make wines a part of their daily life, there’s confidence that there will be more Australian quality wines filling the cellars, bars, and cabinets in homes and bars across the nation.

Pent up demand in Global Duty Free markets, but there is caution

The global duty free retail market size was valued at USD 35.87 billion in 2021. The market is projected to grow to 72.23 billion by 2029, exhibiting a CAGR of 9.17% during the forecast period. The global Covid -19 pandemic saw the Duty Free Retail experiencing lower-than-anticipated demand across all regions compared to pre-pandemic market exhibited a decline of 42.38% in 2020 as compared to 2019.

This market generates significant revenue for airports, airlines, tourism, and other travel-related industries worldwide. Total income from duty free and travel retailing. Duty free goods’ sales typically happen within international zones, and these goods can also be sold on ships or onboard aircraft with shoppers/travelers in transit.

The duty free retailing market is majorly driven by increasing growth of travel and tourism industry coupled with rising penetration of low cost airlines. Increasing sales alcohol and confectionery is a major factor driving the growth of the global market.

Travel retail revenues make a functionally important influence to the overall financing of airports, the maritime companies as well as their infrastructure. All in all, these physiognomies of duty free retailing pose distinctive offerings for the travelers by meeting their needs, generating revenues and in turn supporting the maritime and aviation transport infrastructure and their services. Duty free retailing has emerged in parallel with the expansion of sea and air travel.

Although, the use of perfumes and cosmetics has a long history, increasing demand for premium fragrances and cosmetic products has raised the growth of the global duty free retailing industry. Rising investments by the governments of several economies to set up duty free retailing centres to cater to international tourists is another key factor driving the global market. Perfumes and cosmetics as well as tobacco goods are expected to register the fastest growth over the forecast period owing to increased demand for international tobacco and cosmetic products. Travellers prefer tasting tobacco and other products of different countries and prefer purchasing them from duty free retailing shops. This is expected to drive the overall market growth.

According to the research, in 2021-22 lower prices vs the domestic market and value for money are consistently quoted across all segments, whether age groups, genders or travel purposes. Good value for money is a particularly significant purchase driver for seniors at 49% and millennials, 34%.

Convenience is also an important purchase driver for both seniors, 36%, Gen Z shoppers and leisure travellers (both at 23%). Another common purchase driver in travel retail in 2021-22 is loyalty to the brand, especially for seniors (30%) and females (26%).

Travel retail revenues make a functionally important influence to the overall financing of airports, the maritime companies as well as their infrastructure. All in all, these physiognomies of duty free retailing pose distinctive offerings for the travellers by meeting their needs, generating revenues and in turn supporting the maritime and aviation transport infrastructure and their services. Duty free retailing has emerged in parallel with the expansion of sea and air travel.

Although, the use of perfumes and cosmetics has a long history, increasing demand for premium fragrances and cosmetic products has raised the growth of the global duty free retailing industry. Rising investments by the governments of several economies to set up duty free retailing centres to cater to international tourists is another key factor driving the global market. Perfumes and cosmetics as well as tobacco goods are expected to register the fastest growth over the forecast period owing to increased demand for international tobacco and cosmetic products. Travellers prefer tasting tobacco and other products of different countries and prefer purchasing them from duty free retailing shops. This is expected to drive the overall market growth.

The research also analyses the importance of sales staff in influencing shopper behaviour. Sales associates have a significant impact on the decision to purchase and this varies quite considerably by customer segment as well as by region. The research reveals that the impact of the interaction has increased considerably in the wake of the pandemic as travellers set to the skies again.

Recent years have witnessed considerable demand for duty free alcohol across countries, notably in Asia. The diversifying consumer buying habits, rapidly increasing international tourist arrivals, and rising spending among the rising demand for premium liquor is creating heightened consumer interest in duty free alcohol worldwide at a macro. The alcohol category has also witnessed significant developments, most notably product launches, in recent years. At a macro level, the growing demand for retail will boost duty free alcohol sales and other product types during the forecast period. Furthermore, the alcohol category is likely to encourage market key players to offer luxury and premium products.

The proliferation and introduction of new international airports across countries are creating lucrative business opportunities, in February 2021, the Airport Authority of India (AAI), an Indian governmental body that operates 125 airports saw revenues of USD 135.07 million (`987 crore) for the first phase of an international airport named ‘Dholera’ in Gujarat. According to Civil Aviation Ministry’s ‘Indian Aviation’s Vision 2040 claims that by 2040, India will have 190-200 operational international airports, while the top 31 Indian cities will have two operating airports. The fleet of 622 airliners to more than double to 2,359 aircraft by March 2040.

Numerous airlines across countries are expanding their international networks and establishing new airports as post the Covid-19 crisis.

Duty free markets are sensitive to exchange rates among countries. Although they operate in several countries with currencies including Euros, Dollars, and Pound, which have specific exchange rates, they are subject to global market changes exchange rate of a particular day. The currency exchange fluctuations in the global market may positively or negatively including retail chains that offer luxury goods, depending on the fluctuating exchange rate.

Based on type, the global market is segmented into perfumes, cosmetics, alcohol, cigarettes, and others. Internationally reputed distribution channels offer luxury perfumes worldwide. Affluent global travellers typically visit duty free retail chains that offer perfumes of internationally reputed Gucci, Giorgio Armani, Al Haramain Dazzle Intense, Belle, Signature Rose, Signature Silver, and Khulasat Al Oud. Perfume types, including Perfume or De Perfume, Eau De Perfume (EDP), Eau De Toilette (EDT), and Eau De Cologne.

Based on sales channel, airports, onboard aircraft, seaports, train stations, and others constitute the market segment worldwide. The mushrooming number of domestic and international airports across countries is favouring products. Various developments within the ‘airports’ category highlight the increasing number of duty free stores across airports in 2022, Flemingo, a Dubai-based global travel retail operator, and Adani Group, an Indian integrated business establish a duty free shop at the Thiruvananthapuram International Airport by mid-May 2022. This strategic move intensifying competition in the Indian market.

As the duty free & travel retail industry had hoped, 2022 has so far brought real signs of hope that the recovery in international travel is under way. The pent-up demand for travel, so often alluded to during the darkest days of the pandemic, is evident in all markets. But that demand is putting severe pressure on airport and airline capacity. And the reopening of some countries, notably in Asia, is only taking place at a gradual, even glacial, pace.

The duty free and travel retail market was hit hard in 2020 due to the sudden fall in tourism amid the Covid-19 pandemic. The tourism sector has already felt the negative impact of the pandemic on its performance much earlier. Globally, travel restrictions and measures started as early as January 2020. Domestic and international tourists limited their travel due to fear of contracting Covid-19, which reduced the number of domestic and international customers for this retail channel.

Duty-free and travel retail comprises a category in a growing list of ancillary offerings by airlines. For some low-cost and ultra-low-cost carriers, the growth in the scope and magnitude of ancillary revenues has become key to their operations, allowing them to offer lower ticket prices and stimulate the overall demand for air travel as a result. Furthermore, when compared to airport duty-free and travel retail, the duty free and travel retail sales generated by airlines are substantially smaller, both in magnitude and relative to the financial performance of the respective recipient.

November 2022

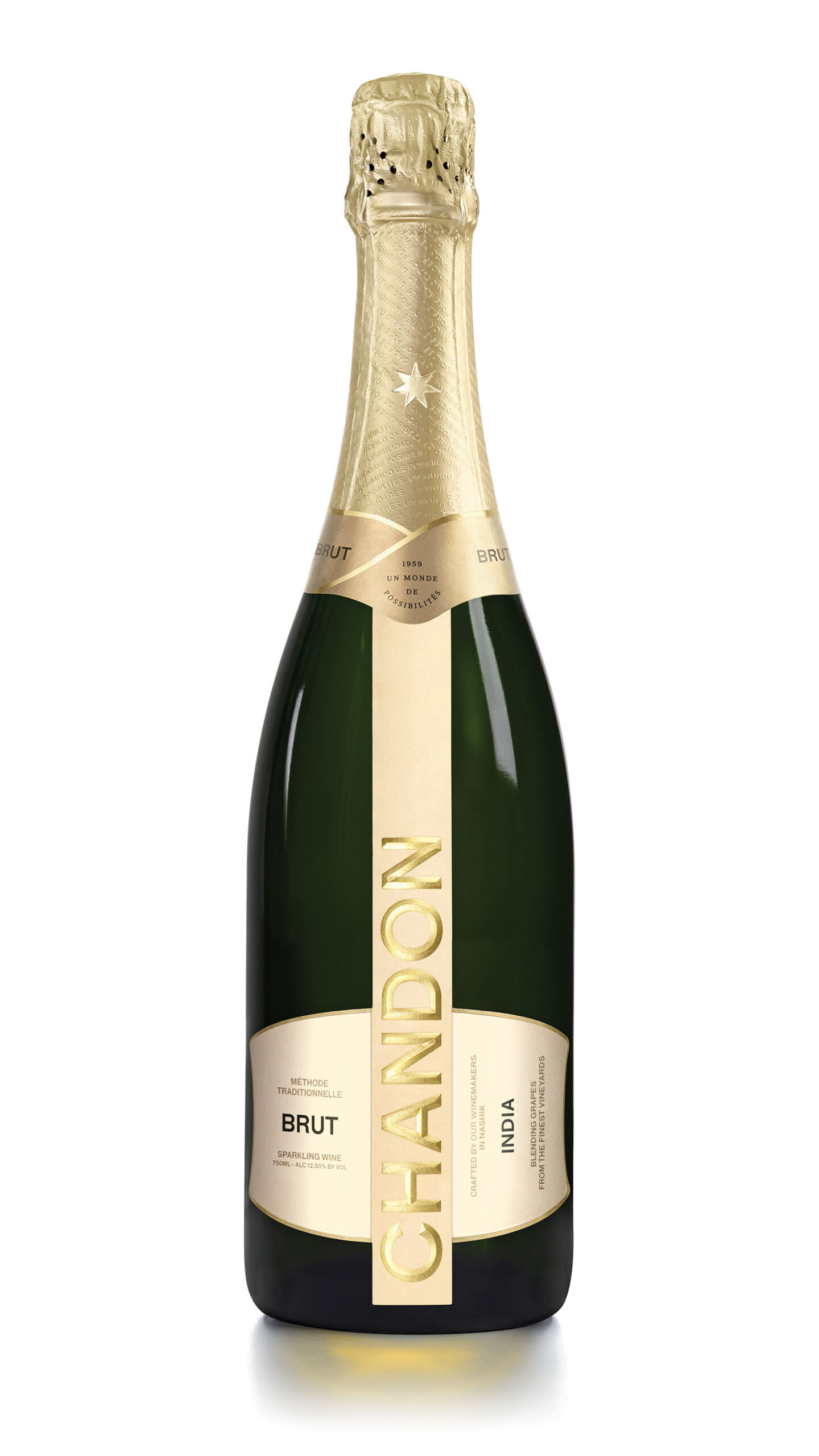

Chandon India says cheers to celebrations and experiences

What is the current portfolio of brands that the company is marketing in India?

In India, the company is involved in the import, sales, and marketing of Moët Hennessy’s luxury portfolio of wines and spirits, besides operating the Chandon winery in Nashik. Apart from Chandon, the current portfolio in India also includes brands like Moët & Chandon, Dom Perignon, Glenmorangie, Hennessy, and Belvedere that have helped in driving revenue for the country’s overall sales. There is also a larger portfolio of wines, champagnes, and still wines that we sell in India. Moët Hennessy as an organisation is also introducing experiences among all our brands. Based on our understanding of the consumer mindset of trends that are happening, and also the quality of experiences that the consumers are looking for, but also elevate it to something that they may not have seen.

Are all marketing initiatives directed to the Indian market or also to the export market?

Moët Hennessy India is focussed on building desirability for consumers residing in India whether they purchase Chandon during their international or domestic travels, while our core goal is still building brand love for consumers in India.

What new brands do you plan to add to your portfolio?

Moët Hennessy has deep innovations in the pipeline. In the last year, we have introduced three to four new brands in the wine space and continue to build our portfolio of imported wines. There are also some spirits tested internationally that we plan to introduce in the Indian market by introducing it via the airport channel and continue to build that space for Moët Hennessy India in the years to come.

What has been the cornerstone of your pricing strategy for the Indian market?

Moët Hennessy uses retail selling price which is established for the consumer in the positioning of the product as well as our comparative strategy. We plan to use the retail selling price as the key driver in how we price our products in various markets. Having said that, India has multiple layers in pricing due to state policies and excises, and the strategy of pricing varies from state to state.

How are your different brands faring in the Indian market?

In the Indian market, we are market leaders for Cognac and Champagnes. When it comes to the other brands we have an aggressive strategy to continue to build on our single malts and vodka portfolio in the market and there is a large portfolio of wines that we are aiming to build and are loved by consumers and introduce them in tier 1 & 2 cities as well.

Which are your marquee brands and how do you plan to boost their growth?

Each of the brands under the Moët Hennessy India portfolio has a unique strategy set in place owing to various factors like the consumer target group, market availability, growing trends, etc. We aim at building awareness and top-of-mind recall for our brands through creative campaigns and the right partnerships, as we did with Chandon for the Rosé O Clock and Own The Sunset campaigns. The Rosé O Clock campaign solely focussed on celebrating moments with friends and family while featuring the Rosé variant which is growing the fastest among wines, which has resulted in an increase in sales in the Rosé variant within the portfolio mix. Own The Sunset campaign positions Chandon Brut and Chandon Rosé as the perfect drink to celebrate with your close circle while enjoying picturesque sunset moments.

What new sparkling wine moments do you plan to create to increase sales of your brands?

Sparkling wine, as a category has really grown over the last year, because of the occasionality of that product, or that category has really gotten expanded. We’ve seen during the pandemic, people occasionally picking up a glass of wine during the day, we’re seeing people celebrating small occasions at home and small celebrations, milestones if you might. So with that, we feel like the occasionality of sparkling wine is becoming more diverse. And, you know, our campaigns, especially on Rose o’clock, which we spoke about, allowed us to sort of capture those consumer occasions and build brand law in those locations. Leaders from various fields of life while showcasing their unique sunset moments distinct to their own personalities.

Do you plan to take the cocktail route more aggressively?

The emergence of the Indian bartenders in the global cocktailing scene is representative of consumers becoming more open-minded and experimental with their drinks. In our survey, nine out of 10 Indian drinkers said that they’re willing to try more categories. With that context, earlier this year, we hosted Hanky Panky from Mexico, the 8th best bar in World’s Best Bars in a 2 city bar takeover tour. Moet Hennessy will continue to build unique experiences for Indian consumers focussed on global trends.

Any new marketing tools you plan to introduce in your marketing process to grow your brands?

We use consumer insights and focus group discussions quite actively, alongside various digital tracking mechanisms to check the effectiveness of campaigns, and share of voice in a digital space.

What kind of brand growth are you looking at?

The consumer is drinking better and the premiumisation trend is here to stay. With that, Moët Hennessy’s has a large portfolio of luxury wines and spirits which allows us to build a unique relationship with consumers.

Alcohol Market Insights Report 2022 and Future Growth Analysis by 2026

The number of alcohol consumers in India continues to rise on the account of rising urban population. Consuming alcoholic beverages has become a customary tradition for a majority of people residing in India’s urban cities. Changing lifestyles and increasing incomes are compelling them to consume alcohol on a frequent basis.

Future Market Insights recently published its study on India’s alcohol market, which estimated that more than `2.5 trillion worth of alcohol was consumed in 2016. The study further projected that consumption of alcohol in India is less likely to decline in the years to come. By the end of 2026, more than 14 billion litres of alcohol will be sold across India.

According to the report, revenues amassed from sales of alcohol in India will soar vigorously at 7.4% CAGR, and reach `5.1 trillion value by the end of 2026. In terms of volume, India’s alcohol consumption in 2016 has been estimated to have surpassed 8 billion litres and will grow at 5.5% CAGR in the due course of forecast period. An in-depth analysis on India’s alcohol distribution indicated that just above three-fourth of alcohol consumed in the country is government controlled. In 2016, alcohol distributed in India through open market sales made revenues worth over `400 billion. Meanwhile, about 550 million litres of alcohol was auctioned in India by the end of 2016.

The wine market in India is set to grow by USD 274.00 million from 2021 to 2026 as per the latest market report by Technavio. The report projects the market to decelerate at a CAGR of 19.78%. Also, the market to record a 29.30% Y-O-Y growth rate in 2022.

The wine market share in India is expected to increase by USD 274.00 million from 2021 to 2026, and the market’s growth momentum will decelerate at a CAGR of 19.78%.

The wine market share growth in India by the domestic segment will be significant for revenue generation. The demand for premium wine brands is increasing among consumers in India. Rising consumer preferences for smooth, rare, and innovative flavours of wine have increased, which has fostered the domestic production of wine. The rising demand for premium wine in recent years has led to an increase in the launch of innovative products.

India’s Alcohol Market: Report Highlights

- Nearly two-third of India’s alcohol revenues will be accounted by sales of Indian-made foreign liquor (IMFL)

- In 2016, more than 1,800 million litres of strong beer was consumed in India

- By the end of 2026, white wine sales in India will have brought in an estimated `16.8 billion in revenues

- Revenues amassed from sale of country liquor in India will have soared at 5.5% CAGR

- Whisky will be the most-preferred type of alcohol in India, while sales of white spirits will grow at more than 11% CAGR

- Key findings of the report, titled “Alcohol Market: India Industry Analysis and Opportunity Assessment, 2016-2026”, projected that Southern and Western states of India will continue to contribute to more than 80% of alcohol revenues through 2026. Bangalore’s SAB Miller India Ltd. and United Spirits Ltd., and Mumbai-based Tilaknagar Industries Ltd. and Allied Blenders & Distillers Pvt. Ltd. are key players partaking in the growth of India’s alcohol market.

Meanwhile, the consumption of alcohol will witness a considerable dip in India’s northern and eastern zone. Even still, a majority of alcohol manufacturers and suppliers in India are originating from New Delhi. Companies such as Carlsberg India Pvt. Ltd., SOM Distilleries & Breweries Group, Radico Khaitan Limited, Globus Spirits, and Jagatjit Industries Ltd. are based in and around the country’s capital. Shimla’s Mohan Meakin Ltd. and Daman’s Khemani Group are also recognised as some of the leading alcohol manufacturer in India.

Among every ten alcohol consumers in India, nine of them will most probably be men; leaving a slight chance that the tenth one is a woman. With more than 90% stake in India’s alcohol revenues, the country’s men will be offering over `4.7 trillion for consuming alcohol by the end of 2026. Likewise, Indian women are also likely to increase their contribution to the Indian alcohol market. During the forecast period, revenues accounted by sales of alcohol to Indian women will have soared at the fastest pace, registering a stellar CAGR of 8.6%.

The availability of online stores and online specialty retailers provides a wide range of choices to consumers in addition to online shopping conveniences.

The increasing use of online channels for purchasing products is likely to drive the growth of the wine market in India. The presence of strong online distribution channels and platform providers is expected to boost the growth of online sales.

The increase in the use of online sales channels is expected to create new opportunities for vendors where they can target customers without geographical boundaries, improve operational efficiencies, and provide customised products to consumers. Thus, the growing adoption of online sales channels will increase the profit margins of wine vendors, which, in turn, will drive the growth of the wine market in India.

The growing incidence of alcohol abuse and alcohol-related accidents, especially among the younger population, has led to many regulatory and social organisations launching campaigns against alcohol consumption and players to prevent this.

The increasing preference for non-alcoholic beverages, such as health drinks, is also affecting the growth of the market in the country.

The stringent advertising restrictions on alcoholic beverages, along with increasing campaigns against alcohol consumption in India, can hamper the growth of the wine market in India.

Consumption of alcohol containing molasses as key ingredients will remain higher in India. Grains will also serve to be a preferred raw ingredient used for producing alcohol in India. Although, production of alcohol through agricultural produce such as fruits and vegetable will remain negligent till the end of 2026. The report also anticipates that consumers will be more inclined towards buying Indian-made liquor – regardless of it being a foreign or Indian brand. Consumption of foreign liquor bottled in India is also likely to grow, but showcasing a marginal degree of increment.

Wine Market in India: Key Drivers and Trends

The increasing use of online sales channels is notably driving the wine market growth in India, although factors such as campaigns against alcohol consumption may impede the market growth. The research analysts have studied the historical data and deduced the key market drivers and the Covid-19 pandemic impact on the wine industry in India. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Wine Market Driver in India

The availability of online stores and online specialty retailers provides a wide range of choices to consumers in addition to online shopping conveniences. The increasing use of online channels for purchasing products is likely to drive the growth of the wine market in India. The presence of strong online distribution channels and platform providers is expected to boost the growth of online sales. The increase in the use of online sales channels is expected to create new opportunities for vendors where they can target customers without geographical boundaries, improve operational efficiencies, and provide customised products to consumers. Thus, the growing adoption of online sales channels will increase the profit margins of wine vendors, which, in turn, will drive the growth of the wine market in India

Key Wine Market Challenge in India

The growing incidence of alcohol abuse and alcohol-related accidents, especially among the younger population, has led to many regulatory and social organisations launching campaigns against alcohol consumption and players to prevent this. The increasing preference for non-alcoholic beverages, such as health drinks, is also affecting the growth of the market in the country. The stringent advertising restrictions on alcoholic beverages, along with increasing campaigns against alcohol consumption in India, can hamper the growth of the wine market in India.

This wine market analysis report of India also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

This statistical study of the wine market in India encompasses successful business strategies deployed by the key vendors. The wine market in India is fragmented and the vendors are deploying various organic and inorganic growth strategies to compete in the market.

To make the most of the opportunities and recover from post Covid-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The wine market in India forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

The wine market share growth in India by the domestic segment will be significant during the forecast period. The demand for premium wine brands is increasing among consumers in India. Rising consumer preferences for smooth, rare, and innovative flavors of wine have increased, which has fostered the domestic production of wine. The rising demand for premium wine in recent years has led to an increase in the launch of innovative products.

Diageo India initiates removal of mono cartons of VAT 69, Black & White and Black Dog

In line with its initiative Society 2030: Spirit of Progress and its 10-year ESG action plan, Diageo India will be initiating a phased removal of mono cartons from its popular Scotch brands in India VAT 69, Black & White and Black Dog. Although there isn’t a clear timeline on when this removal is expected to commence, it includes Diageo’s global effort to be zero-waste to landfill from its own operations and offices by 2030.

The move comes following the announcement in May this year for the removal of mono cartons from its scotch portfolio brands globally, which included brands like Johnnie Walker Black Label, Johnnie Walker Red Label, Buchanan’s Blended Scotch Whisky and Bell’s Original Blended Scotch Whisky.

Although there isn’t a timeline on when the phased removal in India will commence, in May Diageo had stated that the removal of these mono cartons will allow the company to assess the response from the consumer, which if successful will be expanded to other brands as well in 2023.

What will the customer response be to this announcement in India remains to be seen, especially since standing out in a shelf space in a country like India is important, due to its stringent marketing policies. It will also be interesting to see if this move will prompt other manufacturers to follow a similar path.

Currently there isn’t any update yet if there will be any changes made to the packaging (we will update the article periodically), considering mono cartons play an important role in branding and packaging of the product. Also whether the removal of mono cartons is expected to affect the product pricing, also remains to be seen. Since manufacturers spend a considerable cost towards packaging their products, the cost is often passed onto the consumer.

Diageo believes that the phased removal will engage consumers to participate, contribute and promote a progressive move to a sustainable future and will result in saving 10,000 tonnes of paper and reducing 7,000 tonnes of carbon emissions annually.

ABD launches ‘ICONiQ White Whisky’ in Metaverse

Allied Blenders and Distillers (ABD), the domestic alcobev company, has launched of its new whisky “ICONiQ White” on the metaverse, before the offering becomes available in the market.

The brand has been launched first in ABD MetaBar – the organisation’s presence in the metaverse. The brand will subsequently be launched in the physical world in markets nationally.

ABD India forayed into the metaverse with ABD MetaBar, an immersive virtual reality space providing consumers and enthusiasts with a differentiated experience of product discovery. Optimised for both mobile and desktop usage, the MetaBar taps into the growing interest in the Metaverse especially the youth and their willingness to experiment with novel digital activations.

Shekhar Ramamurthy, Executive Deputy Chairman, ABD, said, “A core belief at ABD is to ‘Think Differently’. The launch of ICONiQ White in ABD MetaBar, ahead of its physical launch, gives consumers an opportunity to immerse with the brand before they experience it in stores. We believe this is the shape of things to come and ABD would like to lead that change.”

Bikram Basu, Chief Strategy and Marketing Officer, ABD, said, “ICONiQ White is a contemporary whisky for blend, packaging, and positioning. It will appeal to the young adult and plays in an affordable premium segment which has the largest pool of consumers today. We are here with something very special and here to win.”

Sohini Pani, Founder and Managing Director – River, said, “Crafting the communication mix for ‘ICONiQ White’ was a delightful experience. It all started with the name. ‘ICONiQ’ is bold and trendy, while ‘White’ is a surprising twist in the world of whisky. The visual space and the idea pitch the brand as a playful companion for fun-loving younger audiences. The icing on the cake was the opportunity for us to build ground-up the ABD MetaBar a few months ago and work towards the launch of Iconiq White on the platform.”