• UP alcohol industry to get a boost with investments worth ₹16,392 crores

• Radico investing ₹650 crores in Sitapur 400KL grain distillery

At the recent Global Investors Meet in Lucknow, organised by the Uttar Pradesh government, Radico Khaitan, the fourth largest Indian liquor manufacturer, said it was committing investments worth ₹900 crores in UP, including the ₹650 crores in the new Sitapur 400KL grain distillery with an annual bottling capacity of 20 million cases.

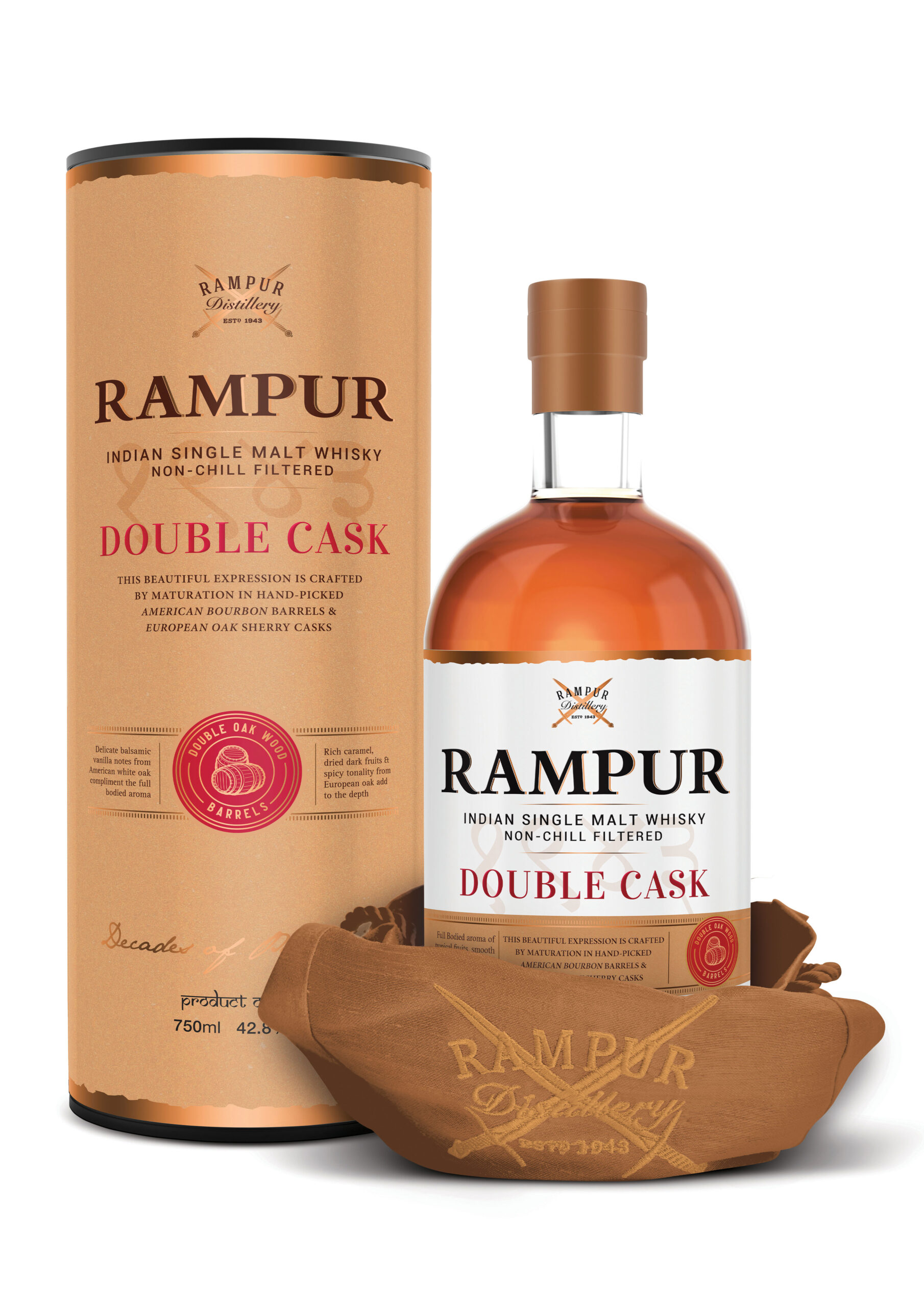

Making a presentation on the opportunities for the liquor industry in UP, the Chief Operating Officer of Radico Khaitan, Mr. Amar Sinha said that the UP alcohol industry would get further boost as investments worth ₹16,392 crores would be made by different players. Radico is a major player in UP, contributing 24% (about ₹7,000 crores) of the state’s Excise revenue. Radico has Asia’s largest manufacturing plant in Rampur with three distilleries (molasses, grain and malt), Malt maturation facility and bottling lines, having invested about ₹1,500 crores. The Rampur plant recently converted its existing 140 KLPD molasses distillery into Dual Feed with an investment of ₹250 crores.

The Sitapur plant would generate 1000 direct and 2,000 indirect employments and contribute nearly ₹1,000 crores annually to the excise exchequer. The plant would manufacture IMFL, country liquor, ENA and Ethanol.

Giving an overview about Radico Khaitan which started in 1943, Mr. Sinha said that as one of the largest spirits manufacturer it was expanding capacity from 160 million litres to 327 million litres. It was strategically limiting interstate taxes and transport costs, having five own and 28 contract bottling units spread across the country. It was consistently increasing Prestige & Above brand contribution to total IMFL volumes; 53% in value terms. The gross revenue for FY 2022 was ₹12,470 crores with an EBITDA of ₹402 crores.

Radico Khaitan’s 8 PM has been the fastest growing whisky globally in 2022, being the 9th largest whisky globally by volume. Similarly, Magic Moments is the 12th largest vodka; Contessa, the 8th largest rum and Old Admiral, the 3rd largest brandy, all globally by volume.

UP volumes grown by 2.6 times

Mr. Sinha said with a progressive policy approach by the UP government, industry volumes had a compounded annual growth rate (CAGR) of 17% for Indian Made Liquor (IML) and 13% for Indian Made Foreign Liquor (IMFL). “Ever since the formation of the new government and policy, industry volumes have grown 2.6 times and we expect it to double in five years.” In 2016-17, UP distillery volume was 348.4 lakh cases of IML and 112.9 lakh cases of IMFL and the estimates for 2022-23 is 903.8 lakh cases of IML and 231.3 lakh cases of IMFL.

Highest excise revenue grosser

Citing figures, he said the excise duty collection had increased from ₹17,320 crores in 2017 to ₹40,400 crores in 2022-23 (estimated). Karnataka is a distant second at ₹24,580 crores. The UP revenue target for 2023-24 is ₹45,000 crores, having potential to touch ₹100,000 crores in five years.

To sustain this industry growth, an investment of ₹10,000 Cr has been made including an investment of ₹2,500 Cr in setting up grain capacity for potable liquor; molasses distilleries – ₹2,100 crores; bottling lines for country liquor ₹400 crores; present investment in IMFL (including ancillary industries) – ₹5,000 crores.

Mr. Sinha mentioned that UP was witnessing substantial flow of investments in the distillery sector with the Excise department having already got letters of intent worth ₹1,400 crores and signing 17 MoUs for setting up industries based on distillery, brewing and alcohol products. The state government has issued a mandate regarding approval of distilleries from different feeds such as molasses, grains, potatoes etc. and also eased rules for establishment of microbrewery in hotel bars. With a view to promote horticulture in the state, the government has exempted tax for five years for making fruit wine.

Simplified licensing process

The simplified licensing process, he said, was exemplary which many other states want to emulate. The ease of interaction with excise department has been transformational and like never experienced before in UP. Licenses are granted online in a timebound manner within 30 days after verification of all required KYC documents. The application is made online to the Commissioner of Excise through the concerned District Magistrate who then forwards his consent to Additional Chief Secretary (Excise & Sugar) and delivery of license is sent on WhatsApp besides online delivery. This process is applicable for all verticals like liquor, beer, winery, import and export permits.

Mr. Sinha mentioned that post 2017 (when Yogi Adityanath became the Chief Minister), the free market policy has been a game-changer. The government introduced a progressive excise policy, eliminated monopolistic nature of business and freed market at all levels of channels of distribution, starting from manufacturing to retail. While the consumer has a choice of brands, the industry has started expanding with a new level of confidence and exuberance.

Ethanol opportunity in UP

Delving on the ethanol opportunity in UP, Mr. Sinha said with ethanol blending target of 20% by 2025-26, there is a big opportunity for investment in grain distilleries for potable liquor and ethanol production. Giving an industry overview, he said the production of ethanol for blending with petrol was introduced in India in 2006-07 under the Ethanol Blending Programme (EBP). The initial target was blending of 5% ethanol with petrol by 2016-17 which got scaled to 10% by 2021-22 and revised to 20% by 2025-26. A 100 KLPD distillery would cost ₹120-130 crores (excluding land cost).

Ethanol production in August 2022 reached 327 crore litres and achieved blending ratio of 10.1% with UP contributed about 99 crore litres. The target is 1,016 crore litres by 2025 with sugar / molasses contributing 684 crore litres and grain 332 crore litres. Approximately 800-1000 crore litres of additional grain-based alcohol capacities are required by 2025 to meet the demand for 20% EBP and potable alcohol industry, thus opening up immense opportunities for grain distilleries in UP. The current India projects is 386 (molasses 263 and grain 123) and the capacity is 948 crore litres (molasses 619 and grain 329). The total UP projects is 85 (molasses 81 and grain 4) and the capacity is 209 crore litres (molasses 205 and grain 4).

Central Government initiatives

The Central Government has taken several initiatives for EBP and they include – Additional differential excise duty of ₹2 per litre on unblended fuel from October 2022; Financial assistance in the form of interest subvention @ 6% per annum or 50% of the rate of interest, whichever is lower for five years including one-year moratorium; Fixing remunerative prices of ethanol produced from different feed-stocks for the supply of ethanol to Oil Marketing Companies (OMCs); Reduced GST on ethanol meant for EBP programme from 18% to 5%; FCI rice and maize also allowed as feedstock; Environmental Clearance procedures simplified by the Ministry of Environment; Enhancement of storage capacities to store ethanol started by OMCs; Use of automotive fuel E12 (12% ethanol with 88% petrol) and E15 notified; Flexi-fuel engine and components (capable of running up to E85 fuel) included under PLI scheme; and Amendments to the National Policy on Biofuels to make India energy independent by 2047. The total requirement for 20% blending and other uses is 1,750 crore litres of alcohol (650 crore litres from sugar sector and 1,100 crore litres from grain-based distilleries) by 2025.

Liquor consumption to rise manifold in India in 5 years

Mr. Sinha said liquor consumption in India is set to rise manifold in the next 5-years and cited Boston Consulting Group (BCG) report which mentions increase 3.5 times from ₹31 trillion (3.1 Lakh Crore) to ₹110 trillion (110 Lakh Crore) over the decade ending 2018 of domestic liquor consumption. The report estimates consumption in India to touch ₹335 trillion (335 Lakh Crore) by 2028, exhibiting a CAGR of 13.2%, from its 2018 level.

UP is the second largest producer of sugarcane in India with molasses as the by-product for the alcohol industry. With 23.1 lakh hectares under cultivation, the state advisory price is above the fair and remunerative price of the centre. It is pegged at ₹340 per quintal as against ₹280-310 in South. The output value of sugarcane grew 43.9% from ₹24,860 crore to ₹35,770 crore over the decade ending 2022.

UP driven to achieve $1 trillion economy

Giving an overall view of the UP economy, he said the government is driven to achieve $1 trillion economy goal by 2027. The state scored high on Law & Order; Infrastructure & Connectivity; Power; Work Force; Raw material; and lesser political intervention. UP’s contribution to Indian economy as GSDP India: 100, UP 8; GSDP growth rate: 11.5 %, UP 8.43%; Per capita GSDP (US$) – India: 2,092 | Uttar Pradesh: 1,016; Cumulative FDI inflow (from Oct 2019-Jun 2022) (US$ million) – India: 158,879 | Uttar Pradesh: 995.

Mr. Sinha cited that the Chief Minister’s vision was laudable and that according to the Mood of the Nation survey, conducted by India Today & C Voters, 39.1% of respondents consider CM Yogi Adityanath as the best performing chief minister in the country. The survey was conducted in 30 states, thus making a case for UP as the best investment destination.