Uttar Pradesh better known as the ‘Granary of the Nation’ is the largest sugarcane and wheat producer and the second largest rice producer in the country. In its bid to become one of the top states every which way, the Yogi Adityanath led BJP government has set itself a target of becoming a one trillion economy by 2027, for which it is laying out the red carpet for different industries, infrastructure project development, agri-produce and more. One of the verticals which is doing well is the alcohol production sector and here the Secretary General of the Uttar Pradesh Distillers Association, Rajneesh Agarwal talks about the efforts being made by the industry, the association and the state government in pushing the envelope further.

Tell us how Uttar Pradesh is a land of limitless opportunities?

Rajneesh Agarwal (Agarwal): Uttar Pradesh is indeed a land of limitless opportunities in the distillery/alcohol sector due to several reasons. Firstly, UP is the largest producer of sugarcane in India, which is a primary raw material for alcohol production, making the State an attractive destination for investment in the alcohol industry.

Secondly, the state has a diverse agricultural base that includes grains such as maize, wheat, and barley, which can be used as alternative raw materials for alcohol production and the government is encouraging the same, thus increasing the capacity of distilleries and reducing their reliance on traditional raw materials like sugarcane and molasses.

Thirdly, with a population of over 240 million people, UP has a large and growing consumer market for alcohol. Also with rising incomes and changing consumer preferences, the demand for premium quality alcohol and varieties of alcohol is increasing, supplemented with streamlined licencing process.

Finally, UP has a well-developed transportation network, with several major highways and railway lines passing through the state. This makes it easier for distilleries to transport their products to customers across the country and the world.

What has been a game-changer for the distillery sector in UP?

Agarwal: There are many factors – Expansion of Alcohol production; Ease of doing business; Robust government policies; and growing consumer base.

a. Expansion of alcohol production: In 2018, the UP government announced the new excise policy that allowed the production of ethanol from alternative feedstocks, such as maize, barley, and wheat. This decision supplemented with streamlining of licensing system and restoration of working hours from sunrise to sunset were all game-changers, opening up new opportunities for distilleries to diversify their raw material base and expand their production capacity.

In 2017-18 there were 60 distilleries in UP with total installed capacity of 161 Cr. litres of alcohol production, which in 2022-23 jumped to 85 distilleries with 346 Cr litres of alcohol production, a growth of 115% in a span of five years. While 20 grain distilleries have established in just last one year, 20 more distilleries are in the pipeline which will produce another 80 Cr. litres of alcohol.

The decision to allow the production of ethanol from alternative feedstocks was a significant shift from the state’s traditional focus on sugarcane and molasses as the primary raw materials for alcohol production. This has helped to reduce the reliance of distilleries on these traditional feedstocks and create new business opportunities for farmers and other stakeholders in the supply chain.

The policy has also helped to boost the state’s ethanol production capacity, which has significant implications for the biofuel sector. Ethanol produced from alternative feedstocks can be used as a fuel additive to reduce emissions in the transport sector, which is a key focus area for the Indian government’s energy policy.

b. Ease of doing business

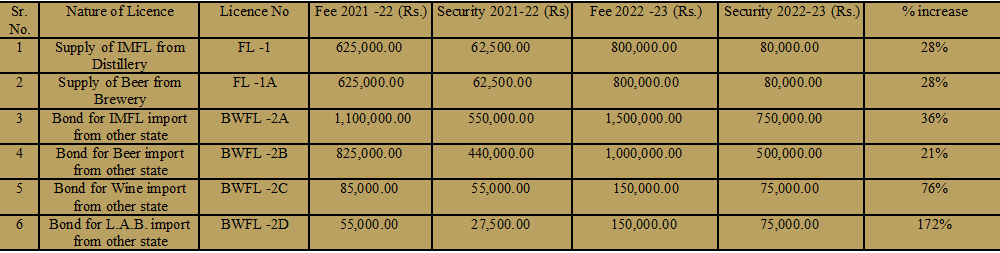

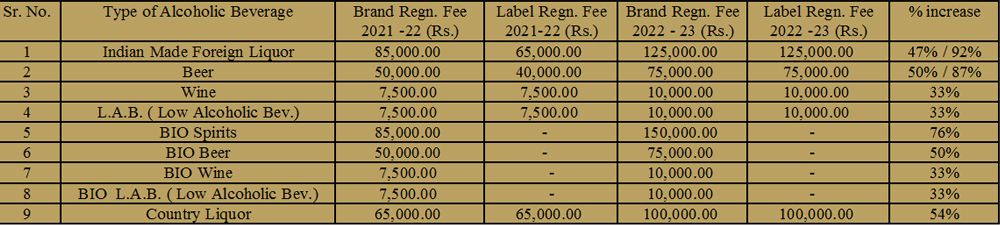

The excise policies in recent years has a significant positive impact on the distillery sector in UP. It has made it easier for distilleries to obtain licenses and permits, reducing bureaucratic hurdles and increasing the ease of doing business in the state. The reduction in taxes on liquor has also made alcohol more affordable for consumers, leading to an increase in demand for alcohol in the state.

Additionally, the policy has encouraged investment in the alcohol industry in Uttar Pradesh, leading to the establishment of new distilleries and expansion of existing ones. This has helped to increase the capacity of the distillery sector in the state and generate employment opportunities for local residents.

c. Robust government policies

There have been robust and encouraging government policies from 2017 onwards. In potable liquor segment itself specific to Country Liquor (mammoth volumes with significant revenue to the state exchequer) the distillery sector volumes have grown 2.3x or at a compounded annual growth rate of 18%.

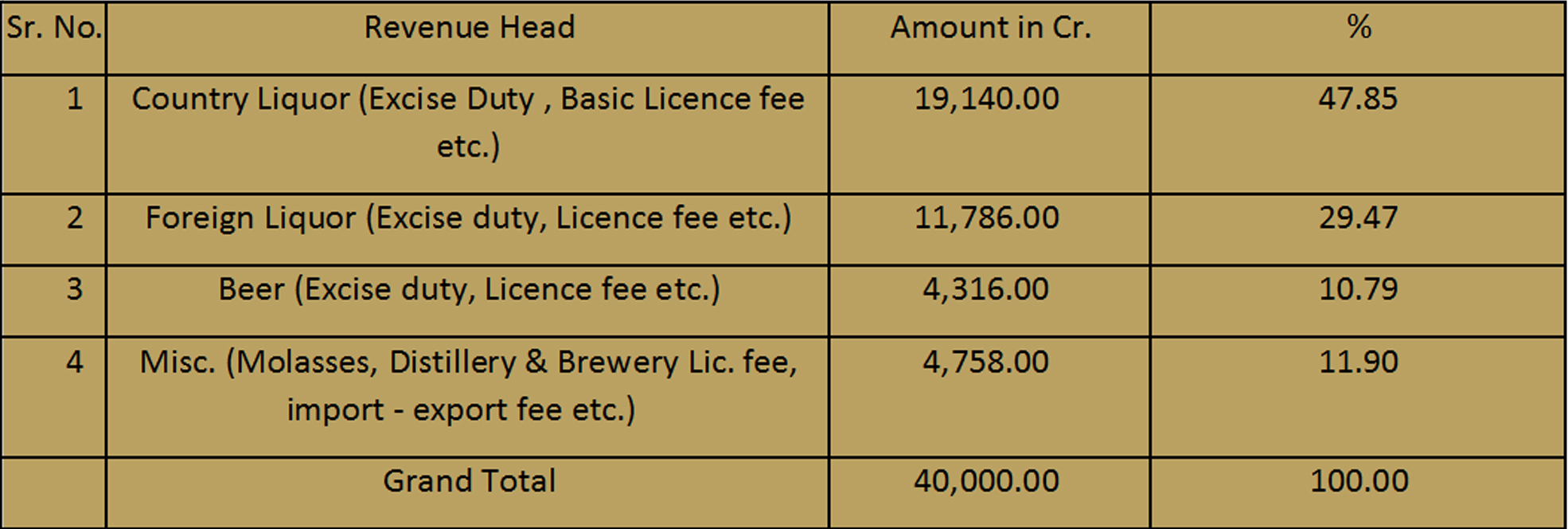

The total Excise Duty collection increased from ₹17000 Cr. in 2017-18 to ₹41000 Cr. in 2022-23. To sustain this industry growth, an investment of approx. ₹10,000 Cr. has been made by distilleries including an investment of around ₹3000 Cr. for setting up grain alcohol plants.

UP has been primarily producing over 200 Cr. litres of alcohol from molasses and there has been a paradigm shift of producing alcohol from grain too. Over 20 grain distilleries have been established in this short span which are producing around 62 Cr. litres of grain alcohol. Overall, as on date UP has over 85 molasses and grain distilleries producing nearly 350 Cr. liters of alcohol making a massive growth of 150% in less than two years.

UP has been a major contributor in the country’s ambitious ‘Ethanol Blending Programme’ having achieved highest blending of 11.89% with the national average of 11.56% as in March’23.

Tell us about the investments that are coming in this sector?

Agarwal: UP’s alcohol sector is all set to get a shot in the arm with investments worth ₹16,392 crores. According to the state’s excise department, ahead of the Global Investors summit, the department signed 17 MoUs for setting up industries based on distillery, brewing and alcohol products. Along with this, letters of intent have been given for investments worth ₹1400 crore. These include distilleries, breweries, microbrewery, yeast units, malt manufacturing units and caramel manufacturing units.

What efforts are being made to meet the demand for 20% EBP and potable alcohol industry?

Agarwal: To meet the target of 20% EBP by 2025 it is estimated that 1150 – 1200 crore litres of alcohol would be required for ethanol purposes. In present context of having achieved over 11.5% blending, the sugar / molasses capacities for alcohol production are nearing saturation. Moving forward, grain would be the primary source to meet the 20% EBP programme.

In UP over 20 grain distilleries have come up in a short span, with 13 more grain distilleries expected by 2024. Overall UP is expected to have over 20 new distilleries (Grain + Molasses) in the next one year.

However, the Ethanol producers within the State and pan India are presently facing operational challenges due to severe shortage and availability of broken rice and damaged food grains (DFG) at the prevailing prices of the government. Ethanol producers are jointly seeking an SOS upward price revision with the Central Government for both broken rice and DFG to put Ethanol producers back on momentum.

What kind of investments have been made to increase grain capacity for potable liquor in UP, a state which has seen industry volumes grow by 2.6 times and expected to double in the next five years?

Agarwal: To sustain this industry growth, an investment of approx. ₹10,000 Cr. has been made by distilleries including an investment of around ₹3000 Cr. in setting up grain alcohol plants in UP. With 13 more grain plants itself expected by 2024 will have an additional Investment of more than ₹1200 Cr.

The state government has approved establishment of distilleries based on molasses, grains, potatoes etc. Could you let us know if the UP distillers have taken that route?

Agarwal: Traditionally, many distilleries in Uttar Pradesh have been based on molasses, as the state is one of the largest producers of sugarcane in India. However, in recent years, there has been a growing trend towards using alternative raw materials such as grains, potatoes, and other vegetables, which can provide a more diverse and sustainable supply of raw materials for the industry. Some distilleries in UP have already taken this route and started using grains like maize, barley, and wheat to produce alcohol. For example, in 2019, a distillery in the state started using maize as a raw material for alcohol production. Similarly, there are distilleries in UP that are using potatoes to produce alcohol, taking advantage of the state’s large potato production. The government is launching numerous schemes and incentives to develop agro-processing industries in UP.

The UP government has allowed production of Absolute Alcohol of Pharma grade, could you give us an update on the same?

Agarwal: The production of pharma-grade absolute alcohol in UP is expected to substitute imports and reduce the country’s dependence on imported alcohol. The state government has allocated land to set up a pharma-grade alcohol plant and several companies have expressed interest in setting up such plants.

The UP government in April’22 has given permission to commence production of Absolute Alcohol of Pharma grade from Cane crushing season of 2022-23. This has paved way for self-reliance on Absolute Alcohol of Pharma grade which till now is dependent on imports from countries like USA, Australia, China etc. The State has envisioned production capacity of 25 lac litres from the total requirement of nearly 50 lac litres currently, saving revenue of around ₹10 cr. in import substitution.

What are the challenges for distillers in UP, regulatory or otherwise, and how can the government resolve it?

Agarwal: Today, UP is proud to hold its head high for turning the major challenges into opportunities. The rapid expansion and overall growth in past years is quite evident of this fact. However, the government continues to make radical reforms in the policies in ease of doing business, simplified regulatory environment, rationalising taxes & duties, expansion of infrastructure development with better road & rail connectivity etc. The ground water being the main source of irrigation, the State’s Environmental Board is taking various measures to avoid over exploitation of ground water.

Tell us about the role of UPDA in promoting the sector?

Agarwal: The UP Distillers Association (UPDA) is an apex body of distillery industry with nearly 90 distilleries. The Association is a 40-year-old body, actively rendering services as interface between its members and both State & Central Government authorities primarily through its advocacy role for policy makers and resolving issues of the industry.

To tap the limitless opportunities, UPDA is fast spreading its wings in international arena to explore and adopt best practices and technologies across the world. In recent years, under the close guidance of UPDA President – Mr. S.K. Shukla and Vice-President – Mr. Manish Agarwal, the association has ensured industry benefits.

The UPDA conducted its first International Summit in Aug’22 with six countries participating. The second UPDA International Summit will be held in July 2023, showcasing global innovation technologies with USA, Brazil, Israel and many more countries, besides home grown technologies.

This was followed by a visit to Brazil a delegation jointly organised by the All India Distillery Delegation and the UPDA, with the objective to explore synergy and business avenues of mutual interest between Indian and Brazilian distilleries and technology providers. Brazil has achieved 27% blending in 2G ethanol.

UPDA-AIDA are planning their next distillery delegation visit to USA under an exchange programme which will explore:

1) Corn supply chain model comparison between, India and Brazil & India and USA.

2) Corn cultivation and corn grains productivity enhancement in India, GM corn cultivation in India, testing of new corn cultivators from USA, and developing a holistic model for the corn growing farmers and industry.

3) Ethanol production technology transfer from corn grains and from corn biomass (cobs and leaves-corn stover).

4) DDGS (Dry Distillers Grains Soluble) valorization, Proteins recovery from DDGS and purification, Oils recovery from DDGS and its profiling, Develop of DDGS based holistic nutritive and palatable feed for cattle and poultry.

UPDA is in process of collaboration with ‘Invest India’ wherein UPDA will interface and support bringing investments & technologies, with initial focus in bio-fuels sector and grain based distilleries.

Will UP become the distilleries hub, if so, by when and what are you betting on? How many distilleries are there in UP and how many of them are your members?

Agarwal: Out of the around 520 distilleries in India, UP itself has nearly 90 distilleries with nearly 33 more distilleries coming up in 2024. These numbers show that UP is already a distinctive hub.

UP Distillers Association’s a prime focus all along has been on potable distilleries and now fast catching up with the industry at large on grain and ethanol producing distilleries. Presently, UPDA has 16 members on board which produce over 90% of the potable Country liquor requirement of the State. UPDA takes pride in having on-board Patron members such as Radico Khaitan Ltd., India Glycols Ltd., Wave Group, Sir Shadi Lal Industries and Superior Industries. Country Liquor sales of over 9 Crores cases per annum contributing significantly to the overall excise revenue of over ₹41k Crores with target of ₹45k Crores in 2023-24.