Craft brands in India are currently redefining the perception of premiumness. It is now much more about authenticity, craftsmanship and embracing innovation to produce something uniquely groundbreaking. Today, we see a lot of Indian consumers are excited to try a good homegrown product without it being a compromise and brands like ours are able to communicate and ensure our high quality standards. Moreover, with India’s growing cocktail culture, we see that a lot of Indian consumers are open to trying new, atypical cocktails as well as local, homegrown products which have indeed contributed to the rise of craft producers in the country. That is Sakshi Saigal, the co-founder and director of Stranger & Sons. In an email interview, she maps the journey of crafted gin which has just embarked upon an exciting phase of spirits in India.

Ambrosia: Could you tell us about the spark that led to the creation of Stranger & Sons?

Saigal: It goes without saying that we individually are not just cocktail enthusiasts, but also had access to observe the beGinnings of the Gin Revolution first hand. I was working towards my MBA in Barcelona, while Vidur was studying in the UK and Rahul had just set up his craft brewery in Mumbai. While we were tasting and drinking a variety of gins every day – whether in London’s cocktail bars or the Gin Tonics of Barcelona, we were getting well acquainted with the gin landscape. That’s when it piqued our interest as to why India wasn’t up to speed with gin although gin manufacturers all over the world looked to India when it came to sourcing botanicals and we kept encountering brands based on a vision of India that we knew very well had never been a reality. This made us question why products with these botanicals are made everywhere but here. To add to this, there wasn’t any other quality homegrown product then that was conveying the story from our perspective; so we decided to change that and embarked into a lot of research before setting up Third Eye Distillery.

Ambrosia: Could you give us insights into the growth journey of Stranger & Sons?

Saigal: It’s honestly been a phenomenal experience so far! Right from the start, we wanted to build a truly Indian gin that would stand out on the shelves of top bars in the world but fit in just as well in the colourful and vibrant bars in Panjim. Made from inherently Indian botanicals, Stranger & Sons Gin captures the essence of contemporary India in every bottle for a curious and discerning consumer. What makes Stranger & Sons interesting is how we celebrate our diverse, unique and complicated history while recognising India in its current context instead of the stereotypical version with just palaces, elephants, and so on. Embracing this wonderful strangeness inherent in the contemporary India we live in today through our gin allows consumers to connect with the story and the brand in a very organic manner. Creating this emotional connection with our audience has always been at the core of our thought process and that’s where we believe that it’s not just what our gin is made of that matters, but what it represents.

Starting out as a home-grown gin brand from Goa to being declared one of the 8 best gins in the world by the International Wine & Spirit Competition in 2020, to winning the highest honours at The Asian Spirit Masters 2021, we’ve managed to put Indian gin on the world map and continue to work towards showcasing India’s diversity to the rest of the world! We’ve had an action-packed and eventful journey so far and the terrific response we get from our consumers at our international and domestic events is backed by an exciting, entrepreneurial team, all of whom feel very strongly about the brand. With regard to sales, we sold 25,000 nine litre cases in our first full year of operations, which was extremely exciting for us and was mainly attributed to being available in just two Indian cities and one international market. This year, despite the pandemic, we will be focussing on domestic and international expansion.

Ambrosia: How much has the pandemic hit production?

Saigal: Being absolutely aware that it has been an extremely tough phase for the hospitality industry and brands including ours, thanks to our team’s sheer creativity and persistence, we never lost sight of our consumers, favourite bars and bartenders. During the pandemic, we launched ‘Strange Times’ bottled cocktails in Singapore as an initiative to support the trade, made in collaboration with some of the best bars there to help keep the spirits up amidst the pandemic. We also got selected as the first Indian brand for the Craft Gin Club and shipped bottles to over 70,000 homes across the UK. During the lockdown, we launched India’s first distilled cocktail with local, seasonal pink guavas – Perry Road Peru, in collaboration with The Bombay Canteen, a high-end Indian restaurant which was a massive success in the market! Regardless of the digital shift, we continue to prioritise innovation, crafting immersive experiences and strengthening our relationships with consumers and trade alike.

Ambrosia: Which markets are you present in and what are your expansion plans?

Saigal: We launched Stranger & Sons from the shores of Goa and expanded to Maharashtra, Delhi, Karnataka and Rajasthan within India and UK, Singapore, Thailand and the UAE, internationally. We will indeed be exploring various domestic markets including Telangana, Uttar Pradesh, Assam, and more. In terms of international expansion, we look forward to increasing our global footprint through our upcoming launches in Australia, Mauritius and more, very soon. Each new market brings a unique, diverse consumer base which makes the experience, well, let’s just say thrilling!

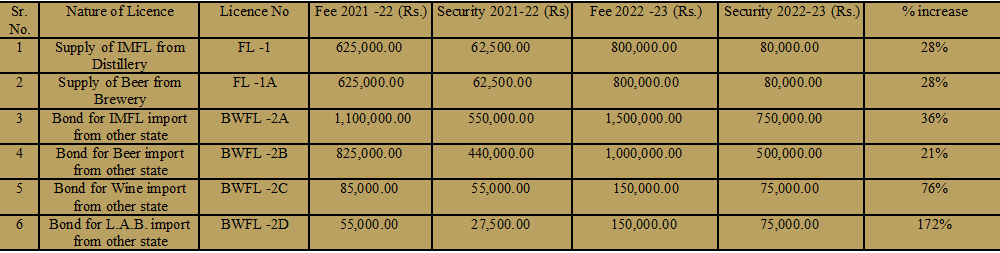

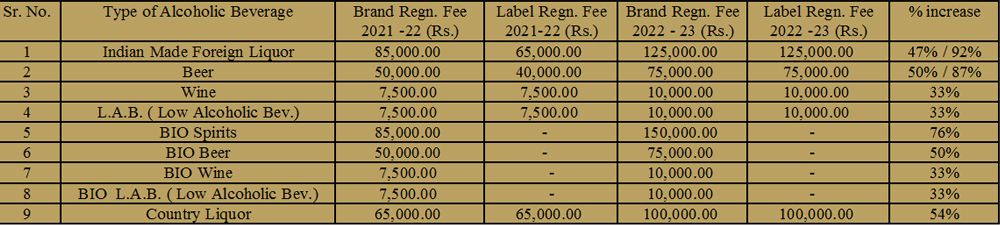

Ambrosia: What are the challenges – regulatory and distribution network – faced in India?

Saigal: In the spirits world, India has always been known for the sheer volume of alcohol we produce over anything else. The distilleries here are mostly large-scale, daunting structures and it’s difficult to contract distill small quantities here which is often a great way for craft distillers to beGin their journey. Adding to the challenge, India follows a federal system of laws and when it comes to alcohol and so, the guidelines and regulations vary across states in India. Access to good quality equipment and adequate space also pose a challenge, particularly once companies start expanding.

Ambrosia: Tell us about the botanicals that make your gin unique?

Saigal: Indian botanicals and spices that are indispensable to every Indian household and form the backbone of India’s culinary heritage. Among India’s most fertile states, Goa was a natural choice for us for its lush expanse of spice farms. The mace, cassia bark, licorice, black pepper and nutmeg that perfume our gin are sourced from spice farms surrounding our distillery making Goa the beating heart of our narrative. Our unique citrus peel mix of Indian Bergamot, Nimbu (Indian Limes), Nagpur Oranges & Gondhoraj have also been put together to represent different parts of our country and each of these citrus’ are extremely integral to the region they represent and make their way into local cuisine, juices, pickles, jams, preserves and more. By making use of all the wonderful spices available to us, we built a three-dimensional Gin that is proudly Indian and true to its oriGin. Our signature serves include fresh, flavourful Gimlets & aromatic, layered Gibsons which are also homage to India’s pickling and cordialling culture.

Ambrosia: What next?

Saigal: Third Eye Distillery was never built as a one-product-company right from the get go. There doesn’t go a day when someone from the team isn’t trying to answer this same question and one up the other. There are so many things that we’re working on at the moment when it comes to innovation and new product releases, no thought goes untested and no idea wins without a fight! We are also constantly trying to do our bit to make our distillery more responsible and sustainable while exploring new extensions and experimenting with various ideas. The one thing we know for sure, whichever product we release next, it won’t just be another bottle on the shelf, but will truly be adding to the conversation and be integral to taking our cocktail culture to the next step.