No, we are not saying move on Feni which is unique to Goa and mind you growing in its own way. Suddenly, in the last two years, despite the pandemic, about 15 brands of Gin have been crafted and launched across the country and 11 of them, yes a full team of brands, have their oriGin s in Goa. What is brewing over here in this beautiful coastal state? A lot ! And what warms the cockles of the heart is that young entrepreneurs, in their 20s and 30s, are the craftspeople. Cheers to this young brigade.

And it was a Goan – Cedric Vaz, it’s in his genes, right, to launch the first truly crafted Indian Gin by the name ‘Black Jewel’ and believe you me crafted Gin has turned out to be a connoisseur’s delight, irrespective of the brand.

There has been a resurgence of sorts for Gin . No, the pandemic has got nothing to do with it. Though the British East India company created the drink in the 1700s, it was a military cocktail, devoured by the troops to stay healthy. The British residents in India added Gin , sugar, ice and citrus and thus was born the Gin and Tonic. The witty statesman Winston Churchill words remain for eternity “The Gin and tonic drink has saved more Englishmen’s lives and minds, than all the doctors in the Empire.” Somewhere along the way, Gin lost favour and it was perceived as a ‘ladies drink’ and everyone with some knowledge has some reasoning for that. Around the same time, vodka and tequila captured the imaGin ation of the world and these spirits kind of drowned Gin. It was circa 2016 that in the United Kingdom there was growing interest in Gin which reportedly grew 44% year on year with about 100 home grown brands hitting the market. India is the fifth largest consumer of Gin after the UK, USA, Germany and Spain, but within the country Gin accounts for just about 1% of spirits consumed.

Young entrepreneurs driving craft Gin segment

But it is growing. In the recent past, it has caught the attention of the Indian spirit maker and consumer. The young co-founder and director of Stranger & Sons, Sakshi Saigal says “Though its presence in its current form is limited to the main metro cities, Gin is going through an extremely exciting phase and still transcending into the mainstream. There aren’t just new consumers every day but new Gin s too! As people travel, they have slowly started to understand India’s rich history when it comes to Gin and agricultural bounty when it comes to ingredients, so it has become an obvious choice for Gin makers alike.”

There are several reasons for this resurgence, one of which certainly is the drinking culture which is getting nuanced, thanks to the new generation which likes to explore, experiment and be expressive. The Chief Operating Officer of Radico Khaitan, Amar Sinha states “The Gin market appears very promising in the country as over the years people have been open to move beyond the regular brown spirits. They have started developing and appreciating the fine taste of the white spirit for the botanical infusions. There are many factors behind the popularity of this category such as increased exposure to global culture, the growing trend of cocktail culture, and Generation Z’s inclination towards experimentation with white spirits.”

Craft Gin comes with a price and why not?

If one looks at the drinking profile, these crafted Gin s seemingly are not for the hoi polloi. Almost all of them (Stranger & Sons, Greater Than, Hapusa, Samsara, Jin Jiji, Pumori, Jaisalmer and a few others) are priced in a way attracting the upwardly mobile. This is the segment that these manufacturers are looking at and not for nothing most of them are produced in small batches. “Craft Gin can only ever be premium. A low-priced Gin , will not ever be a craft product. Even so, we aim to make our Gin s as accessible as possible,” states Anand Virmani, Founder and CEO of Nao Spirits and Beverages (creators of Greater Than and Hapusa).

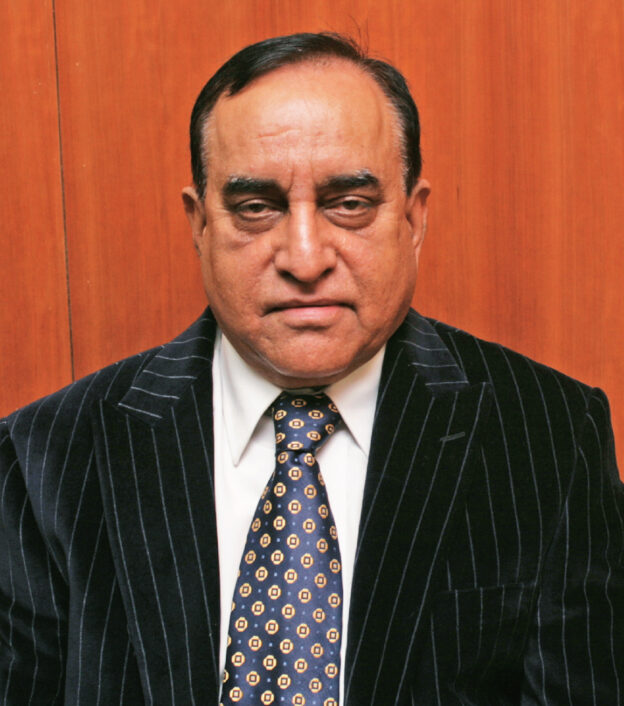

However, Mac Vaz of Madame Rosa distillery and the founder president of the Goa Cashew Feni Distillers and Bottlers Association, has another take on it. The first craft Gin , Black Jewel, from Madame Rosa stable is reasonably priced as to make Gin drinking accessible and affordable. All of them in some way or the other are working in that direction, coming up with a distinct touch of their own. It makes sense in a market which is slowly opening up, thanks to the many bartenders who are peppered across the country and ever open to experimentation.

Botanicals are at the core of this revolution

Botanicals are coming into that experimentation while Juniper is the predominant botanical ingredient in Gin , there are other accompaniments, most of them sourced locally. States Sakshi Saigal “Our botanicals are crafted together, taking inspiration from India’s culinary heritage which is centred around spices. Spice boxes are commonly found in almost all Indian kitchens and for centuries, they have been manipulated in different ways to create flavour in food, liquid, sweets and scents. Our Gin goes beyond the customary juniper and highlights inherently Indian botanicals and spices that are indispensable to every Indian household and form the backbone of India’s culinary heritage.”

In an article in The Hindu, Anoothi Vishal cites Dr. Anne Brock, master distiller at Bombay Sapphire, “I believe it is important that juniper remains the core, but we may need to relax and encourage difference. Gin is a global spirit with different botanicals and styles, and consumers are interested in the people who make their Gin , its provenance and story.”

Goa, India’s watering hole has friendly policies

And it is all happening in Goa, India’s watering hole. That is good enough a reason for many of the distillers to descend upon Goa, an investment-friendly state in the hospitality industry. Mac Vaz emphasizes “Goa being the apex tourist destination of the country gives smaller players a cost-effective advantage due to the consumer watering hole ! Also unlike in most other parts of the country, in Goa there is no hypocrisy and taboo quotient connected to liquor consumption in moderation. Lastly, Goa has a brand, has a natural USP in perception. Everything that is produced within Goa has its exotic positioning – Feni is a classic example of this.”

Why Goa? And Sakshi Saigal has the perfect answer for that going beyond the friendly excise policies of the state which has been eulogized at various forums. “We often hear a lot being said about Goa having more liberal excise laws and so on, making it easier to start brands there but honestly, that undermines what Goa truly has to offer. A former colony, Goa adopted a lot of the Portugese way of life which adds to its own unique charm. The roads wind through green fields, the people speak Konkani with as much ease as they do Portuguese; colonial bungalows and local spice markets all co-exist with some of the most progressive hospitality and restaurant establishments. Further, the Goan way of living life to the fullest inspires us every day to strive for innovation and keep experimenting with various spirits and expressions of our Gin .”

She adds “A truly special place for most Indians where you’ll find the cuisine, architecture and culture of India & Portugal come together, Goa is home to Stranger & Sons. Tucked away in a corner of South Goa, you’ll find us, hunched over our still, throwing iconic Indian botanicals into our Gin , while the local women peel fragrant Indian citrus outside. Goa indeed has its own strange ties to Gin , having been the heart of spice trade for centuries. Our wonderfully strange roots in Goa where cultures, societies and spiritual beliefs stand united under a liberal approach to life translates into the invisible essence in our bottle. When we aren’t distilling, you’ll find us sitting on a porch sipping on some Gibsons made with our pickles! “

Strange it may sound, can you believe it, there are over 3,000 registered micro distilleries in the coastal state and they have enough capacity and more to allow for manufacturing of any spirit. If you have an idea, some capital and a good recipe, just head to Goa.