Craft beer which is available mostly in kegs is now moving to the retail shelf. A look at some of the compelling reasons.

As the craft beer demand continues to grow, the more successful craft beer produces have a happy dilemma when growing organically, is moving on from the first phase when the start-up microbrewery only kegs the beer to bottling beers.

The margins created by retailing your beer instead of selling it wholesale have sustained the growth of microbreweries. This successful approach has succeeded in generating phenomenal growth in the industry.

The margins created by retailing your beer instead of selling it wholesale have sustained the growth of microbreweries. This successful approach has succeeded in generating phenomenal growth in the industry.

Wholesaling only has downsides, mainly for those micro breweries that do not have their own direct chain of distribution. Those without direct distribution have struggled in the past and are the micro breweries most likely to disappear. Microbreweries without their own direct outlets are those that have tended to fail first over the years. The need to have a substantial distribution network was recognised immediately for example by BrewDog in Scotland, and Whitewater Brewery in Northern Ireland.

The important initial capital outlay required to open a microbrewery needs a rapid growth of sales and margins to sustain the business. You have to have a guaranteed high margin from your own distribution from the very start, or you will need deep pockets to sustain the start up from zero.

Many of your clients will also want to enjoy their favourite beer at home or on a picnic. And you need to serve them, or they will buy their tipple from the competition. Therefore you need to satisfy this type of consumption by offering bottled beer, pretty soon after starting your brewery. Initially the quantities to be bottled are relatively modest – maybe only 500 or 1000 bottles at a time for each of your various recipes. Initially, therefore, the easy way, although an expensive way, is to contract bottle outside the premises. This seems the way to go. Contract bottling has many disadvantages and could eat into your margins because of extra logistics cost and scheduling. In-house bottling could be the solution. Bottling in-house requires generally more money than anticipated.

Many of your clients will also want to enjoy their favourite beer at home or on a picnic. And you need to serve them, or they will buy their tipple from the competition. Therefore you need to satisfy this type of consumption by offering bottled beer, pretty soon after starting your brewery. Initially the quantities to be bottled are relatively modest – maybe only 500 or 1000 bottles at a time for each of your various recipes. Initially, therefore, the easy way, although an expensive way, is to contract bottle outside the premises. This seems the way to go. Contract bottling has many disadvantages and could eat into your margins because of extra logistics cost and scheduling. In-house bottling could be the solution. Bottling in-house requires generally more money than anticipated.

More and more fancy craft beer is also showing up in aluminum cans. Five years ago, just a few dozen craft brewers in the U.S. were canning, while today there are more than 500. The beer in a can cools faster. The can protects from beer-degrading light. Beer cans are portable and take up less space, advantages both for retailers and for consumers who want to take them camping, hiking or fishing. There’s also more space on a can for wraparound design and decoration.

While glass bottles take longer to cool down, they also stay cold longer once they come out of the cooler. Plus, glass producers and plenty of brewers will tell you translucent amber glass has been working fine to protect beer from light and air. The biggest selling point for the bottle, though, is flavour. There’s at least a perception that cans impart a metallic taste, whereas liquid stored in a bottle comes out tasting pure.

The metal touching your lips is still a factor in terms of flavour, but most craft brewers suggest pouring out beer into a glass before sipping, whatever package it comes in. It may be coolness, or it may be convenience, but the bottom line is, cans are getting cheaper. Bottling in-house remains a simpler, cheaper process. The Brewers Association estimates just 3% of craft beer on the shelves is in a can. Sixty percent still goes out in bottles, and the rest is sold in kegs. Glass has been a very reliable package and tradition will prove itself well that glass is not going anywhere.

The metal touching your lips is still a factor in terms of flavour, but most craft brewers suggest pouring out beer into a glass before sipping, whatever package it comes in. It may be coolness, or it may be convenience, but the bottom line is, cans are getting cheaper. Bottling in-house remains a simpler, cheaper process. The Brewers Association estimates just 3% of craft beer on the shelves is in a can. Sixty percent still goes out in bottles, and the rest is sold in kegs. Glass has been a very reliable package and tradition will prove itself well that glass is not going anywhere.

In India quite a few microbreweries plan to launch bottled beer brands to cash in on rising demand for India’s craft beer. So far, India has seen just a few craft beer brands such as Bira, White Owl and Simba, sold off shelves despite nearly 170 microbreweries that opened over the past decade. Karnataka government does not allow brewpubs to distribute in-house beer and are permitted to produce a maximum of just 1000 litres a day. Windmills Craftworks will start producing cans of craft beer from their newly-acquired 2000-litre production brewery in Goa.

India’s craft beer industry accounts for 2-3% of the country’s beer market which is largely skewed towards the stronger version. The surge of interest in craft beer has been driven by millennials, many particularly interested in this form of beer that is more authentic, premium and has a complex flavour compared to regular lager sold by MNCs.

India’s craft beer industry accounts for 2-3% of the country’s beer market which is largely skewed towards the stronger version. The surge of interest in craft beer has been driven by millennials, many particularly interested in this form of beer that is more authentic, premium and has a complex flavour compared to regular lager sold by MNCs.

But making and selling craft beer at a larger scale isn’t easy. Besides licenses and distribution, brewpubs have to wrestle with cold chain supply infrastructure, short shelf-life of craft beer and smaller budgets compared to United Breweries, Ab InBev and and Carlsberg that together control 90% of the market. As a result, many are planning to roll out variants such as hefeweizen, stout and light golden ale – that can survive better in these tough conditions. And some are opting for pricier cans to package their products instead of glass bottles. Cans are lighter, unbreakable, carry more branding information, have little oxygen uptake and do not allow light to enter easily, unlike bottles. International craft beer brands can collaborate and set up bottling plants in India to retail now. Big commercial beer brands are also waiting, and will hop on the craft brewery segment in the next two-three years. Perhaps herein lies the opportunity for Praj, Krones, Alfa Laval and KHS.

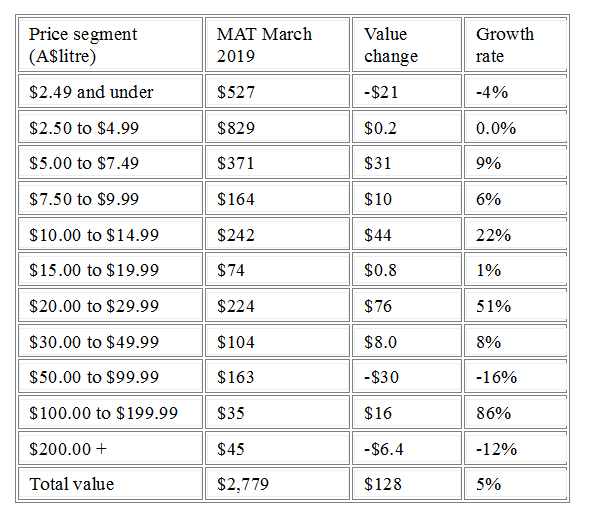

“What we are seeing is a drop in volumes in the lower value categories and this places Australia well as the global consumer premiumises and drinks less but more expensive wines,” Mr Clark said.

In the China market we have grown our value again and we are outperforming competitors, with the Global Trade Atlas figures showing that in the year ended February 2019, Australia had a 29% share of the imported wine market – up from 26% a year ago

“What we are seeing is a drop in volumes in the lower value categories and this places Australia well as the global consumer premiumises and drinks less but more expensive wines,” Mr Clark said.

In the China market we have grown our value again and we are outperforming competitors, with the Global Trade Atlas figures showing that in the year ended February 2019, Australia had a 29% share of the imported wine market – up from 26% a year ago

In the 12 months to March 2019, the value of wine exported in glass bottles increased 3% to $2.22 billion and decreased in volume 5% to 355 million litres (39 million 9-litre case equivalents). The combination of the increased value and lower volume means that the average value of bottled wine increased 9% to $6.24 per litre FOB, a near-record.

In the 12 months to March 2019, the value of wine exported in glass bottles increased 3% to $2.22 billion and decreased in volume 5% to 355 million litres (39 million 9-litre case equivalents). The combination of the increased value and lower volume means that the average value of bottled wine increased 9% to $6.24 per litre FOB, a near-record.

The regions in growth are:

• Northeast Asia, up 8% to $1.2 billion,

• Europe, up 3% to $612 million,

• Southeast Asia, up 7% to $170 million,

• Oceania, up 15% to $107 million, and the Middle East, up 16% to $32 million.

The regions in growth are:

• Northeast Asia, up 8% to $1.2 billion,

• Europe, up 3% to $612 million,

• Southeast Asia, up 7% to $170 million,

• Oceania, up 15% to $107 million, and the Middle East, up 16% to $32 million.

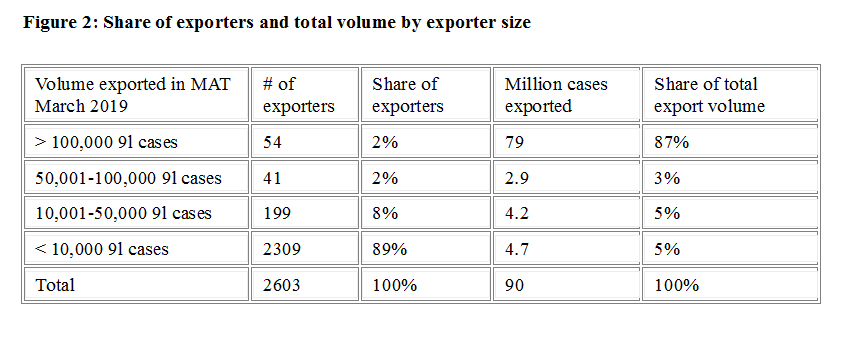

There were 2603 active exporters in the period, a 16% increase from the previous year. During the year, 1786 companies either started exporting or increased the value of their exports, contributing $374 million to the growth in overall value. This growth was partially offset by 1328 exporters whose export value decreased or they ceased shipment altogether; their exports declined by $246 million.

There were 2603 active exporters in the period, a 16% increase from the previous year. During the year, 1786 companies either started exporting or increased the value of their exports, contributing $374 million to the growth in overall value. This growth was partially offset by 1328 exporters whose export value decreased or they ceased shipment altogether; their exports declined by $246 million.

Cheese and garlic naan bomb starter is a must try. Tiny naan discs served as starter with cheese and garlic stuffing had the right flavours.

Cheese and garlic naan bomb starter is a must try. Tiny naan discs served as starter with cheese and garlic stuffing had the right flavours.

With dishes inspired from the western coast, the menu not only includes the names of the dishes, but also the place they are inspired from. Signatures include Khakhra from Gujarat, Tadka Hummus from South India, Amritsari Fish from Mangalore and Prawns Koliwada from Mumbai, find your tastebuds, taking a ride along the coast too. The grill section, includes the basics like, Cheese Seekh, Achari Aloo, Fish Tikka and Masala Prawns. The nouveau main course section has dishes like, Truffle Oil and Okra Khichadi, Chicken Gassi, and Goan Fish Curry and Rice.

SHOR promises you endless stories and binging sessions over the course of its journey. With a menu that is carefully hand-picked and curated which is juxtaposed with music, this place is sure to win your heart.

With dishes inspired from the western coast, the menu not only includes the names of the dishes, but also the place they are inspired from. Signatures include Khakhra from Gujarat, Tadka Hummus from South India, Amritsari Fish from Mangalore and Prawns Koliwada from Mumbai, find your tastebuds, taking a ride along the coast too. The grill section, includes the basics like, Cheese Seekh, Achari Aloo, Fish Tikka and Masala Prawns. The nouveau main course section has dishes like, Truffle Oil and Okra Khichadi, Chicken Gassi, and Goan Fish Curry and Rice.

SHOR promises you endless stories and binging sessions over the course of its journey. With a menu that is carefully hand-picked and curated which is juxtaposed with music, this place is sure to win your heart.

sign that the Scotch Whisky industry remains confident about the future. This is great news for our many employees, our investors, supply chain and, of course, for our consumers all over the world, who love Scotch.

“This report also highlights the high rate of domestic tax that Scotch Whisky faces in the UK. In the US, Scotch and other whiskies are taxed at just 27% of the rate that HM Treasury taxes us here at home. We will continue to press the Chancellor for fairer treatment of Scotch Whisky in our domestic market, which reflects the vital economic contribution the thousands of people who work in whisky make to the UK economy every day.”

sign that the Scotch Whisky industry remains confident about the future. This is great news for our many employees, our investors, supply chain and, of course, for our consumers all over the world, who love Scotch.

“This report also highlights the high rate of domestic tax that Scotch Whisky faces in the UK. In the US, Scotch and other whiskies are taxed at just 27% of the rate that HM Treasury taxes us here at home. We will continue to press the Chancellor for fairer treatment of Scotch Whisky in our domestic market, which reflects the vital economic contribution the thousands of people who work in whisky make to the UK economy every day.”

contributes more than double than life sciences (£1.5bn) to the Scottish economy, supporting more than 42,000 jobs across the UK, including 10,500 people directly in Scotland, and 7,000 in rural communities.

contributes more than double than life sciences (£1.5bn) to the Scottish economy, supporting more than 42,000 jobs across the UK, including 10,500 people directly in Scotland, and 7,000 in rural communities.

A growing spirits distribution sector worldwide – especially in France where there were now between 20 and 30 national distributors compared with three or so 29 years ago – was further evidence of trade and consumer demand.

Trends pushing spirits expansion are: revivals of traditional spirits such as Calvados and Armagnac where there was growing interest in Asia; rediscovery of locally-produced spirits, eg Irish Whisky, Gin and Vodka; global interest in little-known spirits such as Mezcal; new exotic spirits such as agricultural rum from Tahiti, “where no spirits at all were made 10 years ago”.

A growing spirits distribution sector worldwide – especially in France where there were now between 20 and 30 national distributors compared with three or so 29 years ago – was further evidence of trade and consumer demand.

Trends pushing spirits expansion are: revivals of traditional spirits such as Calvados and Armagnac where there was growing interest in Asia; rediscovery of locally-produced spirits, eg Irish Whisky, Gin and Vodka; global interest in little-known spirits such as Mezcal; new exotic spirits such as agricultural rum from Tahiti, “where no spirits at all were made 10 years ago”.

“A stable government is indeed welcome for the nation and economy. We hope that the new government will reinforce its progressive policies towards the industry, and usher in the next phase of reforms to promote ease of doing business and ‘Making in India’. We also look towards the Federal government to encourage states to urgently bring comprehensive regulatory reform into key state- GDP contributing sectors such as alcoholic beverages,” says, Anand Kripalu, Managing Director and CEO, Diageo India.

“A stable government is indeed welcome for the nation and economy. We hope that the new government will reinforce its progressive policies towards the industry, and usher in the next phase of reforms to promote ease of doing business and ‘Making in India’. We also look towards the Federal government to encourage states to urgently bring comprehensive regulatory reform into key state- GDP contributing sectors such as alcoholic beverages,” says, Anand Kripalu, Managing Director and CEO, Diageo India. The beer industry has its fair share of challenges. And with the competition heating up and input prices rising it is becoming difficult to invest in growth. “With a strong mandate that the government has received, we look forward to sustained reforms that will spur further growth in the economy. We also look forward to continued emphasis on ease of doing business,” says Shekhar Ramamurthy, Managing Director, United Breweries Ltd.

The beer industry has its fair share of challenges. And with the competition heating up and input prices rising it is becoming difficult to invest in growth. “With a strong mandate that the government has received, we look forward to sustained reforms that will spur further growth in the economy. We also look forward to continued emphasis on ease of doing business,” says Shekhar Ramamurthy, Managing Director, United Breweries Ltd. “It is indeed a blessing that India has elected a strong and stable Goverment and I look forward to more structural reforms so that India can continue on a strong growth trajectory with gainful employment for all its citizens. I also expect the federal goverment to build consensus amongst all states to include potable alcohol in GST,” said Deepak Roy, ABD Vice Chairman.

“It is indeed a blessing that India has elected a strong and stable Goverment and I look forward to more structural reforms so that India can continue on a strong growth trajectory with gainful employment for all its citizens. I also expect the federal goverment to build consensus amongst all states to include potable alcohol in GST,” said Deepak Roy, ABD Vice Chairman. But now companies are scaling down their volumes where the margins are thinner, introducing premium brands and focussing on profits. Diageo is working to get consumers to ‘premiumise’. The company is working to taking a long term view and creating business value. The history associated with Diageo’s iconic brands, too, bears testimony to such far-sightedness.

But now companies are scaling down their volumes where the margins are thinner, introducing premium brands and focussing on profits. Diageo is working to get consumers to ‘premiumise’. The company is working to taking a long term view and creating business value. The history associated with Diageo’s iconic brands, too, bears testimony to such far-sightedness.

While congratulating on the grand come back of PM Narendra Modi, Dr. Lalit Khaitan, Chairman of Radico Khaitan Ltd. says, “The voters have endorsed Modi’s decisive leadership, his ability to take the country from red tape to red carpet, his government’s multiple schemes to pull out millions from abject poverty and provide them essential services like electricity, cooking gas, bank accounts and free health services.”

While congratulating on the grand come back of PM Narendra Modi, Dr. Lalit Khaitan, Chairman of Radico Khaitan Ltd. says, “The voters have endorsed Modi’s decisive leadership, his ability to take the country from red tape to red carpet, his government’s multiple schemes to pull out millions from abject poverty and provide them essential services like electricity, cooking gas, bank accounts and free health services.” KALS CMD Mr.S Vasudevan says on the historic victory of the NDA government, “I wish our Honourable Prime Minister Mr. Modi for his impeccable victory. This is a well-deserved victory for transforming our nation in terms of controls, governance, and GDP growth. I personally look forward to having reforms in the IMFL Industry as well that contributes significant revenue to the respective states. I wish the new government all the very best and I’m confident under the leadership of our Honourable PM, India will get into the strides of excellence.”

KALS CMD Mr.S Vasudevan says on the historic victory of the NDA government, “I wish our Honourable Prime Minister Mr. Modi for his impeccable victory. This is a well-deserved victory for transforming our nation in terms of controls, governance, and GDP growth. I personally look forward to having reforms in the IMFL Industry as well that contributes significant revenue to the respective states. I wish the new government all the very best and I’m confident under the leadership of our Honourable PM, India will get into the strides of excellence.” And having overcome the legacy issues associated with the USL acquisition, Diageo claims to have set itself the ambitious target of “changing the alcohol industry in India”. Much of that effort revolves around a campaign to inculcate the spirit of ‘responsible drinking’, which translates into reinforcing moderation, and in promoting road safety in collaboration with State governments.

And having overcome the legacy issues associated with the USL acquisition, Diageo claims to have set itself the ambitious target of “changing the alcohol industry in India”. Much of that effort revolves around a campaign to inculcate the spirit of ‘responsible drinking’, which translates into reinforcing moderation, and in promoting road safety in collaboration with State governments.

India is a country of diverse cultural heritage and as Indians, we love to savour this diversity indistinct with mouth-watering cuisines from all parts of the country.

India is a country of diverse cultural heritage and as Indians, we love to savour this diversity indistinct with mouth-watering cuisines from all parts of the country.

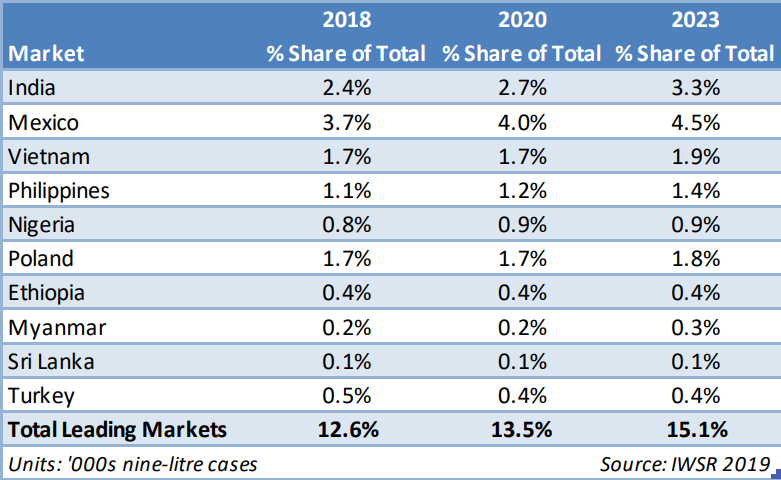

of the market. By 2023, the gin category is expected to reach 88.4m cases globally, with particular strong growth in key markets such as the UK, Philippines, South Africa, Brazil, Uganda, Germany, Australia, Italy, Canada and France. Notably, Brazil has emerged as a new hotspot for the category, with volumes there more than doubling last year and forecasted to grow at 27.5% CAGR 2018-2023, as the gin-and-tonic trend has increased in upmarket bars of São Paulo and Rio de Janeiro.

of the market. By 2023, the gin category is expected to reach 88.4m cases globally, with particular strong growth in key markets such as the UK, Philippines, South Africa, Brazil, Uganda, Germany, Australia, Italy, Canada and France. Notably, Brazil has emerged as a new hotspot for the category, with volumes there more than doubling last year and forecasted to grow at 27.5% CAGR 2018-2023, as the gin-and-tonic trend has increased in upmarket bars of São Paulo and Rio de Janeiro.

they are relatively dry, which makes them more food-friendly and sessionable. In the US, the popularity of alcohol seltzers has been a tremendous engine for growth in the RTD market. In the cider category, as investment levels in those products continue to rise, almost 270m cases are expected by 2023, a 2.0% CAGR 2018-2023. Both of those categories (mixed drinks and cider) are taking share from beer as perceived accessibility increases (less bitter, easier to drink.)

they are relatively dry, which makes them more food-friendly and sessionable. In the US, the popularity of alcohol seltzers has been a tremendous engine for growth in the RTD market. In the cider category, as investment levels in those products continue to rise, almost 270m cases are expected by 2023, a 2.0% CAGR 2018-2023. Both of those categories (mixed drinks and cider) are taking share from beer as perceived accessibility increases (less bitter, easier to drink.)