Alcohol consumption in India to touch 6.5 billion litres by 2020 Although perceived to be a recession-free industry, Covid-19 proved that the alcobev industry too could be brought to its knees. However, demographics in India and various factors prove that the industry could bounce back provided that legislative interference is to a minimum.

Alcohol consumption in India is estimated to touch about 6.5 billion litres by 2020 from about 5.4 billion litres in 2016, data from Statista revealed.

Revenue in the alcoholic drinks market amounts to US$1,371,385m in 2020. The market is expected to grow annually by 8.7% (CAGR 2020-2023).

The market’s largest segment is beer with a market volume of US$522,299m in 2020. According to global comparison, most revenue is generated in the United States (US$222,098m in 2020). In relation to total population figures, per person revenues of US$184.26 have been generated in 2020.

Revenue in the whisky segment amounts to US$18,791m in 2020. The market is expected to grow annually by 8.5% (CAGR 2020-2023). Compared globally, most of the revenue is generated in India (US$18,791m in 2020). In relation to total population figures, per person revenues of US$13.62 have been generated in 2020. The average per capita consumption stands at 2.6 L in 2020. Revenue (2020)+2.2% yoy is US$18,791m. Average Revenue per Capita (2020)+1.2% yoy is US$13.62. The alcohol market in India is divided into different segments such as country liquor, Indian Made Foreign Liquor (IMFL), beer, and imported liquor. According to IWSR Drinks Market Analysis, a London-based research firm, India is the world’s ninth-largest consumer of all alcohol by volume. After China, it is the second largest consumer of spirits (whiskey, vodka, gin, rum, tequila, liqueurs). India consumes more than 663 million litres of alcohol, up 11% from 2017. Per-capita consumption is rising. India consumes more whiskey than any other country in the world – about three times more than the US, which is the next biggest consumer. Nearly one in every two bottles of whiskey brought around the world is now sold in India. When worldwide booze consumption dipped in 2018, India partly drove a 7% uptick in the global whiskey market.

Five southern states – Andhra Pradesh, Telangana, Tamil Nadu, Karnataka and Kerala – account for more than 45% of all liquor sold in India. Not surprisingly, more than 10% of their revenues come from taxes on liquor sales, according to the research wing of Crisil, a ratings and analytics firm.

The other six top consuming states – Punjab, Rajasthan, Uttar Pradesh, Madhya Pradesh, West Bengal and Maharashtra – mop up between less than five to 10% of their revenues from liquor. The combined annual sales of alcohol companies have grown 3.7% in the last five years. Among listed entities, Diageo-controlled United Spirits has the highest market capitalization at `38,000 crores. The company which sells local whiskey, McDowells as well as Johnnie Walker, is the biggest player in the spirits market and holds 33.4% of the Indian scotch and whiskey market by volume. French rival Pernod Ricard commands 24% of the market with brands such as Royal Stag and Glenlivet, according to International Wine and Spirits Research (IWSR). Even within the premium segment, Diageo and Pernod Ricard control more than 70% of the whiskey segment.

Three global spirits giants – Beam Suntory, Brown-Forman and Bacardi – are collectively introducing more than a dozen new brands in the premium whiskey segment in India, which is the world’s largest whiskey consuming nation. These three companies are among the biggest distillers globally.

“The whisky category is large and in growth. Consumers are increasingly opting for quality over quantity and prefer blends that appeal to the Indian palate,” said Neeraj Kumar, Managing Director, Beam Suntory India, which recently launched Yamazaki, Hibiki, Oaksmith Indian whisky and Roku gin. Suntory, the world’s third largest spirits producer, said these new brands will benefit from the distribution and customer partnerships serviced by Teacher’s and Jim Beam for the past many years.

India consumed 212.7 million cases of whiskey in 2018

Scotch sales in the Indian market was among the top three in terms of volume, with 112.6 million bottles sold to India in 2018, compared to top-ranked France at 187.8 million bottles and second-placed US at 136.8 million bottles. In terms of value, India came in at £138.8 million, up 34.1% compared to 2017.

IWSR data showed double-digit growth for Indian whisky last year, and this market continues to expand despite considerable roadblocks. The importance of the Indian whisky market to the global well-being of the whisky category cannot be overstated: nearly one in every two bottles of whisky bought around the world is now sold in India, and seven of the top ten global whisky brands are Indian.

Indian whiskies, notwithstanding, India is still the sixth biggest global destination for Scotch whisky. The Indian influence on the whisky market is not waning either, with the IWSR reporting double digit growth last year.

India’s performance last year was mildly amplified by the boost that the regularization of the Uttar Pradesh market gave sales, but the 11% volume rise has still highlighted the opportunities that continue to exist for whisky in India. Demand is being fuelled by a rising consumer base of young consumers who are becoming more affluent in a country where the global reach of some of the smaller cities is becoming more significant, diluting the historical whisky sales bias towards the big three cities of Mumbai, Delhi Gurgaon and Bangalore.

According to IWSR figures, 93% of all whisky traded in India falls into the ‘value’ segment, and that leaves plenty of scope to develop the higher end segments. These new affluent consumers prefer premium products, and the value of the whisky market in India increased by 17% last year. This is a long-term trend, with the average price of whisky in India nearly doubling in ten years to US$7.18 for a litre. The appeal of the Indian whisky market is not just that all price bands are thriving, but just how early in the premiumization cycle the market is in.

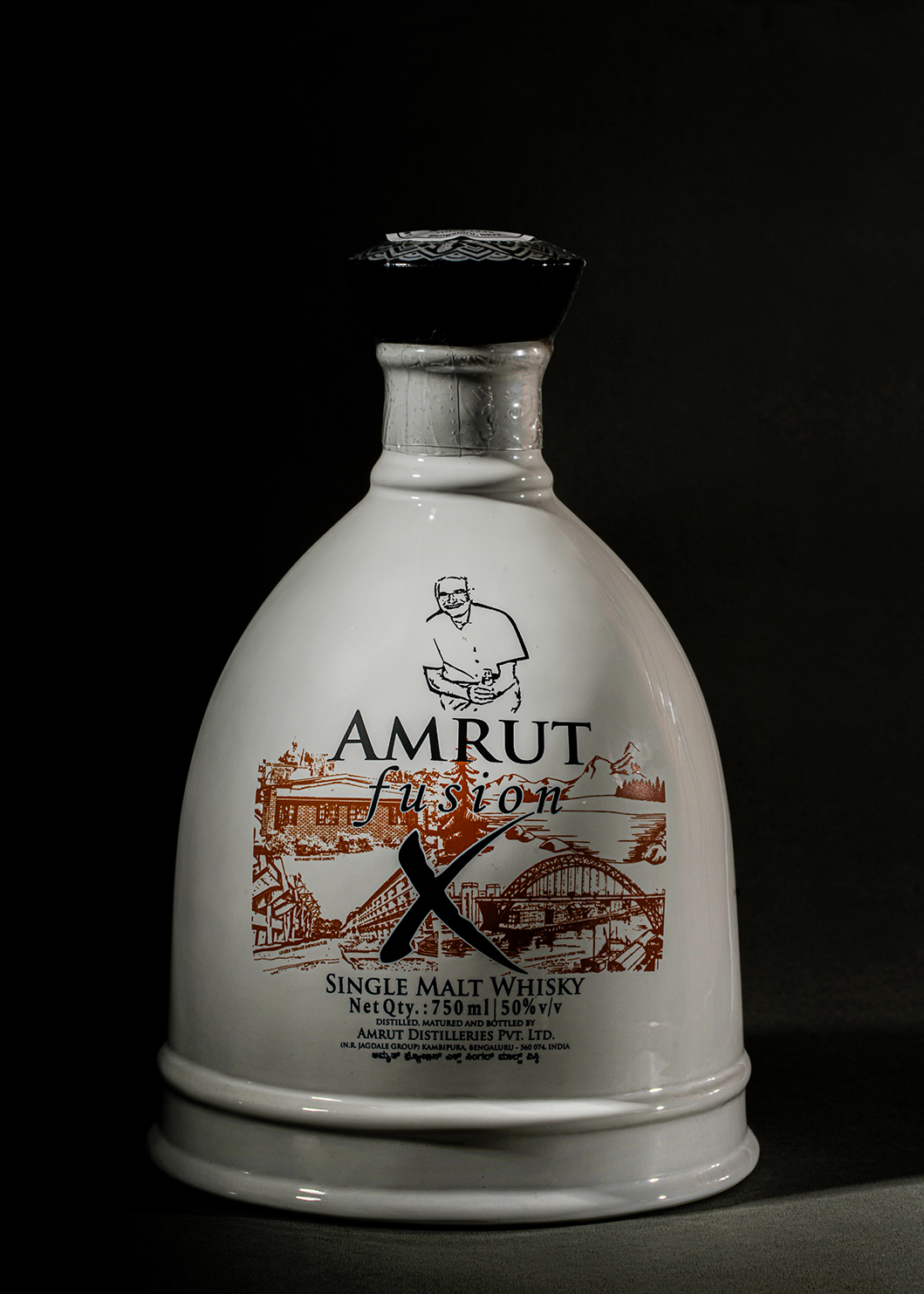

Conversely, India’s 2018 results were helped by no new regulatory or tax interference and the market progressed accordingly. The premiumization process resumed, with the top end of the ‘Bottled in India’ market (selling for around a ₹1000 a bottle) flourishing. This has prompted the emergence of some pioneering and cult Indian whisky companies like John Distillers and Amrut Distillers who are raising the bar for Indian whisky.

Attempts are also being made to create a buzz around the use of whisky in cocktails, which will make the category more relevant not just to younger drinkers, but also to the female market. Many of these new ‘young brands’ are helping to contemporize the category and broaden the appeal away from the 35-year-old plus core users to the rapidly expanding younger age segments. There is already evidence that in the higher echelons of Indian society, women are developing a taste for top end whiskies.

The innovation in the category is helping Indian Whisky to carve out its own identity and in the longer term this will enhance its reputation among whisky connoisseurs from further afield. To date, Indian whisky exports have tended to follow the path of the large Indian expat communities, particularly in the Gulf. They have also attracted a following in some African markets, serving as entry level brands for those consumers wanting to upgrade from the illicit spirits market. The next generation of high-end Indian made malts are already showing that they are of a sufficient standard to capture an audience in Western markets.

Currently, the Indian Whisky category is strong: its innovation is bringing new consumers into the category and is building its profile among whisky purists, both internally and externally. Whether this trend will continue with the ever-present threat of Federal or State disruption remains to be seen; the category is prone to taking one step forward and two steps back following government regulation or tax changes.

While India consumed 212.7 million cases of whiskey in 2018, imported whiskey accounted for about 2% of the overall consumption by volume as Indian-made foreign liquor dominates the segment with relatively low price tags.

India’s alcoholic beverages industry is heavily regulated, with high excise and taxes imposed in most states, making it an important source of revenue. Additionally, import duties on foreign wines and spirits exceeds 150%, making them three to five times pricier than elsewhere in the world. As a result, many companies launch their products at duty free to gauge consumer responses. For instance, Brown-Forman recently launched Woodford Reserve Baccarat Edition, Woodford Reserve Double Oak, BenRiach scotch and Jack Daniel’s Bottled-in-Bond Tennessee whiskey at Indian duty free before introducing them at retail shelves and bars.

Despite slowdown in the overall spirits segment, companies, especially selling either imported or the pricier bottled in India (BII) spirits, said their business has remained insulated in the country where 19 million people are becoming eligible for drinking every year. And newer launches are not just restricted to whiskey. Bacardi, maker of the eponymous white rum and the world’s largest privately held spirits company, said consumers are trading up to premium liquor across categories. Online liquor delivery remains a non-starter, four months after markets like West Bengal, Jharkhand and Chattisgarh permitted the same, said company and industry executives, attributing the slow burn to steep delivery fee charged by aggregators Swiggy and Zomato and lack of clear guidelines. Online food delivery, in contrast, has reached pre-Covid numbers.

During peak lockdown months, while the central government had permitted opening of shops to sell essentials, it had denied sale of alcoholic beverages, which led some states to allow online delivery of alcohol. Spirits brands such as single malt maker Amrut Distilleries and whisky maker John Distilleries said retail outlets must be roped in to bring fair trade practice.

The government should encourage licensed retail outlets to set up their own portals to sell alcohol rather than allowing aggregators such as Swiggy and Zomato. Online players directly eat into the share of conventional retail outlets. Leading liquor firms such as United Breweries, Radico Khaitan, Amrut Distilleries and John Distilleries said that the e-commerce model for liquor will take a few years to scale up.

The long-term dynamics of the industry in India remained intact due to a host of favourable factors. Expansion of the middle-class, increasing rural consumption and dispersed urbanization, greater acceptance of social drinking and a higher proportion of the young population entering the drinking age are some of the factors, that will work in India’s favour.

When some Indian cities eased the grinding lockdown recently to prevent the spread of the novel Coronavirus, long queues were seen outside liquor shops across the country. In cities like Mumbai, a Covid-19 hotspot, booze-loving people made a mockery of social distancing rules, prompting the government to shut the shops again.

The harsh lockdown meant that the demand for alcohol was intact. There have been reports of a spike in alcohol sales around the world: in the UK, sales were up by 22% in March and in the US they have risen 55% compared to the same period last year.

“There have been long queues outside liquor shops across India. But not a drop was sold in April, and given the dire state of their revenues, these states have been anxious to make good their losses by opening up the liquor vends,” the research agency said. Lack of liquor taxes has left near-bankrupt states groaning under the lockdown with little money to spend.

A third of Indian men drink alcohol, according to a new government report. More than 14% of all Indians aged between 10 and 75 drink. The World Health Organization (WHO) estimates 11% of Indians are binge drinkers, against the global average of 16%. Indians are drinking more than before. A recent study of liquor consumption in 189 countries between 1990 and 2017 found that consumption in India had grown by 38% – from 4.3 litres a year per adult to 5.9 litres. Consumption had gone up because the “number of people with sufficient income to purchase alcohol has outpaced the effects of measures aiming to reduce consumption”. However, selling alcohol in India is challenging because the local governments are intrinsically anti-alcohol, something that is partly driven by philosophical reasons, but also because a hard-line attitude to alcohol is a political vote winner. In India, each of the twenty-nine states govern their own alcohol policy and regulations. There is no legitimate cross-border trade allowed, and state governments control taxation, production, the route-to-market, regulation and pricing. If a company wanted to have national reach in India, they would need to have an operation in each state – a process that is both bureaucratic and expensive.

To further complicate matters, marketing alcoholic drinks brands in India requires considerable ingenuity. India is ‘dark market’ where advertising and promoting alcohol is prohibited; as such, companies marketing and launching new brands do so prudently with good liquid, good packaging and good distribution.

Allied Blenders & Distillers (ABD) demonstrated this last year with the fabulous success of their new premium range of whisky, Sterling. Sterling was a good, well presented product and with ABD’s distribution channels, they were able to persuade retailers to put the whisky on their shelves at the cost of sacrificing the shelf space of another of their brands.

There may be ways of improvising, but India remains a difficult trading environment for drinks companies. These conditions are compounded by the fact that the law makers do not legislate with the commercial sensitivities of drinks companies in mind: regulations, tax rises and rule changes can be introduced at damagingly short notice.

The market was blighted in 2017 by unexpected monetary reform as well as a Supreme Court ruling imposing a ban on liquor vends (retail outlets) within 500m distance of any national or state highway. Rules were later clarified to permit bars in hotels to sell alcohol, and the industry deployed their initiative to overcome the ruling. National Highways were quietly exempted by changing them to City Highways, while one resourceful vendor, sited 50m from a liable highway, is said to have created a 501m path that wound its way to his store, so that he would still be eligible to continue to trade. Despite this resilience, it is estimated that 6-8% of outlets closed and the vibrant Indian whisky market flattened.