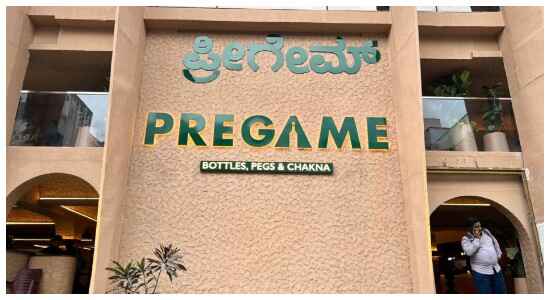

Bengaluru’s nightlife has never lacked imagination. Pubs are history, lounge bars are passe, microbreweries continue to vibe and now it’s the BYOB (bring your own booze or bottle, as you please) trend that’s making all the noise on social media. The city has long been India’s test lab for new drinking formats. Yet, the launch of ‘Pregame’ in Koramangala, a veritable waterhole, has added a fresh twist to that narrative, a hybrid concept that’s part liquor store, part bar, part restaurant, and entirely tuned into the city’s evolving drinking habits.

At first glance, ‘Pregame’ might look like another upbeat watering hole, neon signage, a buzzy crowd, a quick-serve menu, and loud playlists. But what sets it apart is its simple, subversive idea, “Bring your bottle, we’ll bring the vibe.” Customers can pick up a bottle from the liquor store on the ground floor or carry one they already own, and the venue takes care of the rest, the mixers, the glassware, the ice, the food, and the music. There is a minimal 9 per cent glassware and corkage fee.

Pregame founder S. Jagadish has created this space where people can shop, taste and experience the brands they prefer in a cool ambience and at prices that are so so reasonable. It is a go between a liquor shop and a pub, when it comes to pricing and experience.

It’s Bangalore’s newest “BYOB” (Bring Your Own Bottle) venue, but with a professional twist, legal, licensed, and curated for a safe, social, and Instagram-ready experience. And that’s precisely why it’s become a talking point across the city’s F&B circles.

Addressing a pain point

“We wanted to create a space that’s easy, social, and affordable,” adds Jagdish who describes Pregame as “an answer to the pre-drink dilemma.”

It’s a relatable pain point. In a city with soaring alcohol taxes and premium bar mark-ups, a night out can easily turn into a wallet-drainer. Many prefer gathering at home for a few drinks before heading to clubs later, hence the term “Pregame”. The founders simply turned that ritual into a business model.

At Pregame, guests can buy their bottle, pay a modest service fee, and enjoy the comforts of a bar without the inflated drink prices. The food menu is designed around the concept—shareable bar bites, skewers, sliders, and spicy chakhna. Add a DJ, community tables, and dim lighting, and you have a format that bridges the gap between home drinking and nightlife.

Bangalore’s Shifting Spirits Culture

The emergence of Pregame also signals a larger shift in the city’s drinking culture. Bangalore’s consumers, especially the 25–40 age group, are increasingly discerning about what they drink, how they drink it, and where.

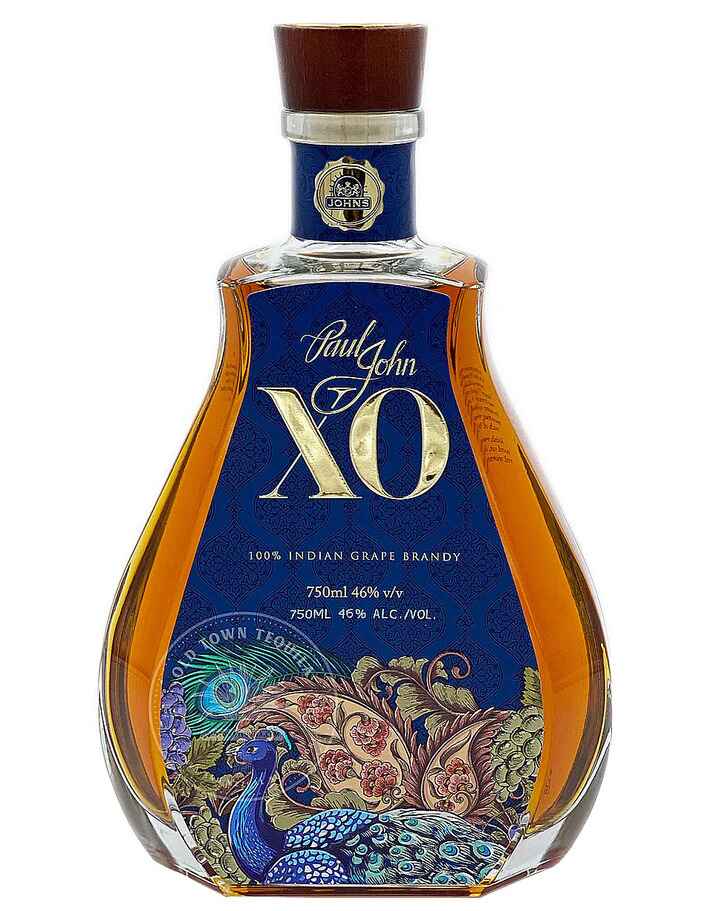

Over the past five years, the city has seen a wave of premiumisation, the rise of craft gins, small-batch whiskies, and local rum brands. Artisanal spirits like Greater Than, Tamras, Samsara, and Short Story are now fixtures on retail shelves. Importantly, consumers are not just trading up, they’re also seeking control and creativity in their drinking experiences.

People are willing to pay for quality, but they also want flexibility. “The BYOB bar model like Pregame gives them both, they bring their own bottle, but still get the ambience and service of a bar. It’s clever and consumer-first.”

The BYOB concept is hardly new, but in India, it’s been a regulatory grey zone, with varying rules on liquor consumption in semi-commercial premises. Yet, states like Karnataka have slowly opened up to formats that blend retail and hospitality, provided they follow the correct licensing framework.

For Pregame, that’s where the innovation lies. The venue holds a retail licence, allowing the sale of alcohol to customers, and a separate dining space that offers the food and mixers. The result is a compliant, safe, and profitable middle-ground.

It’s not just about convenience. The social format itself has strong psychological appeal, shared ownership of the night. You bring your bottle, your friends bring theirs, and the venue turns it into a party. It makes the evening feel participatory rather than transactional.

This is also aligned with broader global trends. From London’s bottle clubs to New York’s mix-at-table lounges, post-pandemic nightlife has evolved toward personalisation and smaller, curated experiences rather than large-format drinking.

Changing Palates, Changing Playlists

Step into Pregame on a Friday evening, and you can sense the city’s evolving taste profile. The crowd isn’t ordering plain rum-and-coke anymore. Instead, they’re requesting tonics, ginger ales, low-sugar mixers, and even soda infusions with herbs or fruit. The cocktail menu focuses on refreshing spritzes, quick mixers, and easy pours that complement the BYOB ethos.

It reflects how Bengaluru’s drinkers have matured. The city’s residents, a mix of tech professionals, expats, and students, are increasingly health-conscious and mindful about consumption. The focus is less on quantity and more on quality and experience.

Low-alcohol and no-alcohol beverages are also making their way onto menus. Kombucha cocktails, flavoured sodas, and non-alcoholic G&Ts are regulars. This mirrors a larger urban trend—moderation as a lifestyle choice, not a compromise.

Experience is the Key

Another key reason behind Pregame’s buzz is its value proposition. With cocktail prices in premium bars often crossing ₹800–1,000, Pregame taps into a segment that seeks affordability without sacrificing atmosphere.

“Bangalore’s nightlife used to be binary, either dive bar or fine cocktail lounge,” says hospitality consultant Pranav Bhat. “Now, venues like Pregame sit neatly in the middle. They’re social, safe, and stylish, but they don’t intimidate you with luxury pricing.”

And that’s the sweet spot for Gen Z and millennial consumers. They’re drinking less, but better. They’re brand-aware, social-media-savvy, and eager to explore homegrown spirits. They prefer venues that feel authentic, communal, and experience-driven.

The timing couldn’t be better. Karnataka remains one of India’s largest alcohol-consuming state, and Bengaluru is its most lucrative market. Post-COVID, liquor retail sales in the city have surged, and premium spirits have seen double-digit growth.

This has also led to experimentation in how alcohol is retailed and served. Liquor boutiques with tasting counters, in-store mixology demos, and restaurant-linked stores are beginning to appear. The government’s push to formalise retail through better licensing has opened space for such innovation.

Industry analysts see formats like Pregame as part of a wider trend—the blending of retail, entertainment, and lifestyle. What used to be three separate industries are now converging.

If this experiment succeeds, it could redefine what a “bar” means in India’s metros. Not every social drinker wants a club or an expensive cocktail den. Some just want a table, their own bottle, good food, and better company, and that’s precisely the space Pregame is betting on.

In a city that loves its craft beer and boutique gins, the next phase of evolution might not be about what’s in the glass, but where and how that glass is raised.

R. Chandrakanth

Ambrosia