A few years ago, if someone walked into a bar in Delhi and asked for tequila in a tumbler with ice, eyebrows would rise. Today, it fits right in. Spirits that once lived in the background of parties are now selected with care, discussed over meals, and sipped with intention. Tequila is part of this change, gaining recognition not through noise but through dimension.

Now arriving at Mumbai and Delhi airports during peak travel months is Patrón El Alto, the latest premium expression from Bacardi’s portfolio. With passport counters running overtime, new flight routes expanding, and flyers strolling through upscale duty-free stores before takeoff, this launch feels like smart timing.

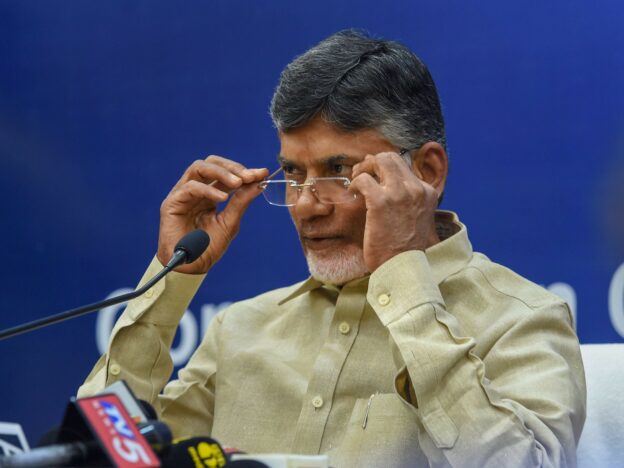

Behind the scenes of this shift stands Jonas Gustav Ax, Head of Advocacy for Bacardi across India and nearby regions. With two decades of experience behind the bar and in the field—from London’s cocktail scene to Malaysia’s mixology circles—Jonas brings global perspective to local conversations. Based in Delhi with his wife and their rescue dog, he balances his time between bar takeovers, education programmes, and a growing curiosity about Indian ingredients.

In this interview with Ambrosia, Jonas shares why Patrón El Alto speaks to India’s new wave of drinkers, how it blends tradition with ambition, and what makes a tequila feel right at home in a whisky-loving country.

What makes the launch of Patrón El Alto in India timely from a strategic perspective?

India’s premium spirits market is expanding steadily, with consumers making more thoughtful decisions around what they drink. There is growing interest in products that reflect skill, origin, and quality. At the same time, cocktail culture is becoming more expressive, and bartenders are approaching spirits with new energy. This moment presents the right opportunity to introduce a tequila that captures both care in creation and potential for creativity. El Alto aligns with this shift and lands at a time when people are open to discovering something layered and thoughtfully prepared.

Tequila is moving into the premium category globally. What factors are supporting this change and how does El Alto connect with that direction?

Drinkers are becoming more curious about what goes into the bottle. There is growing awareness about where spirits come from, how they are produced, and what kind of character they develop over time. Tequila, which was once seen through a limited lens, is now being explored with the same attention once reserved for whiskies and brandies. For decades, Patrón has focussed on small-scale production and unprocessed ingredients. El Alto builds on that foundation by introducing a blend of aged styles that reflect precision and thought. It continues the journey while also expanding what tequila can offer.

El Alto is described as ultra-premium. How would you define its role in the Patrón collection, and how is it different from the others?

This expression sits at the highest point within the lineup. The core variants—Silver, Reposado, Añejo—highlight clarity and structure, while El Alto introduces additional depth through its blend of long-aged components. It draws from a range of barrels, each bringing something distinct to the final composition. What also shapes its identity is the use of both volcanic stone milling and more modern methods, resulting in a profile that is broad, polished, and complete. The attention to technique sets it apart in both texture and personality.

Tell us more about how El Alto is crafted. What role do blending and production methods play in defining its character?

The entire process begins with two contrasting extraction styles. The Tahona method, involving a circular stone, brings out grounded, mineral elements, while the roller mill introduces freshness and herbal tones. After that, the spirit is placed in a variety of barrels—eleven in total—each lending unique qualities. The final blend is assembled after several rounds of testing, where careful proportions are chosen. The result carries warmth, sweetness, subtle fruit, and a refined finish. It reflects care at every point, from start to final pour.

What inspired the choice to combine Extra Añejo and Reposado tequilas in this expression? Was this primarily creative or strategic?

It came from both intention and instinct. From a broader viewpoint, this combination creates something that appeals to seasoned agave fans as well as those more familiar with aged dark spirits. At the same time, it gave the master distiller room to create balance: one part richness, one part brightness. That duality makes it versatile. It performs well in spirit-forward drinks while remaining approachable in simpler formats. The blend brings together structure and softness in a way that adds reach across styles and settings.

What are some common myths about tequila that you’re hoping to change with El Alto and Patrón’s larger storytelling?

One of the most familiar beliefs is that tequila belongs only in party settings or is meant to be consumed quickly. Another assumption is that all tequilas deliver a similar experience, with little variation in quality. Through El Alto, the intention is to introduce a different perspective; one that highlights nuance, aging, and variety. This spirit carries the kind of structure and intensity often associated with dark aged liquors. Whether served neat, over clear ice, or in a well-built drink, it encourages a more considered way of enjoying agave.

Who is the ideal Patrón El Alto consumer in India? Are you targeting connoisseurs, new-age luxury seekers, or both?

Both profiles are part of the audience. El Alto speaks to individuals who already understand the value of process-driven spirits and are looking to explore further within the agave category. It also connects with a newer generation of luxury-minded drinkers who want experiences that feel international yet rooted in authenticity. These are curious people who look for meaning in what they select, and who value elegance and intention in their choices.

What’s the distribution strategy for El Alto in India? Will it be available only in select cities or at premium venues?

The emphasis is on placing El Alto in environments where attention to quality is a shared value. This includes bars and restaurants known for refined menus, thoughtful bartending, and strong engagement with premium spirits. Along with that, the spirit will be available in high-end retail outlets across key locations. This approach allows people to encounter the brand in different ways: through curated pours at hospitality spaces, or as part of their personal collection at home.

Can you share details around the pricing strategy for the Indian market and how it aligns with your global positioning?

This expression is crafted for those who appreciate refinement and are comfortable choosing quality through a well-made product. Its preparation involves selecting agave with care, aging across multiple cask types, and blending in small batches. That level of effort is reflected in the pricing. In Mumbai, El Alto is placed at ₹29,500, which corresponds with its position across other markets. The amount captures the time, materials, and craftsmanship that define its identity.

With India’s luxury spirits market evolving rapidly, what long-term opportunities do you see for premium tequila in the country?

India holds significant promise for growth in this category. As more people look for substance and origin in what they enjoy, tequila becomes a natural addition to their repertoire. Awareness around sipping tequilas is growing, and cocktail menus are evolving to include more agave-based options. The openness to newer formats, ingredients, and cultural references works in favour of this spirit. As people continue to explore spirits with character, tequila has the potential to become a regular part of premium choices in both casual and formal settings.

Are there plans to expand the broader Patrón portfolio in India following El Alto’s launch? What can we expect next?

The core Patrón range—including Silver, Reposado, and Añejo—is already present across India. With El Alto now available, the portfolio feels complete in terms of offering options for both cocktails and sipping. The next phase is not about more products, but about building understanding. That includes working with hospitality partners, creating engaging experiences, and giving drinkers more opportunities to explore how each variant expresses agave differently. Once familiarity grows further, additional introductions may follow, based on what consumers show interest in exploring next.

You’ve travelled extensively for the brand. How does the Indian palate compare when it comes to accepting complexity in spirits?

People in India have always had an appreciation for flavour that carries variation and richness. The way cuisine is prepared and enjoyed already reflects this instinct. When introduced to a spirit that reveals something new with every sip, the response is immediate. There’s curiosity and a willingness to ask questions, explore textures, and notice changes over time. This makes it an exciting space for introducing agave spirits with structure and identity.

How do food pairing and cocktail culture influence how you present tequila in emerging markets like India?

Food plays an important role in shaping how spirits are experienced here. The variety in ingredients, preparation styles, and flavours allows tequila to be presented in creative and surprising ways. Pairing El Alto with bold, well-seasoned dishes enhances both elements, creating an experience that feels complete. On the cocktail side, bartenders are constantly experimenting with new formats, regional ingredients, and storytelling techniques. Their work helps open new doors for tequila and brings it into conversations where it previously had limited presence.

Finally, what’s your favourite way to enjoy El Alto and how would you introduce it to someone trying tequila for the first time?

My favourite way to enjoy El Alto is on a big single block of ice, served super chilled. I also love it in a tall Ranch Water: El Alto in a highball glass full of ice, topped to the brim with soda water. For someone new to this style, that second option works well. It’s refreshing, inviting, and gives space to appreciate the liquid without overpowering the senses.