India is known to be a whisky drinking country. With changing demographics, liquor bans, demonetization, non inclusion in GST and prohibition could change that perception. A report.

According to brokerage Emkay Research, 62 percent of the liquor is consumed in southern India, while northern India consumes only 18 percent of the industry volumes. The eastern region consumes 8 percent and western India consumes 9 percent.

Five states account for 61 percent of the industry volumes. Tamil Nadu is the largest consumer of liquor accounting 18 percent, followed by Karnataka at 17 percent.

According to NSSO, an average person in rural India consumes 220 ml of alcohol in a week, or nearly 11 litres in a year, spending Rs 18.47 a month on intoxicants. Urban Indians consume much less — 96 ml of alcohol a week or 5 litres a year — spending Rs 16.77 on intoxicants in a month.

While whiskey remains a favourite, wine, which entered Indian markets in the ’90s, is still not the first choice for many, say experts. “Indian wine industry is very young, barely 40 years old. India traditionally does not have a wine drinking culture; it was considered a luxury. In the past 10 years, and specifically in the past five years, there has been substantial growth — 10 to 15 per cent — compared to Europe, where growth has stagnated.

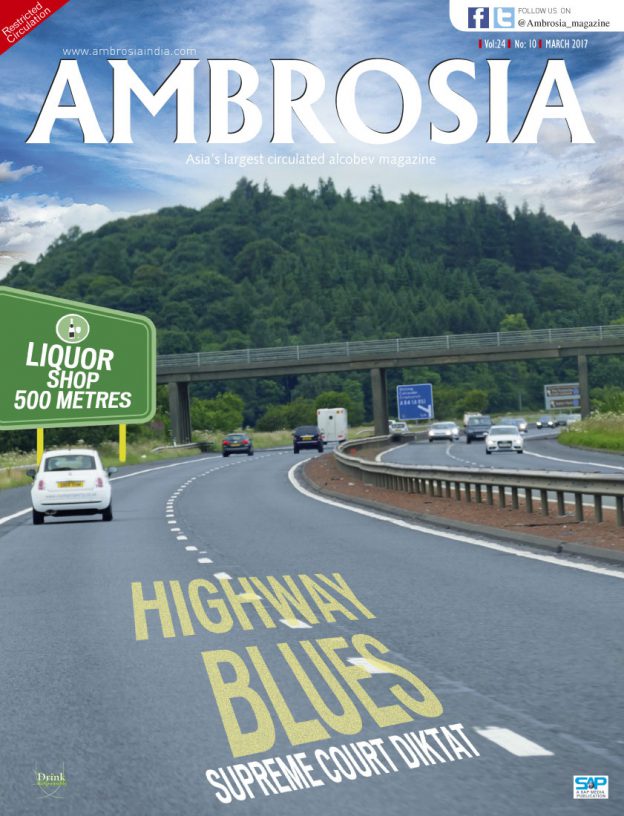

The Supreme Court ban on liquor vends within 500 m of highways comes amid a growing clamour for prohibition. But from toddy to whiskey, country liquor to IMFL and beer to, more recently, wine — we are knocking it all down.

It was only in the ’90s, after liberalisation, that alcohol entered our drawing rooms. The recent Supreme Court decision to ban liquor vends within 500 metres of national and state highways, with the bench expressing concern over nearly 1.5 lakh deaths every year in road mishaps, has come amid a growing clamour for prohibition across the country. But away from the government orders and crackdowns, across India, alcohol consumption is still showing a steady increase.

According to the 68th report of the National Sample Survey Office (NSSO) on Household Consumption of Various Goods and Services in India, in 2011-12 (the last year for which the data is available), per capita alcohol consumption in rural India increased by nearly 28 per cent, while that of urban India rose by nearly 14 per cent.

Three states in the southern part of the country — Andhra Pradesh, Tamil Nadu and Kerala — along with Arunachal Pradesh and Assam make frequent appearances in the NSSO data on states that consume the maximum amount of toddy, beer, foreign liquor and wine across rural and urban centres.

Arunachal Pradesh tops both beer and country liquor categories in rural and urban areas. Among urban areas consuming foreign liquor/wine, Arunachal tops with 213 ml per capita per week, while at 93 ml, Sikkim is the top consumer in this category in rural areas. According to Arunachal’s excise figures, the state downed 1.93 crore litres of IMFL and nearly 5 lakh litres of beer in 2015-16.

Contrary to popular perception, it is not Kerala but Andhra Pradesh that has the highest intake of toddy both in rural and urban centres — 793 ml and 69 ml respectively — over a 30-day period.

More recently, 2015-16 excise department figures for Telangana and Andhra Pradesh show 303 lakh cases of IMFL (one case has 12 bottles, each of 750 ml capacity) and 189 lakh cases of beer were sold in Andhra Pradesh in 2015-16; in Telangana, 238.62 lakh cases of IMFL and 334.56 lakh cases of beer were sold over the same period.

“The entry of IT companies, especially in Hyderabad, has contributed to the rising sales. In the past 2-3 years alone, 60-80 new pubs have opened in Hyderabad,” says Gopal Singh Thakur, general manager at Spoil bar in Hyderabad. “When I started out, 100 Pipers and Blender’s Pride were big brands. Today it is all about imported liquor and single malts.” The hospitality professional, who has been working in the city for 13 years, says the rise in beer sales can also be attributed to the many breweries that have come up in Telangana the past year.

While alcohol sales earned the Kerala government Rs 10,012 crore in 2014-15, the Tamil Nadu government clocked up to Rs 26,188 crore in revenues through its outlets of the Tamil Nadu State Marketing Corporation (TASMAC), which has near-complete monopoly over wholesale and retail vending of alcohol in the state. Of the Rs 1.48 lakh crore state revenue in 2015-16, 33 per cent came from TASMAC.

Nearly 70 lakh people visit TASMAC shops on any given day in Tamil Nadu and the state revenue growth from liquor sale is around 11 per cent annually. Figures show that over the years the state has largely stuck to brandy — 85 per cent of the total alcohol sales — followed by rum, vodka, gin, whiskey and wine.

Country liquor, however, has managed to hold its own in several parts of the country. Himachal Pradesh, which hosts around 1.5 crore tourists every year, still records at least 90-95 per cent more sales of country liquor — which is said to be preferred by locals — than IMFL. In 2016, the state sold 29.55 lakh boxes (each with 12 bottles) of IMFL, while local country liquor brands such as Una No 1, pulled off nearly double the number in sales.

In UP, Punjab and Haryana too, residents prefer country liquor over foreign liquor and beer. In neighbouring Punjab, country liquor brands such as Khasa Mota Santra are known to do brisk business, selling over 26.92 crore bottles in 2016-17. IMFL and beer brands follow in at second and third place, with sales of 12.61 crore bottles and 5 crore bottles respectively. In Jharkhand, however, the scales are tipped in favour of beer, which sold 2.74 crore litres in 2015-16. IMFL stood a distant second, recording 1.58 crore litre in sales.

Enjoying a drink is not such a big thing anymore,” says Adarsh Shetty, president of the Indian Hotel and Restaurant Association of Maharashtra. His state recorded an annual consumption of 3,228.28 lakh bulk litres of country liquor in 2016, the most preferred alcoholic drink in the state.

According to the NSSO data, Karnataka consumes 101 ml of foreign liquor/wine over 30 days while neighbouring Maharashtra drank a mere 10 ml over the same period.

After reporting sluggish sales growth of just 0.2% in 2015, the slowest rate in a decade, the market for alcoholic beverages struggled with even more hurdles in 2016. Though company results are not yet out, prohibition in Bihar, Supreme Court barring liquor shops from opening up across the country’s highways, starting from April 1, 2017 creating another roadblock for liquor companies, taxes on alcohol increased in 2016, forcing companies to pass on higher costs to consumers, beer makers saw the market stagnant as higher raw-material costs and increased taxes stalled growth, demonetisation was the final nail in the coffin.