- Indian duties on wines, currently at 150%, will be cut to 75% upon entry into force and gradually reduced further to 40%

- EU and India already trade over €180 billion worth of goods and services annually

- FTA to come into effect early 2027

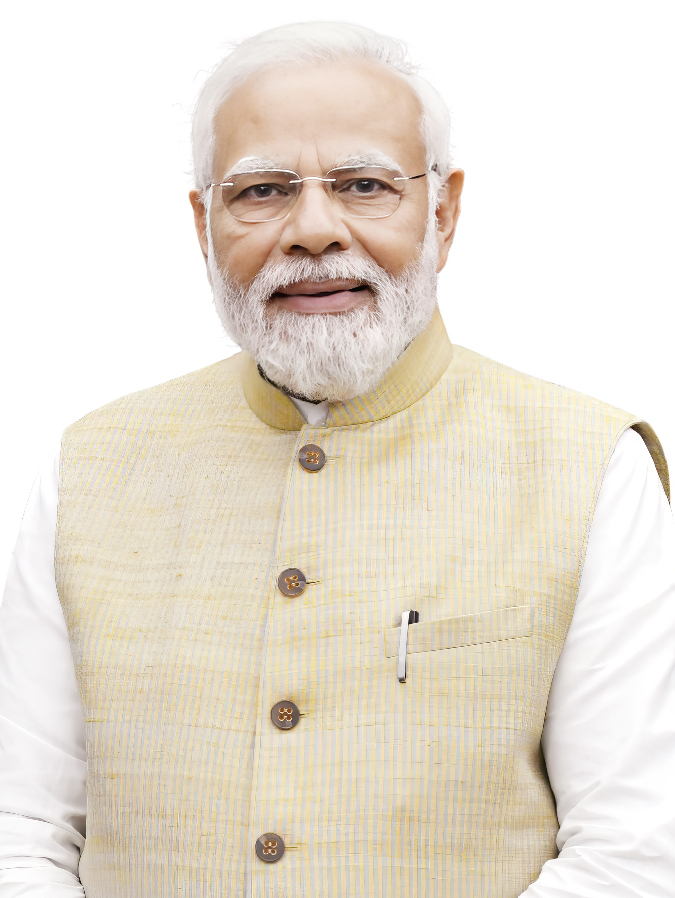

The India–European Union Free Trade Agreement (FTA) was formally concluded on January 27, 2026, marking what leaders on both sides described as a historic reset in economic relations between two of the world’s largest democratic economies. Prime Minister Narendra Modi confirmed the signing while addressing Indian Energy Week, calling it a “significant agreement” that has opened up “a lot of opportunities for 140 crore Indians and crores of Europeans.” The deal, he said, was already being discussed as the “mother of all deals”, underlining its scale and strategic importance.

European Commission President Ursula von der Leyen echoed that sentiment, describing the agreement as a landmark in rules-based global trade. “The EU and India make history today, deepening the partnership between the world’s biggest democracies. We have created a free trade zone of 2 billion people, with both sides set to gain economically. We have sent a signal to the world that rules-based cooperation still delivers great outcomes,” she said. The agreement, she added, is only the beginning of a stronger and more comprehensive partnership. “We did it. We delivered the mother of all deals,” she emphasised.

Commerce and Industry Minister Piyush Goyal, who has steered India’s recent trade negotiations with several developed economies, was emphatic about the scale of the breakthrough. Having concluded trade agreements with the UAE, Australia, the UK, Oman, New Zealand, Mauritius and the four-nation European Free Trade Association (EFTA), Goyal described the India–EU pact as the most consequential yet. “I have done seven deals so far. All with developed economies. This one will be the mother of all,” he said during his recent visit to Brussels, where final negotiations were completed.

A Historic and Ambitious Agreement

The India–EU FTA is the largest trade deal ever concluded by either side and will come into effect early 2027. It eliminates or reduces tariffs on over 96 percent of EU goods exports to India and is expected to potentially double EU goods exports to India by 2032. The tariff reductions are estimated to save around €4 billion annually in duties on European products.

The agreement comes at a time of geopolitical uncertainty and shifting global supply chains. It strengthens economic and political ties between the world’s second and fourth largest economies, creating a free trade zone covering nearly 2 billion people. The EU and India already trade over €180 billion worth of goods and services annually. In 2024, the EU was India’s largest trading partner, accounting for €120 billion worth of goods trade—about 11.5% of India’s total trade. India, in turn, was the EU’s ninth-largest trading partner.

Trade in services has also grown rapidly, reaching €59.7 billion in 2023, nearly doubling from €30.4 billion in 2020. The FTA grants privileged access to the Indian market of 1.45 billion people, with an annual GDP of €3.4 trillion and projected growth above 6 percent, making it one of the fastest-growing large economies in the G20.

The agreement also significantly reduces agri-food tariffs. Indian duties on wines, currently at 150%, will be cut to 75% upon entry into force and gradually reduced further to as low as 20%.

SpirtsEUROPE and ISWAI welcome FTA

The CEO, International Spirits & Wines Association of Indian (ISWAI), Sanjit Padhi said, “Following the successful conclusion of the IND-UK FTA, the India–EU FTA marks another significant milestone for the alcobev sector. This agreement not only deepens trade ties between India and the EU, but also fosters stronger collaboration and strategic partnership in the industry. It underscores the shared commitment to fair, balanced, and mutually beneficial trade that drives sustainable growth for both regions.”

On tariff reduction and mutually beneficial trade: “While the detailed provisions of the agreement are awaited, the initially released agreement indicates that the proposed reduction in import tariffs from the current 150% to 75% across all EU spirits & wines categories from the entry into force of the agreement, is a clearly welcome development. The agreement further outlines that the tariffs will then be lowered to 40% for spirits and as low as 20% on wines in a phased approach. Taken together, these measures under the India- EU FTA offer significant strategic benefits for both markets. India’s increasingly aspirational and discerning consumers will gain improved access to premium international brands at more accessible price points. This broader choice is expected to enhance the overall consumer experience, accelerate premiumisation within the alcobev sector, support growth in allied sectors such as tourism and hospitality, and contribute positively to state revenues.”

“A progressive FTA reinforces India’s position as a compelling investment destination and a growing export market for the alcobev sector. As the industry scales new heights, continued government support through tariff rationalisation and improved market access will be critical to sustaining growth momentum. The Indian alcobev industry is rapidly transitioning from a price-sensitive market to one driven by value creation and premiumisation, with Indian single malts leading this transformation and competing successfully with global benchmarks. The FTA will further enable Indian brands and Bottled-in-India products to access international markets, strengthen global partnerships, and truly advance the vision of ‘Make in India’ on the world stage.”

spiritsEUROPE calls it transformational deal

spiritsEUROPE has called the EU-India Free Trade Agreement (FTA), a transformational deal for the EU spirits sector that will significantly improve access to one of the world’s most important spirits markets.

“This agreement is a real game changer for our sector,” said spiritsEUROPE Director General Mark Titterington. “Cutting tariffs from 150% to 40% will unlock long-term growth, create new jobs across the value chain, and give Indian consumers greater choice through a complementary, rather than competing, offering. The deal benefits both sides: a stronger EU presence will support market diversification, boost revenues, attract investment, and generate downstream employment in India, without displacing domestic production.”

India is the second-largest spirits market globally by volume, after China, and its consumers drink more spirits than beer or wine. While the market remains primarily whisky-driven, growing demand for quality, authenticity, and premium products means all EU spirits categories stand to gain.

Under the agreement, tariffs on EU spirits will be cut by half upon entry into force, followed by a gradual reduction to 40%. This represents a step change for the sector, building on a decade in which the value of EU spirits exports to India increased sixfold, despite historically high tariffs and regulatory barriers.

spiritsEUROPE also welcomes the creation of a dedicated EU-India Working Group on Wine and Spirits, which will allow both sides to deepen regulatory dialogue, enhance mutual understanding and address market access concerns.

“The EU-India FTA opens a new chapter for spirits trade,” Mark Titterington added. “We look forward to working closely with authorities on both sides to ensure swift implementation. This agreement demonstrates how strong partnerships and open trade can deliver tangible growth and benefits for both economies.”

Alcobev Sector in Focus

Among the sectors expected to see transformative impact is alcoholic beverages (alcobev), an area that has long been constrained by steep tariffs and regulatory complexity. Barring agriculture, the FTA covers technology, pharmaceuticals, automobiles, textiles, steel, petroleum products, electronics and the alcobev sector. For European wine and spirits producers, India represents one of the last major high-growth markets still guarded by triple-digit tariffs.

India currently imposes some of the highest import duties globally on alcoholic beverages. Basic customs duties on wines and spirits can reach 150 percent, before state excise duties, additional levies and distribution mark-ups are applied. These high tariffs have historically restricted volumes and confined imported products largely to affluent urban consumers.

Yet the Indian alcobev market is undergoing structural change. The industry is witnessing premiumisation, with consumers in metro and tier-one cities increasingly trading up from mass-market domestic brands to premium and imported labels. Rising disposable incomes, exposure to global lifestyles, growth of organised retail and e-commerce (where permitted), and a younger demographic are reshaping consumption patterns.

Imports of distilled spirits into India were valued at approximately $572 million in 2023, reflecting steady growth in demand for premium international brands. Trade data for FY 2023–24 shows India imported wines worth about $412.4 million from the EU and spirits and liqueurs valued at $22.3 million. In contrast, India’s exports to the EU in wines were around $1.5 million and spirits and mixed products approximately $64.9 million. The asymmetry highlights both the EU’s dominance in premium alcohol categories and the untapped export potential for Indian producers.

Globally, the EU exported nearly €29.8 billion worth of alcoholic beverages in 2024, with wine accounting for the largest share, followed by spirits and liqueurs. India currently accounts for only a small fraction of these exports, underscoring the headroom for expansion if tariff barriers are eased.

| Trade Flow | Product Category | Value (Approximately) |

| India-EU Exports | Wines | USD 1.5 m |

| Spirits and Mixed Products | USD 64.9 m | |

| EU-India Imports | Wines | USD 412.4 m |

| Spirits & Liqueur | USD 22.3 m |

FY 2023–24 trade data Ministry of Commerce

Tariff Rationalisation and Market Access

Under the FTA, phased tariff reductions on wines and spirits are expected to improve price competitiveness for European brands. While final schedules will determine the pace and depth of liberalisation, even gradual reductions could significantly narrow price gaps between imported and domestic premium products.

European producers—including wine exporters from France, Italy and Spain and spirits companies from France, Ireland, Germany and the Netherlands — view the agreement as a pathway to expand beyond niche luxury segments into broader premium categories. Multinational companies such as Pernod Ricard, Diageo, Rémy Cointreau and Beam Suntory have consistently advocated for lower duties and greater regulatory clarity in India.

From the EU’s perspective, the agreement is not solely about tariff cuts. Industry stakeholders have long sought improvements in regulatory predictability, faster label approvals and clearer distribution norms across Indian states. Alcohol in India is regulated at the state level, leading to a patchwork of excise structures, registration requirements and marketing restrictions. Greater transparency and streamlined processes under the FTA framework could reduce compliance costs and encourage deeper market penetration.

Lessons from UK and Australia Agreements

India’s approach to alcohol liberalisation has been cautious and calibrated, as seen in its recent trade agreements. Under the India–Australia pact, duties on premium Australian wines were reduced significantly, leading to improved competitiveness without overwhelming domestic producers. The India–UK FTA included phased duty reductions on certain spirits but maintained a protective stance toward wines.

The India–EU FTA, given the EU’s global leadership in wine exports, is expected to be broader in scope. European negotiators have pushed for meaningful tariff reductions, while Indian industry bodies such as the Confederation of Indian Alcoholic Beverage Companies (CIABC) have advocated safeguards such as minimum import prices, strict rules of origin and anti-dumping protections. These measures aim to prevent under-invoicing and trans-shipment while ensuring domestic manufacturers are not destabilised.

Opportunities for Indian Producers

For Indian alcobev companies, the FTA presents both competitive pressure and strategic opportunity. Lower import duties could intensify competition in premium segments such as single malts, gins, brandies and boutique wines, where European brands enjoy strong heritage appeal. However, Indian producers have been steadily upgrading quality and brand positioning.

Indian single malts and craft gins have gained international recognition in recent years, winning awards in global competitions. Companies with export ambitions see the EU as an attractive destination, offering a sophisticated consumer base and established distribution networks. While EU tariffs on alcohol are relatively low, non-tariff barriers, branding challenges and limited market access have constrained Indian penetration. Stronger intellectual property protections and improved services access under the FTA could ease some of these hurdles.

The agreement’s provisions on IP protection are particularly relevant for premium spirits, where trademarks, geographical indications and brand identity are central to market success. Enhanced enforcement mechanisms could help both European and Indian producers safeguard their brands against counterfeiting and misuse.

Structural Transformation and Long-Term Impact

The timing of the FTA aligns with broader shifts in India’s alcobev landscape. Urbanisation, hospitality sector growth, premium retail expansion and rising tourism are all contributing to category development. A more open trade regime could stimulate investment in distribution, warehousing and marketing infrastructure.

At the same time, policymakers must balance revenue considerations. Alcohol taxation is a significant source of income for Indian states. Any tariff rationalisation must be calibrated to avoid fiscal disruption while promoting trade expansion.

Ultimately, the India–EU Free Trade Agreement has the potential to reshape the alcohol trade between the two regions. For European producers, it opens the door to one of the most promising long-term growth markets in the world. For Indian companies, it presents a dual challenge: compete more effectively at home while leveraging improved market access to expand abroad.

Trilok Desai and R. Chandrakanth