- CIABC urges government to reconsider hike

- CIABC says hike will disrupt the market, erode competitiveness of national brands

- May lead to dumping from neighbouring States

The Maharashtra cabinet, chaired by Chief Minister Devendra Fadnavis, on June 10 approved the Excise Department’s proposal to increase duties on Indian Made Foreign Liquor (IMFL), country liquor and also premium liquor brands. The hike in excise duties is expected to boost the coffers of the state government by about Rs. 14,000 crore.

As per the announcement, the excise duty on IMFL (with a declared production cost up to ₹260 per bulk litre) from 3% to 4.5% of the production cost. The excise duty on country liquor will go up from Rs.180 to Rs. 205 per proof litre. The premium foreign liquor brands have seen the most hike, with a new rate set to bring the minimum retail price to Rs 360.

The Cabinet also approved the department’s proposal to introduce a category ‘Maharashtra Made Liquor’ (MML) to include grain-based spirits produced by local manufacturers. The idea behind this proposal, it said, was to encourage local manufacturing. The MML manufacturers are required to register their brands under the ‘MML’ category.

The excise department had formed a high-level study group which toured other states to understand the excise policies, the distillery operations, distribution etc and recommend the best for Maharashtra. Going by the recommendations, the department has also approved the creation of an integrated control unit powered by Artificial Intelligence (AI) to monitor distilleries, liquor manufacturers, and wholesale vendors. Additionally, a restructured administrative framework for the department has been sanctioned, which includes the offices of the Additional Superintendent for Mumbai Suburban, Thane, Pune, Nashik, Nagpur, and Ahilyanagar districts.

The Chief Minister’s office said “These reforms are a result of an extensive review of excise policies in other states which focused on tax structures, licensing efficiency, and measures to combat evasion. The objective of the new policy is not only to boost state revenue but also to curb illicit trade and foster a more transparent and regulated liquor market across Maharashtra.”

Revised minimum retail prices

The state government has issued the revised minimum retail prices for 180 ml bottles.

- Country liquor: Rs 80

- Maharashtra Made Liquor (MML): Rs 148

- IMFL: Rs 205 (previous Rs. 120 to Rs. 150)

- Premium foreign liquor: Rs 360 (previously Rs. 330)

Reforms in Licensing and Staffing

The Cabinet has also approved reforms in liquor licensing:

Sealed Foreign Liquor Sale Licenses (FL-2) and Hotel/Restaurant Licenses (FL-3) can now be operated on a lease basis (Conducting Agreement)

An additional annual fee of 15% for FL-2 and 10% for FL-3 licenses will be charged

To support these changes and ensure effective implementation, the Cabinet has sanctioned the creation of 1,223 new posts, including 744 new positions and 479 supervisory roles in the State Excise Department.

These comprehensive reforms are part of the government’s broader strategy to strengthen the department and increase revenue through systematic regulation of the liquor trade.

It must be mentioned that the state is facing a financial crunch due to the implementation of many welfare schemes particularly the ‘Ladli Bahin Yojana’ which pays eligible women Rs. 1,500 per month.

The state government is expected to table the relevant bill during the upcoming session of the state legislature.

Presently, it is said that Karnataka levies the highest liquor taxes in the country, with an 83 per cent cess on the actual price. In addition, the state government introduced a 5 per cent additional excise duty on certain products last month. As a result, Bengaluru has become the most expensive metro city for alcohol in India.

In neighbouring Telangana, the state government in May issued an order raising the retail price of select liquor brands by ₹10 for a quarter bottle (180 ml), ₹20 for a half bottle (360 ml), and ₹40 for a full bottle (750 ml).

Almost all the states, barring those having prohibition, treat the liquor industry as the cash cow and keep raising taxes as and when the government is in need of funds.

CIABC Opposes Steep Increase in Excise Duty on IMFL

Expressing grave concern over steep increase in Excise Duty on IMFL by up to 50% by the Maharashtra Government, the Confederation of Indian Alcoholic Beverage Companies (CIABC) has urged the state government to rethink and reconsider such a huge hike as it could trigger serious consequences. The CIABC has urged the state government to immediately hold deliberations with all stakeholders “to arrive at a balanced, data-driven, and sustainable course of action that protects both revenue interests and the long-term viability of the IMFL sector in Maharashtra”.

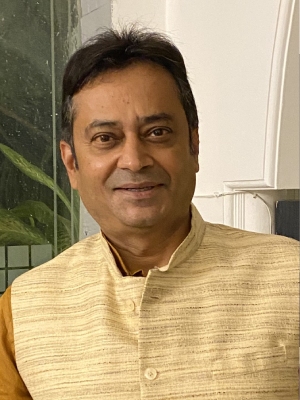

Stating that the CIABC has already written to the Maharashtra government urging to start a consultative process with all stakeholders before releasing any final gazette notification, Mr Anant S Iyer, Director General of the apex body of the Indian Alcoholic Beverage Industry, underlined that this steep hike in excise is projected to push Maximum Retail Prices (MRPs) up by as much as 85%, a step that could severely disrupt the market, erode the competitiveness of national brands, and jeopardize the availability of legitimate alcoholic beverages in Maharashtra.

“Such an unprecedented escalation in duties poses a serious deterrence to consumer access of established and reputed brands, compelling a shift toward lower-category products. This poses a serious threat to the stability of the IMFL industry in the State…such a move will have a far-reaching adverse impact,” Mr Iyer said in a statement.

The hike, he said, would lead to a steep and abrupt increase in MRPs (maximum retail price), destabililsing consumer accessibility and purchasing power, particularly within the mass-market segment which caters to the common man. This will lead to a significant drop in legal sales volumes, overlooking the interest of industry and its substantial investment in the state. It will also endanger the employment of people engaged in the entire value chain from farm to consumer.

Mr Iyer warned that higher MRPs often create a vacuum filled by illegal operators. Past experiences show that pricing arbitrage fosters regional imbalances, encouraging the spread of illicit and unsafe liquor and counterfeits of popular brands—posing a major public health risk and leading to further revenue leakage.

Porous Borders, may lead to Dumping

Noting that this move will also result in increased stock dumping from neighbouring states, the CIABC DG said Maharashtra shares borders with states that are porous. These states have similar brands which have lower MRPs for IMFL. Any additional price escalation will trigger large-scale dumping (exfiltration) from these states, resulting in illicit inflows that damage legitimate trade and erode the State’s tax base. Maharashtra has always ensured minimal impact of such occurrences by ensuring competitive pricing vide neighbouring states till now.

Mr Iyer further said the retail price structure must align with consumer affordability. The proposed price increase risks shifting consumers toward lower-tax categories, undermining premium and mid-tier segments. Such behavioural shifts could dilute revenue contributions from higher-margin IMFL products.

IMFL Accounts for 60% of Excise Revenue

The IMFL industry contributes approximately 60% of the total Excise Revenue of the State. Furthermore, the Excise Duty collected from a single case of IMFL is equivalent to that from four cases of beer, underscoring the critical importance of this category. Duty increase on IMFL, without corresponding changes for a category such as beer will create an uneven playing field and distort category dynamics leading to possible adverse impact on revenue. The CIABC has highlighted to the Maharashtra government that while the intent behind the proposed hike may be to enhance revenue collections by Rs.14,000 crore, the actual outcome may be contrary- driven by declining sales, rising illicit trade, and border leakages. The long-term impact could be deeply detrimental, not only for industry and employment, but also for public safety and overall state revenues.