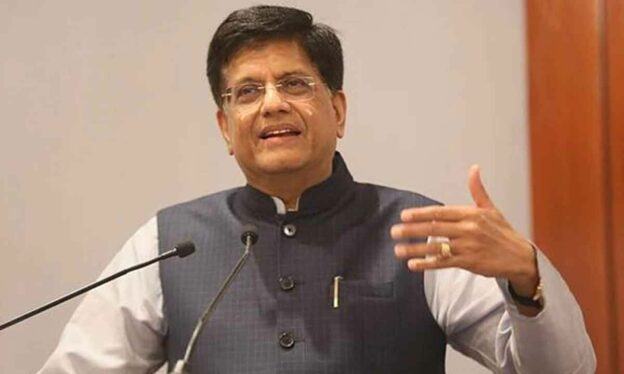

The Union Minister of Commerce and Industry, Piyush Goyal, who concluded a significant two-day visit to Brussels on January 8, as part of the India-European Union Free Trade Agreement negotiations has said this will be the ‘mother of all deals.’ Negotiations are in the final phase and several media reports suggest that the historic FTA will be signed January end.

“I have done seven deals so far. All with developed economies. This one will be the mother of all,” the minister said. Goyal has successfully negotiated FTAs with UAE, Australia, the UK, Oman, New Zealand, Mauritius and the four-nation free trade association (Iceland, Norway, Switzerland, and Liechtenstein).

During their engagement, Union Minister Piyush Goyal and Commissioner Šefčovič carried out detailed deliberations across key areas of the proposed agreement. Both sides took note of the steady progress achieved across various negotiating tracks including Market Access for Goods, Rules of Origin, Services etc. Both sides emphasized the strategic importance of concluding a fair, balanced, and ambitious agreement that aligns with their shared values, economic priorities, and commitment to a rules-based trading framework.

Barring agriculture, the FTA will include technology, pharmaceuticals, automobiles, textiles, steel, petroleum products, electronics and alcobev sectors.

As regards the alcobev sector, India’s alcoholic beverages industry, analysts believe, will be a significant beneficiary of the proposed India–European Union FTA. The EU agreement is shaping up at a time when India’s domestic alcobev market is undergoing structural change, marked by premiumisation, urban consumption growth and a growing acceptance of imported wines and spirits in metro and tier-one cities. Together, these shifts create a fertile backdrop for a recalibration of tariff and market-access rules governing alcohol trade between India and the 27-nation EU bloc.

Imported $572 million in 2023

The distilled spirits market in India is also fast expanding, with imports valued at $572 million in 2023, indicating a growing demand for both wine and spirits from the EU. Worldwide, the EU exported nearly €29.8 billion worth of alcoholic beverages in 2024, with wine dominating and spirits/liqueurs as a major category, but only a small fraction is accounted for by India.

But, India is fast opening up as a strategically attractive market for European spirits (large population, rising middle class), though there are tariffs & regulatory barriers which have historically constrained trade expansion.

| Trade Flow | Product Category | Value (Approximately) |

| India-EU Exports | Wines | USD 1.5 m |

| Spirits and Mixed Products | USD 64.9 m | |

| EU-India Imports | Wines | USD 412.4 m |

| Spirits & Liqueur | USD 22.3 m |

FY 2023–24 trade data Ministry of Commerce

At present, India imposes some of the world’s highest import duties on alcoholic beverages, with basic customs duties on wines and spirits going as high as 150 percent, even before state-level taxes and mark-ups are added. These tariffs have historically limited volumes but have not dampened European producers’ interest in India, given the country’s long-term consumption potential and rising disposable incomes.

According to trade data, the EU is already India’s largest source of imported wines and a major supplier of premium spirits, with imports dominated by France, Italy and Spain in wines, and by producers from countries such as France, Ireland, Germany and the Netherlands in spirits and liqueurs. European companies see the FTA as a pathway to improve price competitiveness and expand beyond niche, high-end consumption into broader premium segments.

Hoping for Faster Label Approvals

From the EU’s perspective, the agreement is not only about tariff reductions but also about regulatory predictability, faster label approvals and clearer rules on distribution and state-level taxation in India. Large multinational players such as Pernod Ricard, Diageo, Rémy Cointreau and Beam Suntory, along with leading wine exporters from France, Italy and Spain, have long argued that India’s current duty structure distorts pricing and restricts category development.

A phased reduction in customs duties under the FTA could make European wines and spirits more accessible to Indian consumers who are increasingly trading up from mass-market domestic brands to premium and international offerings.

For Indian producers, the India–EU FTA presents a more nuanced picture. On the one hand, lower duties on imported alcohol could intensify competition in the premium and luxury segments, particularly in wines, brandies, gins and liqueurs, where European producers enjoy strong heritage and brand recall. On the other hand, the agreement could significantly improve export opportunities for Indian spirits and wines in the EU market, where tariffs are already low but non-tariff barriers, branding challenges and distribution costs have limited India’s presence. Indian companies with premium aspirations see the EU as an important destination for Indian-made whiskies, craft gins, rums and niche wines, especially as global consumers show greater openness to new origins and styles.

The likely structure of alcohol concessions under the India–EU FTA is expected to draw lessons from India’s recent trade agreements with the United Kingdom and Australia. Under the India–UK FTA, India agreed to phased duty reductions on certain spirits and limited concessions on beer, while keeping wines largely outside the scope of tariff liberalisation. The agreement reflected India’s cautious approach to protecting domestic wine producers and managing state-level sensitivities around alcohol pricing and availability.

The India–Australia trade pact, which came into force earlier, went further on wines, with duties on premium Australian wines reduced substantially from earlier levels, improving their competitiveness in the Indian market and providing a clear example of how tariff relief can stimulate category growth without overwhelming domestic producers.

Tariff Reductions?

In comparison, the India–EU FTA is likely to be broader in scope given the EU’s dominance in global wine exports and its diverse portfolio of spirits and liqueurs. European negotiators are expected to push for meaningful, though phased, tariff reductions on wines and spirits, Indian industry bodies such as the CAIBC (Confederation of Indian Alcoholic Beverage Companies) have advocated a calibrated approach that links duty cuts to minimum import prices, safeguards against under-invoicing and strong rules of origin to prevent trans-shipment. These demands reflect concerns that overly aggressive liberalisation could disrupt domestic manufacturing and state revenues, even as policymakers recognise the need to align with global trade norms.

Ultimately, the India–EU Free Trade Agreement has the potential to be more transformative for the alcohol sector than India’s recent FTAs. For European producers, it represents access to one of the world’s most promising premium alcohol markets. For Indian companies, it offers both competitive pressure and the opportunity to scale exports to a sophisticated, high-value consumer base. As negotiations move closer to the finish line, the alcohol industry on both sides is watching closely, aware that the final contours of the agreement could shape drinking patterns, brand strategies and investment flows for years to come.