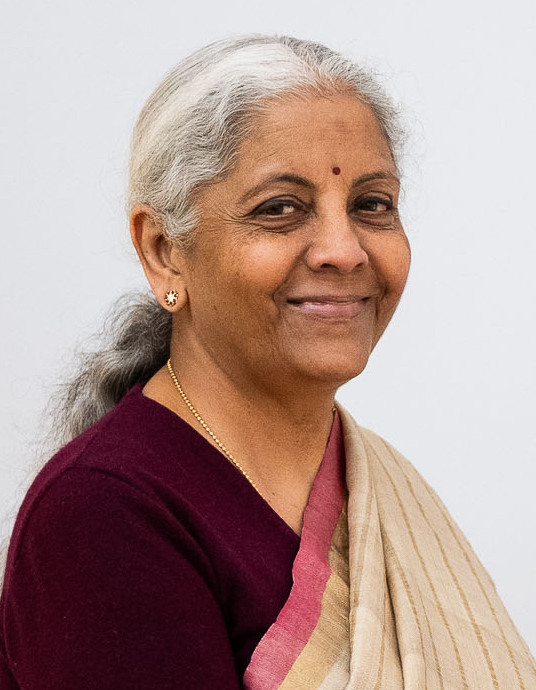

In the Union Budget 2026-27, Finance Minister Nirmala Sitharaman announced changes affecting alcohol and tobacco products. The Tax Collected at Source (TCS) rate for sellers of alcoholic liquor, scrap, and minerals has been simplified to a flat 2%. Previously, these sectors had varying rates, which in some cases were higher. This move is aimed at easing compliance and making the tax system simpler and more business-friendly.

As a result, sellers will benefit from a uniform rate, while it is set to become costlier for consumers. Although alcohol taxation falls under state governments, central budget decisions still influence retail prices through indirect levies and compliance costs.

This change, the industry says, will have a cascading effect on supply chain, eventually impacting shelf price. Besides, States generally revise excise duties, a common post-budget move, further adding to the burden on consumers. Since excise structures vary widely, there will be varying price increase across India.