India’s alcoholic beverage sector is the world’s third largest. Despite a lack of uniformity in state excise rates, state-specific regulations, and limited opportunities for the marketing of alcoholic beverages, the sector continues to record significant growth.

The alcoholic beverage industry is one largest processed beverage industries in the world. Globally, the alcohol market is valued at 2.4 trillion dollars. In India, the alcohol industry was valued to be at 55.84 billion dollars in 2024. The Indian alcoholic industry is one of the fastest growing and most diverse alcoholic beverages market globally. The sector has a high-growth potential given favourable demographics and increasing social acceptance.

Alcoholic Beverages industry (Alcobev) is a portmanteau for a large variety of alcoholic drinks. These drinks are categorised into Beer, Wine and Other Spirits. They are generated from variety of sources such as corn, wheat, grapes, molasses, and other agricultural products. The Alcobev Industry directly supports the agriculture and food processing industry in India. In India, alcohol consumption stood at 4.9 litres per capita with male alcohol consumption at 8.1 litres per capita. 18.8% of men and 1.3% of women in India consume alcohol.

India has one of the youngest populations globally. The total population of India is estimated at 1.43 billion for 2025. The median age in India is estimated to be 28.2 years in 2023 and is expected to remain under 30 years until 2030.

Regular

The population pyramid of India is bottom heavy with growing working age population and low dependence ratio. This trend is expected to lead to rising income levels per household as well as higher levels of discretionary expenditure.

The Indian middle class constitutes 31% of the population and is expected to be 38% by 2031 and 60% in 2047. Households with annual earnings between USD 5,000-10,000 grew at a pace of 10% between 2012 and 2020. These households are leading to an increase in discretionary spending on food and beverages, including alcoholic beverages, apparel and accessories, luxury products, consumer durables, and across other discretionary categories.

Women Participation: Increasing education, workforce participation, and urbanisation is leading to a change in the socio-economic status of women in society.

This increase of women in the workforce has resulted in a shift of patterns in terms of household activity, an increase in incidence of eating out coupled with entertainment which may lead to higher acceptability of women consuming alcohol.

Semi Premium

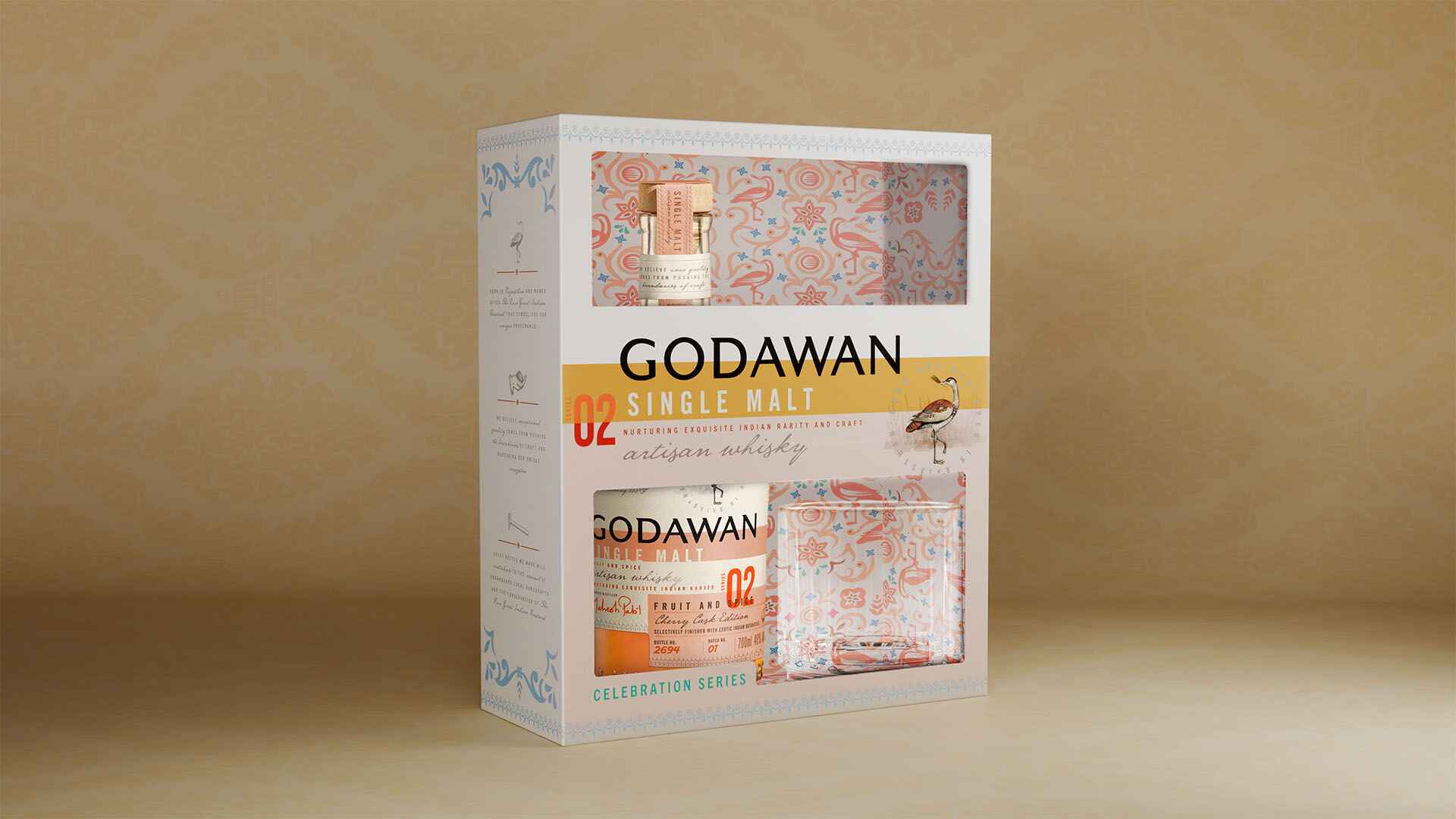

Young consumers are better educated, more tech savvy, well informed, and willing to try new products. Alcobev manufacturers are focussing on craft premium spirits at higher price points to capitalise on margins, while premium brands also tend to command greater loyalty among consumers.

The proportion of people who drink alcohol varies considerably low in a global context. This raises the expectation of significant growth potential in per capita consumption, especially as the acceptance of alcohol is spreading. A major consumer base that has emerged over the past five years is the rising acceptance of drinking amongst women.

The Indian alcobev industry is segmented majorly into Indian Made Foreign Liquor (IMFL) and Indian Made Indian Liquor (IMIL). Based on the type of products, Alcobev is classified as Beer, Whiskey, Wine, Rum, Brandy, Vodka, and other alcohols. The two segments of IMFL and country liquor cater to different sections of society. Country Liquor caters to the low-income groups in rural areas while IMFL caters to the middle-and high-income groups in both urban and rural areas.

Beer, a popular alcoholic beverage made from water, malted barley, yeast, and hops. It contributes approximately 8% to the recorded consumption of pure alcohol in India. The beer market in India is evolving from manufacturing usual beer products such as strong-lager beers to flavoured beers owing to the adoption of foreign trends and technologies. Today, more than 140+ beer brands exist in the Indian beer market, which could address the palate of each customer segment. The per capita beer consumption in India is still very low compared to other countries in the Asia Pacific region, and therefore the market could witness rapid growth in the coming years.

Super Premium

Ranked on its own as a country, India would have a population of 140 million spread across 30 million households, and would be the 10th-largest country in the world. Its per capita income would stand at $15,000 (about ₹12.80 lakh).

This would place it at 63rd position on the list of countries by per capita income. For perspective, Oman, which is at 54 on the real list, has a per capita income of $20,000.

Premium

The Indus Valley Annual Report 2025, published by venture capital firm Blume Ventures, divides India into three categories: India 1, representing the wealthiest 10% of the population; India 2, representing the middle 23%; and 3, 67% the rest of India.

The “aspirant class”, consisting of about 23% of the population, would be made up of 70 million households and 300 million people, and would have a per capita income of $3,000 (about ₹2.55 lakh).

Country

India 3 would consist of 1 billion people across 205 million households, the entire “bottom” 67% of the economy. Per capita income here stands at $1,000 (about ₹85,000).

How badly do averages skew perception? In 2023, India’s average per capita income was placed at $2,500, or about ₹2.12 lakh.

Super Premium

Who are the wealthiest?

3.7% of the world’s HNI individuals are Indian citizens, according to the Knight Frank Wealth Report 2025, released in March. They define HNI as a net worth of $10 million or more. 85,698 Indians met this mark, according to the Knight Frank report.

India is third on the list of countries with the wealthiest billionaires. Indian billionaires collectively hold an estimated $950 billion in wealth, coming in immediately after the US ($5.7 trillion) and Mainland China ($1.34 trillion).

191 is the number of billionaires in India, as of 2025, according to the Knight Frank report. 26 of these billionaires joined the ranks over the financial year 2023-24 alone. A big jump from seven new billionaires in 2019.

Indian Alcoholic Industry Overview

The Indian alcoholic industry has a high growth potential due to favourable demographics and increasing social acceptance. The alcobev industry in India grew remarkably in recent years because of factors such as rapid urbanisation, evolving consumer priorities, a burgeoning middle-class population, greater purchasing power, and growing liking for premium alcoholic beverages.

Alcohol consumption has surged across geographies, as a growing number of consumers, both men and women, enter the target consumer class. The legal drinking age in India varies from 18 – 25 years, depending on the state, highlighting the enabling environment for the alcohol market’s robust growth.

The consumer landscape in India has traditionally been a pyramid, with many households from low incomes forming the base, and a small number of households with large incomes at top. Similarly, alcohol consumption forms a similar structure with lower brand consumption dominating the larger base while premium brand consumption dominating the upper base. With growth being fuelled by economic development and demographic dividend, the rising “middle class” is divided into groups each with distinct consumption drives and needs.

In India, the alcohol consumption is expected to increase. Alcohol consumption stood at 4.9 litres per capita, with male alcoholic consumption at 8.1 litres per capita and female alcohol consumption at a mere 1.6 litres per capita. Alcohol consumption is expected to increase to 5 litres per capita in 2025 and to 6 litres per capita by 2036.

India’s alcohol market is experiencing rapid growth, with a compound annual growth rate (CAGR) of 3.3% from 2022 to 2027, making it the fifth-largest market globally, according to IWSR.

The role of the alcoholic beverage industry in India’s economic landscape is expected to grow. Recognising its potential and addressing the existing hurdles will help spur economic growth. The Indian alcohol beverage market is the third largest in the world and is poised to become a key player in the global spirits industry, with products made in India rapidly gaining prominence internationally. Valued at US$ 59.8 billion in FY24, the sector contributes significantly to India’s economy, accounting for nearly 3% of the nation’s GDP. As India becomes a manufacturing hub, the alcoholic beverage sector will play a key role in this growth. Both global and local players view India as a thriving domestic market and a potential exporter, particularly for home grown single malts. This growing segment aligns closely with the “Make in India” initiative, showcasing India’s potential in premium spirits production.

Whisky dominates the Indian spirits industry by a wide margin. By consumption patterns, Telangana, Maharashtra, West Bengal, Odisha, Karnataka, Uttar Pradesh, and Punjab, are among the largest consumers of alcobev in India. Liquor stores serve as the predominant sales channel nationwide, especially since alcobev consumption and sales primarily occurs outdoors.

The Indian alcohol industry is in a nascent stage compared to the global liquor industry. The growing economy supports the sector through an interplay of demographics, urbanisation, and policy reforms.

Young Population:

In 2024, revenue in the alcoholic beer market in India is projected to reach USD 9.8 billion, and exports experience a value of 34 million in 2023. The market is expected to experience an annual growth rate of 6.89% (CAGR 2024-28).

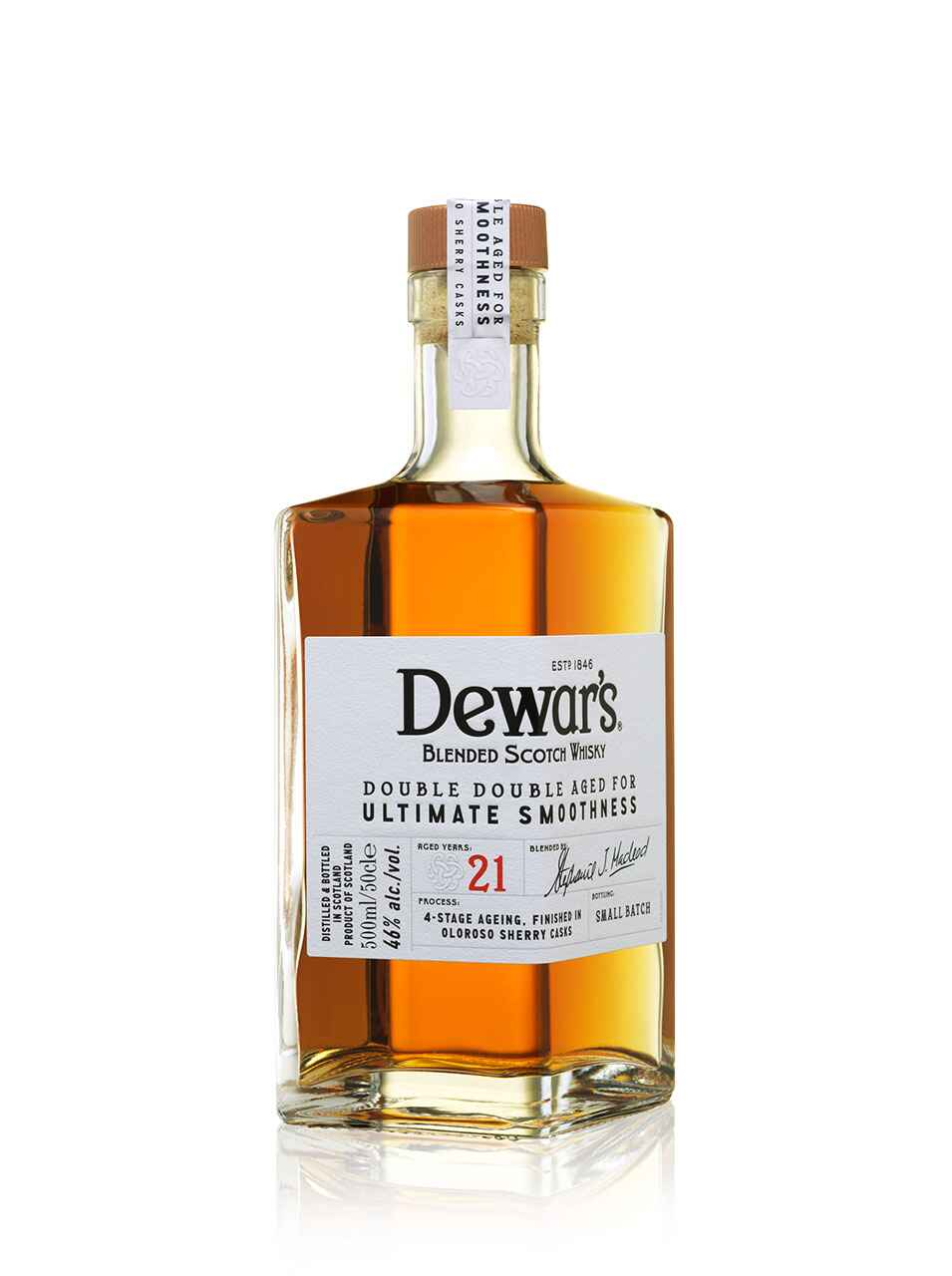

Whisky market

India is the largest whisky market in the world, with almost one out of every second bottle of whisky sold in India. The Indian whisky market was projected to reach USD 17.4 billion in 2024 and was expected to reach USD 22.4 billion by FY 2025 by leveraging demographic trends, new customers and premiumisation. Indian whisky market can be divided into four segments including popular (up to ₹450), prestige (₹450-1000), premium (₹1000-2000) and luxury segments (More than ₹2200). The value segment, consisting of popular and prestige segments, contributed close to 86% of the total volume for the Indian whisky market.

The contribution of the premium and luxury segment by value is projected to reach around 34% of the overall whisky market by FY 2028 from 33% in FY 2023. However, its contribution by volume would still be close to 16% in FY 2028. The Whiskey industry is expected to grow annually at 5.3% (CAGR 2024-2028). The Indian whisky sector generates the highest revenue among all alcoholic beverages in India.

Wine Market

The consumption of wine in India constitutes a small share but is one of the emerging alcoholic beverage categories. Growing awareness, underpinned by income growth, westernisation and a changing profile of consumers, is driving growth in the wine category.

Domestic wine manufacturers have invested in both the upstream and downstream operations of value chain. To leverage the growing acceptance of wines in the premium and luxury segments in metro cities in India. Metro cities including Mumbai, Bangalore, Delhi-NCR, Hyderabad, and Pune are the major consumption centres for wines in India. The Indian wine market is a concentrated market with domestic players controlling the market and steadily increasing their prominence in the market.

The wine segment was valued at ₹2,660 crore, with the domestic wine industry constituting 73% of the market size in 2023. It is expected to grow to ₹6,425 crores in 2028, with the domestic wine industry constituting 77%. The wine market sold 3 million cases in 2023 and is expected to sell 3.9 million cases in 2025 (Provisional). It is expected to experience an annual growth rate of 14.57% (CAGR 2024-2028).

Rum market

Rum is made by fermenting and then distilling sugarcane molasses or sugarcane juice. It is available in dark rum and light rum. Dark rum is the more popular category with a share of ~98% followed by light rum. Dark rum differs from traditional rum due to the addition of caramel or by the maturation in oak containers. Canteen stores department or army canteens are the primary drivers of rum sales in India. Rum is also the preferred alcobev drink in the northern and eastern states of India.

The Rum segment was valued at ₹21,074 crores in 2023 and is expected to increase to ₹30,240 crores by 2028 (provisional). The sale of Rum, which stood at 51 million cases in 2023, is expected to increase to 68 million cases in 2028 (provisional). The sector is expected to grow at 5.65% (CAGR 2024-2028).

Brandy market

Brandy is a beverage made by distillation of wine. It may be aged or matured to possess aroma and taste of brandy. Indian blended brandy is a mixture of minimum 2% of pure grape brandy with any other fruit or flower brandy as recommended by the Indian Law. Indian brandies are permitted to use extra neutral alcohol (ENA) from other agricultural origin sources.

Indian Brandy market can be divided into four segments, including popular (up to ₹450), prestige (₹450-800), premium (₹800-1500) and luxury segments (More than ₹1500). Brandy consumption is price sensitive as most brandy brands are in the popular and prestige segment. There is a high degree of variation in the price structure of brandy in different states, with each having an independent cost structure with unique excise duties and other applicable taxes, which leads to varying prices from state to state.

In 2024, the revenue from the brandy market in India was estimated to reach USD 3.7 billion. The Brandy segment is projected to grow annually at 4.33% (CAGR 2024-2028).

Vodka market

Vodka is a clear distilled alcoholic beverage. It is made from a fermentable base which can be grains, potatoes, or other starchy or high-sugar plant matter. The vodka industry in India constitutes a small part of the overall alcoholic beverage industry, but is experiencing one of the highest growth rates among all the alcoholic industry. Magic Moment, a core Vodka brand in India recorded sales of 6.3 million cases during the year and crossed sales value of 1,000 crore.

The revenue of the vodka segment amounted to USD 37.8 million in 2024. It is projected to grow annually at 2.13% (CAGR 2024-2028).

India’s alcoholic beverage sector is the world’s third largest. Despite a lack of uniformity in state excise rates, state-specific regulations, and limited opportunities for the marketing of alcoholic beverages, the sector continues to record significant growth.

This is attested by the growth in sales, profit, along with projected capacity addition by alcobev companies. The alcoholic drinks sector will witness strong growth prospects in the alcoholic drinks sector over the years, driven by an improving macroeconomic growth, positive demographics, shifting cultural values, expanding young, middle class, rising sophisticated retail channel, a progressively more adventurous consumer base, and a burgeoning premiumisation trend.

The increasing focus on streamlining state excise policy, increasing support from the government, entry of international brands, effective promotion and branding by the companies, and improving the standards of alcoholic beverages available in India will provide further impetus to the growth of the alcobev industry in India. Concerted attempts to relax the cumbersome complex regulatory framework, simplify its operational complexities, enhance its Ease of Doing Business (EODB), and unlock its full growth potential will provide tailwinds to this industry. However, rising consumer inclination to consume non-alcoholic beverages may constrain market growth.