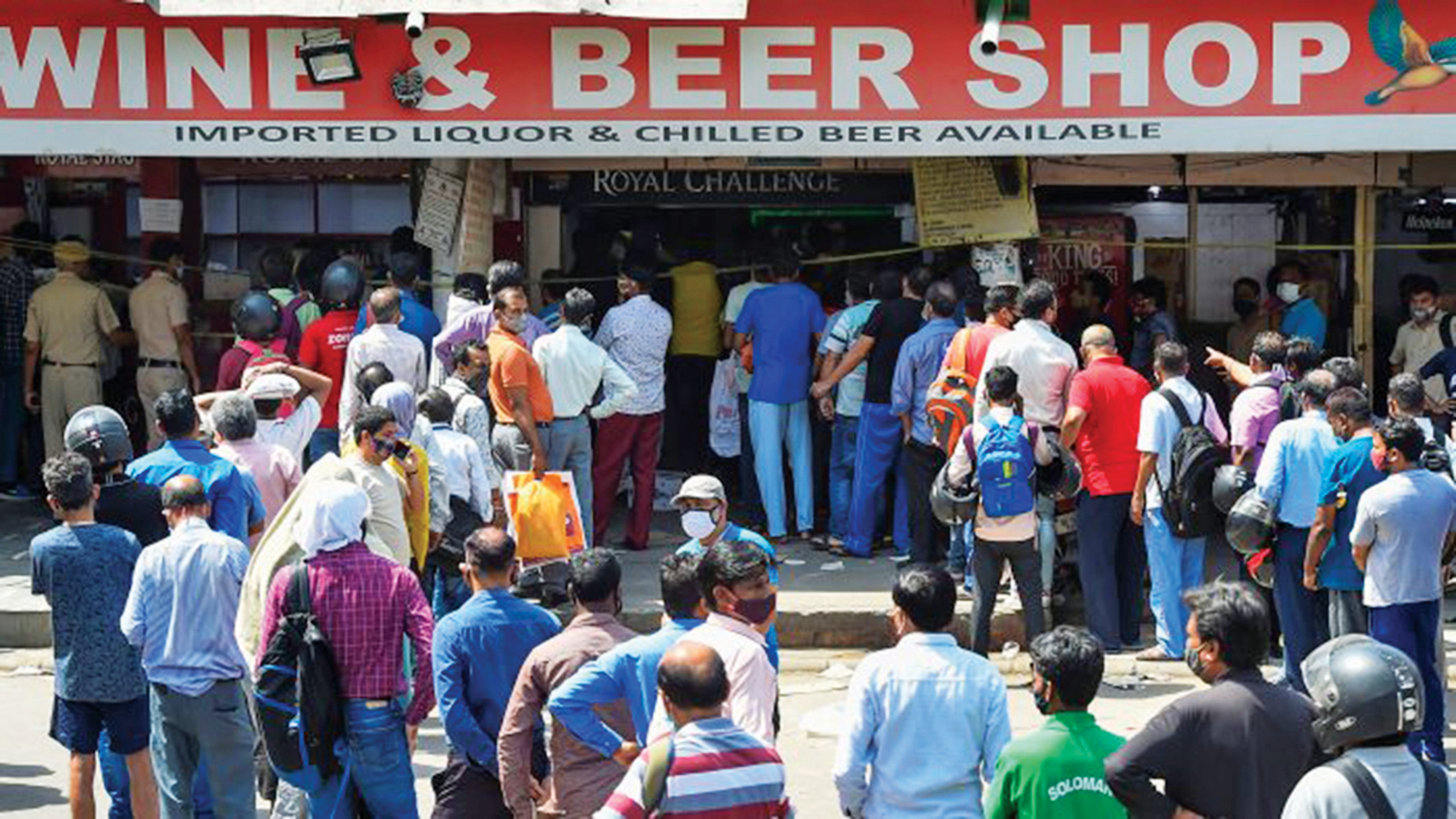

In the late 1980s, when Ramada Pub off Church Street, next to the erstwhile popular Premier Bookshop, started vending ‘draught’ or ‘draft’ beer in mugs, it signalled the arrival of not just Bangalore’s but arguably India’s s first-ever pub, thanks to the ingenuity of Hari Khoday, who was known more for his XXX Rum then. A mug of beer cost only Rs. 2.75 paise with peanuts thrown in. It was a place where you could guzzle beer, not from a bottle, but in a mug, dispensed from a tap, connected to barrels of brewed beer got from the distillery. The concept of microbrewery came in much later. Ramada Pub was a tiny place where you jostled for space and guzzled beer with some loud music in the background.

Around the same time, The Pub, renamed later as NASA (guess one got spaced out just drinking beer then) got launched on Church Street and the music and the dim lighting gave fillip to beer drinkers to guzzle more. The Pub drew the upwardly mobile and then came Black Cadillac on Residency road which played rock music and also had regular gigs. I remember Vijay Mallya hosting some liquor-based events here for the media. These were happening places. Then there was Peco’s, Scottish Pub, Underground, Downtown and the like, all in and around Brigade Road, Residency Road, M.G. Road, becoming the city’s ‘beerholes’, if one may coin that term. And then from nowhere pubs started mushrooming across the hotspots of the city, earning Bangalore the moniker ‘Pub Capital of India’.

The city is a cauldron of cosmopolitan culture, with the tech crowd descending from all over the country and elsewhere too. The techies gave Bangalore a new edge and soon, pubs had to re-invent themselves, and voila there was the birth of microbreweries. The pubs of now are very distinct, trying to cater to the hip crowd, setting trends in not just the social drinking habit, but in cuisine, in music, in events and what-have-you. At one time, pub crawl was quite popular, now not so. With an estimated over 500 pubs in the city, these ‘beer-holes’ have to be up there to cater to the discerning and demanding beer connoisseurs and they are, mind it. From pubs to microbreweries, Bangalore or Bengaluru has indeed come a long way from the days of Ramada. Here are some of the new age breweries you can check out to get a taste of the beer world.

Geist Brewing Factory, the pioneer

Among the first to come up with a brewing factory has been Geist. It was in 2006, Geist was incorporated, thanks to Narayan and Paul and later Mohan, software guys who plunge to brew some of the finest beers Bangalore has known. Initially they made 300-400 batches of beer and then when the microbreweries in the city became ‘in’, Geist was right there. When The Biere Club opened in 2013 and later Byg Brewski, Geist became the catalyst. As the pubs grew, Geist set up its own brewery and supplies draft beer to Bootlegger, Hangover and Tipsy Bull, among many other restaurants and pubs.

The name ‘Geist’ comes from the German word ‘zeitgeist’, which is used to define “the general intellectual, moral, and cultural climate of an era”. The sentiment perfectly captures the evolution of Indian beer drinkers, and the resulting rise of the discerning Indian beer enthusiast and you bet, Bengalureans, by birth or otherwise, fall in that category.

To spread their love for beer, they set up their own Geist Brewing Factory – Restaurant and Beer Garden on Old Madras Road, serving their signature crafted beers – Geist Weiss Guy, Geist Kamacitra, Geist Rauch-a-Fella, Geist Marzen, Geist Golden Ale, Geist Witty Wit, Geist Stouter Space stout and Geist Uncle Dunkel. The ambience here is just about perfect to down a beer or two under the shade of a huge banyan tree.

The Geist Rauch-a-Fella is a smoked wheat beer, inspired by the famous smoke beers of Bamberg, while the Geist Stouter Space has delightful notes of chocolate and aromas of vanilla pods. Inspired by Luponic Distortion from Firestone Walker, the Geist Golden Ale series is designed to showcase different hop varieties. The best way to find out how all their beers taste is to go check it out, right?

The Biere Club, welcome to the club

When it opened in 2010, it started a new trend in the pub city – microbrewing and it caught on like raging fire. The Biere Club located, coincidentally on Vittal Mallya road (the man who built United Breweries, later Vijay Mallya gave Kingfisher global branding) got Bengalureans interested in microbrewing, vending beers including wheat, stout, lager and Belgian style ale. They have even experimented with ‘ragi’, locally grown millet, but one must try out the combination of strawberry & vanilla, lemon & chilli and bayleaf. The Moscow Mule created with ale and ginger ale is a drink that finds favour during summers. The Biere Club has another branch in the IT belt, called The Biere Street.

Byg Brewski, Asia’s largest brewpub

This is supposedly Asia’s largest premium brewpub – Byg Brewski Brewing Company or simply Byg Brewski, which is located in Hennur, away from the central business district. It is massive, with a sprawling 65,000 square feet of space which can seat about 3,000 people at a time in five different experience zones. Truly, the experience makes people come back for more and not just for the home-made craft beers. The ambience is an experience in itself with lush greenery and a lake within and a waterfall to boot. The microbrewery serves some amazing beers including Byg Wit (a medium bodied beer, low in bitterness with fruity esters); Byg Hefeweizen, a Bavarian style wheat beer; Byg Triple, a Belgian style strong ale; New Zealand Pilsner; Byg IPA, West Coast style IPA brewed with American hops; Coffee Chocolate Stout, a dark rich decadent stout and many more for one to quench one’s thirst and to experience some of the best brews this side of the world.

Arbor Brewing Company, everything American about it

Decade-old Arbor Brewing Company or simply ABC is supposedly India’s first American craft brewery. This has origins in Arbor Brewing Company, founded by Matt Greff who pioneered American craft beer revolution at Ann Arbor, Michigan. Having tasted American craft beer while studying at the University of Michigan, Gaurak Sikka headed straight to the ‘Pub Capital’ to launch ABC in 2012 and there has been no looking back. In 2018, Sikka took Arbor Brewing Company to Saligao in Goa and both places are rocking for their American craft beer and everything American. The wooden interiors give the place an authentic look, while what can one say about the beers ABC vends – Bangalore Bliss; Phat Abbot Tripel; Smooth Criminal; Rare Earth Lager; Michael Faricy Stout among others. ABC is the place to try highly innovative beer cocktails such as Wheat on Wheat (Ketel one vodka with mango juice, orgeat syrup and Bangalore Bliss); Chocolate Stout Old Fashioned (Michael Faricy’s Irish Stout, Johnnie Walker Red Label stirred together with chocolate and a hint of chilly; and summer refreshment in the form of 3 Spiced Mules (Pineapple and fresh ginger with Johnnie Walker Red Label served tall with Phat Abbot Tripel). ABC offers a full bar and there is a dance floor for one to dance through the night!

Toit, popular hangout

From night to Toit, it’s a beer walk. Toit in Indiranagar is an out and out brew pub, brewing a revolutionary culture, as they word it. With the promise of some bodacious brews, fabulous foods and a supreme brew pub experience, Toit has gone beyond that. In fact, the revolution has moved to Mumbai and Pune too. Toit claims all their beers are made only with natural ingredients; imported malts, the hippest of hops and the most eukaryotic of yeast, never using any enzymes, chemicals, colouring agents, artificial flavouring or preservatives, “because we want every sip to be nothing short of wholesome, heavenly, beer”. Using the unique and exotic flavours of local fruits, rice, wheat, and spices, this is Toit’s contribution to the world’s great craft beers such as Toit Nitro Stout (a very dark, full-bodied, roasty, malty ale); Toit TinTin (Belgian style fruity ale); Toit India Pale Ale (a bitter, highly hopped, English style ale); Toit Hefeweizen (a full bodied refreshing Bavarian); Toit Basmati Blonde (a light, crisp and refreshing ale, they call it a love child of India’s Basmati rice from which it gets its lightness, colour and floral aroma); and the city’s own Benga-Lager-U (a clean lager with complex maltiness and subtle spicy notes). Said to be one of the most popular brew haunts, it gives a high like no other.

Windmills, energising in a gentle way

Celebrating its decade-young journey in microbrewing is Windmills Craft Works in Whitefield. Known simply as Windmills, it is an upscale pub which has a jazz theatre where artistes from around the world have performed. On tap, they vend Hefeweizen, a Golden Ale, A Stout, 1-2 IPAs and New England IPA. For the tech crowd which makes up its clientele, Windmills offers a ‘boutique’ experience and the techies swear by it, not minding its ‘pricey’ menu. On the terrace, it serves North Indian fare, totally high end offering with a spectacular view of the sprawling tech city.

XOOX Brewmill, its Zooks, ok?

Coming to Koramangala which is peppered with some of the best restaurants and watering holes, there is XOOX Brewmill (don’t know how they came to pronounce it Zooks) which vends artisanal beers and cocktails. Spread across three floors, Zooks, is a live craft brewing space, converted from an old factory. The brewery offers eight styles of craft beers and signature cocktails like the XOOX G&T — a gin, martini bianco, Campari, red wine reduction with grape, apple juice, and tonic water, the C&C (Coffee & Conversation) — gin, black coffee, rose water, orange bitters, ginger ale and The Asian Wife, an interesting cocktail made with vodka, lemongrass syrup, lychee juice, lime juice and lemongrass haze.

BierGarten, so al-fresco

When in Koramangala, check out BierGarten, a sprawling 14,000 sq. ft and an airy, al-fresco seating across two floors. To go with this perfect setting, they’ve got about eight beer variants on tap with traditional German-style Hefeweizen, a dark Dunkel and Amber Lager being the most moving ones. They also have an outlet in Whitefield and a menu that boasts European-style cuisine.

Bier Library, for the ‘beerworm’

From BierGarten, we hop to the Bier Library, which has a beautiful open space and seating with the view of a koi pond located bang in the middle. There’s a cozy reading corner if you want your reading to transport you to another world, yes, of course, drinking the well-crafted beer and that includes a Red Ale, a Spicy Wheat Beer, and a Double IPA. They are also quite well known for their signatures that include Wittle Wit, Ale-O-Drama and Further Lager.

Druid Garden, you will like their potions

Moving to North Bangalore, which is just about seeing some fancy restaurants and pubs coming up, right perched on top is Druid Garden which has a built-in microbrewery that is run by a Chez Brew Master. Naturally, the ingredients are all sourced from Czech Republic and Germany and use recipes that have been tried and tested for years. Since they’ve opened, they’ve introduced 6 beers – Czech Pilsner, Bohemian Dunkel, Indian Pale Ale and a Basmati Lager among others.

District 6, zoned out

From one end of the city, we move to District 6, an upscale microbrewery that offers both fine dining and classic brews. With rustic and modern interiors and a blend of refined fresh German style brews, District 6 is a quaint brewery where you won’t have to shout out while in conversation with your drinking partner, the music just being right, not raucous. The microbrewery offers European, Indian and Chinese cuisine, but the beers are German-style. The brewery features open-air ducts and brewing equipment. True to its number 6, the brewery has a beer tank area; a brewery area; outdoor seating; front kitchen; public and private dining spaces.

Bengaluru is a trend setter and people from all over the world converge here for its cosmopolitan outlook and culture, unmindful of traffic. The city is peppered with so many watering holes, that one tends to forget the potholes, the chaotic traffic and work-related stress. Cheers to ‘namma Bengaluru’